Highlights: - ECB re-starts QE programme, along with further cut in deposit rates - Guidance for indefinite asset purchase and lower rates add to strong liquidity measures - Triad of weak domestic growth, trade uncertainty and low inflation reading weighs on ECB - Second major central bank to say "monetary policy is not answer for every macro challenge" -Tricky lower inflation expectations add to monetary policy uncertainty

--------------------------------------------------

The European Central Bank (ECB), as anticipated, has restarted the quantitative easing (QE) programme wherein it intends to inject liquidity at the rate of 20 billion euros per month from November 2019. The widely expected stimulus package includes lower deposit interest rate at -0.5 percent instead of the earlier -0.4 percent.

The ECB has opted for a change in guidance stating that policy “...interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2 percent and such convergence has been consistently reflected in underlying inflation dynamics".

Reading both "guidance" and indefinite QE together translates into another "whatever it takes" stance of Mario Draghi before he steps down from ECB later this month.

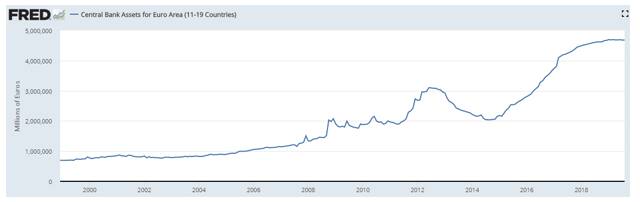

Chart: Euro Area Central Banks balance sheet

While the monthly run rate of asset purchase programme (known as QE) announced is below expectations (30 billion euros), the indefinite time period of the programme has positively surprised market participants. Additionally, tweak in modalities of targeted longer-term refinancing operations (TLTRO) is expected to hasten the smooth transmission of the monetary policy.

This can possibly help in extending the rally seen for global equity markets on the back of easing geopolitical risk events. While the initial rebound was witnessed for a wide spectrum of assets – DAX, Euro Stoxx 50, gold and Euro Bund, post conference, these faded. Among currency, EUR/USD, which had already depreciated by about 4 percent over the last two and a half months, dipped further on the announcement, but strongly rebounded later. Certainly, asset class volatility has spiked despite liquidity measures due to economic uncertainty.

The ECB action has pushed US President Donald Trump to nudge the Federal Reserve towards more rate cuts to keep US exports competitive. However, Draghi reiterated in the conference that G-20 nations are committed to avoiding competitive currency devaluation.

Weak Eurozone growth and fragile inflation readings weigh on ECBECB's policy announcements emanated from three elements, namely, domestic slowdown, downside risks in global trade and downward revisions to inflation projections. Note that Euro area real GDP increased by 0.2 percent (QoQ) Q2 CY19 as against a 0.4 percent rise in Q1 CY19. Surveys indicate further moderation.

IFO institute for Economic Research has forecast that Germany could face technical recession in Q3 CY19 when its economy could shrink by 0.1 percent following a similar contraction in the previous quarter. Furthermore, ECB staff has downgraded near to medium term projections for Eurozone for both GDP and inflation.

Other readings which investors should take note of:Taking a step back from the ECB meet, the global risk barometer appears to be easing. Global equity indices (S&P 500, FTSE 100, Shanghai Composite) are up 4-6 percent in the past three weeks. The US 10-year yield has climbed from the levels 0f 1.45 percent – last seen around Brexit referendum day in 2016 – to 1.75 percent.

There is a bit of yield curve steepening as well as implied from the US treasury 10-year and 5-year yield trajectories. A global financial market rebound is a reflection of improvement in various geopolitical risk scenarios. Moving beyond escalation of trade war in July-August, trade talks between China and the US are set to resume in October. China's move to exempt a few American products from additional tariffs and the 15-day delay in imposition of tariff from the US have helped in easing tensions.

The Hong Kong crisis has cooled, following the withdrawal of the controversial extradition bill, although protests continue as a few political demands from protesters remain.

Coming to the UK, although a Brexit no-deal scenario is not ruled out, there is a possibility for another extension of the deadline. If there is no agreement on the Brexit plan when the UK parliament resumes in October, Prime Minister Boris Johnson would have to request a Brexit extension up to January 31, 2020.

Further, details of a Yellowhammer plan - contingency plan for "no- deal Brexit" scenario – are out. It points to the worst case scenario in the case of a "no-deal Brexit" and these details are expected to put increased public pressure on the incumbent regime for an orderly Brexit.

Also read: Brexit Diary | Parliament suspension makes 'no deal' buzz louderHowever, given the elevated uncertainty for the outcome of political events in the current year, central banks need to tread cautiously. While there is a need to look through short-term noises so that central banks do not exhaust the limited options at hand, lagged impact of global trade uncertainty for more than a year and a half is a real challenge.

In this context, the next event to watch out for investors is the US Federal Reserve policy meet on September 17-18 wherein the US central bank would also grapple with the puzzle of low inflation and the need for political regimes to be more responsible.

We believe markets have entered an anxious phase where central banks may be seen to have not enough tools to combat slowdown, particularly when the tussle between the US and China continues.

Follow @anubhavsaysDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.