March turned out to be an absolute disaster for the D-Street. The benchmark indices Sensex and Nifty50 dropped about 23 percent each and slipped into bear territory.

Now, as we step into April, investors are hopeful that the worst is behind us. But, given the continued exponential rise in COVID-19 cases in India and across the world, recovery may still be some time away despite a slew of measures undertaken by the central bankers around the globe.

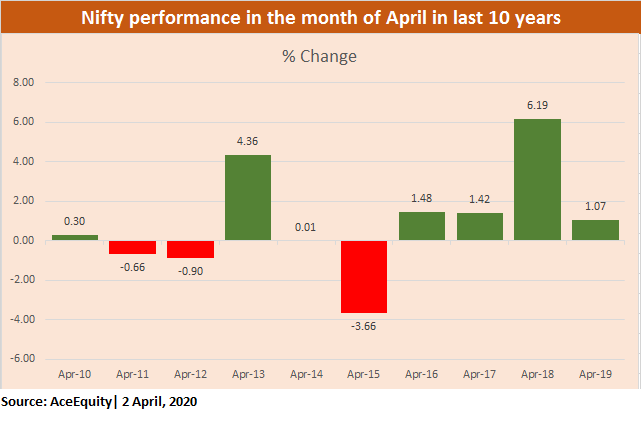

Data from the last 10 years suggest that bulls got an upper hand seven times in the month of April.

Nifty50 jumped over 6 percent in April 2018, followed by 4.3 percent in April 2013 and over 1.48 percent in April 2016 — three of the biggest gains in April in the last 10 years.

On the other hand, Nifty fell three times in April in the last 10 years — in 2015 (Nifty down over 3 percent), 2012 (Nifty down 0.90 percent) and 2011 (Nifty down 0.6 percent).

Experts feel that the trend of the market will be driven by institutional activity, especially foreign investors who have pulled out more than Rs 60,000 crore from the cash segment of Indian markets and rise in coronavirus cases across the world including India.

“It is very tough to make a call for April after a brutal fall in March series because there are still lots of uncertainty about COVID-19 where the market has discounted almost worst-case scenario including a lockdown of 21-Days but if the situation further deteriorates from here then the market will again adjust itself in the downside,” Amit Gupta, Co-Founder & CEO, TradingBells told Moneycontrol.

“We can say that the April is going to be very choppy with moves on both sides, unlike March where the market has fallen vertically,” he said.

After losing more than Rs 30 lakh crore of investor's wealth in March, traders and investors are hoping for some stability in markets.

History suggests that markets have usually bounced back after steep moves on the downside. Hence, the swing low of 7,511 recorded on 24 March could act as a near-term bottom in April – only if there is no sudden spike in COVID-19 cases or selling from FIIs continues.

“Well, past trends indicate that in the months following an abnormal fall, markets usually retrace some of their losses in the immediate next month (like in October/ November 2008). That does give us hope for a positive April series,” Sameer Kaul, MD & CEO, Trustplutus told Moneycontrol.

“Currently, there is a bottom at a place at around 7,500 on the Nifty. At 7,500 selling abated and there was some buying witnessed across the board. However, markets have the tendency to retest the previous lows which investors should be careful about,” he said.

FII Activity:

Foreign institutional investors (FIIs) have pulled out more than Rs 65,000 crore from the cash segment of the Indian equity markets in March, as per provisional data.

“The large sell-off by FIIs due to increased volatility is largely over. Some amount of selling will continue until we see signs of flattening of the virus infection curve. DIIs, on the other hand, have seen good inflows in this month till date as investors and asset allocation funds move more money to equities seeing the markets at attractive levels,” Mahesh Patil, CO CIO Equities, Aditya Birla Sun Life Mutual Fund told Moneycontrol.

“However, if the lockdown is prolonged and the impact on the economy is much more severe, the savings will get impacted and the domestic flows could slow down,” he said.

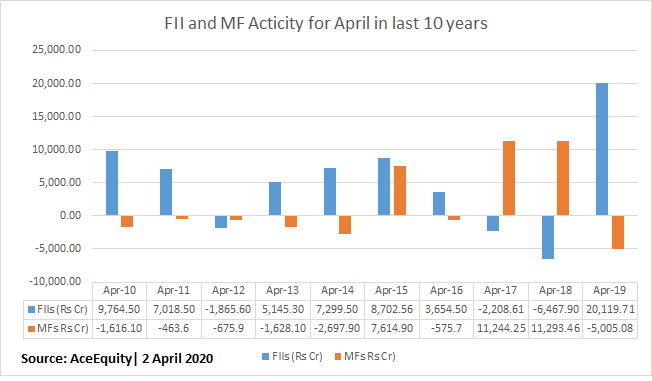

If we look at the historical data, they have been mostly net buyers in the last 10 years in April. FIIs were net buyers of equities worth nearly Rs 20,000 crore in April 2019, followed by Rs 9,700 crore inflows in April 2010, and Rs 8,702 crore inflows recorded in April 2015.

On the other hand, mutual funds were mostly net sellers in the last ten years in the month of April. They pulled out more than Rs 5,000 crore in April 2019, followed by Rs 2,600 crore selloff in April 2014, and over Rs 1,600 crore in April 2010.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.