Cash volumes in India’s equity markets surged about 10 percent to a six-month high in May from levels in the previous month as investor participation widened, driven by the recent market rally, analysts said.

The Indian markets responded positively to a range of recent macroeconomic improvements, including a possible peaking of interest rates and a favourable balance of payments.

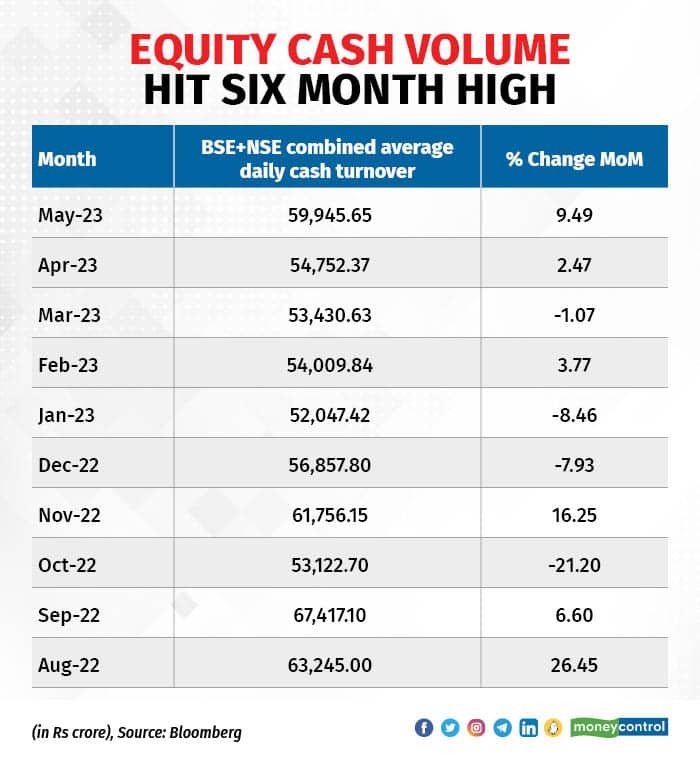

Big gainsThe combined average daily turnover (ADTV) in the equity cash segment of the BSE and the National Stock Exchange of India reached its highest point since November 2022. From May 1 to May 26, the ADTV stood at Rs 60,142 crore, up from the Rs 54,752.37 crore in April. This marked the second consecutive month of gains in ADTV in cash segment.

According to Deepak Jasani, head of retail research at HDFC Securities, the surge in cash volumes can be attributed to increased activity by foreign portfolio investors, especially on the buy side, and heightened trading in small and mid-cap stocks, which is typical during results season. However, there may be a moderation in cash volumes in the future.

“It was a gradual, broad-based and consistent rally which generally traders prefer… Global markets supported during the period. Results season also attracts trading momentum and except IT and metals, other sectors did as per expectations. Such markets attract traders and investors to trade and invest actively… and that's the reason the cash and F&O volumes moved up,” said Shrikant Chouhan, head of research at Kotak Securities.

Gaurav Sharma, smallcase manager and founder of GauravSir.in, said investor participation increased amid the tightening of policies by the market regulator in favour of common investors and strict action against lucrative get-rich-soon schemes.

Derivative volumesAdditionally, volumes in the derivatives segment have remained close to all-time highs since last year. The ADTV for the derivatives segment stood at Rs 264 lakh crore so far in May, representing a 9.1-percent increase from Rs 242.2 lakh crore in April. This increase in turnover is despite the hike in securities transaction tax last month.

There was exceptional growth in options trading turnover, setting new records. Some analysts said the increase in turnover in the futures and options (F&O) segment was primarily due to the positive market sentiment and overall market buoyancy. They suggested that the actual impact of the increase in the securities transaction tax (STT) will be noticeable only when market conditions deteriorate.

The increase in F&O volumes can also be attributed to higher volatility in the Nifty and Bank Nifty indices. Heightened volatility offers traders the opportunity to capitalise on market fluctuations and potentially generate profits, Jasani added.

Suman Bannerjee, CIO of Hedonova, a US hedge fund, attributed the surge to various factors. There has been an increase in market participation by both institutional and retail investors, resulting in higher trading volumes. Investors are actively engaging in derivatives trading to capitalise on market opportunities and manage their risk exposure.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!