Infosys, which came out with results post market hours on Friday for the quarter-ended December, had more disappointments than surprises. Net profit, EBIT and operating margin of the Bengaluru-based software services exporter missed estimates.

Infosys closed 0.56 percent higher at Rs 683 ahead of the results on Friday.

We have collated a list of 10 takeaways from Infosys Q3 results:

Net Profit:

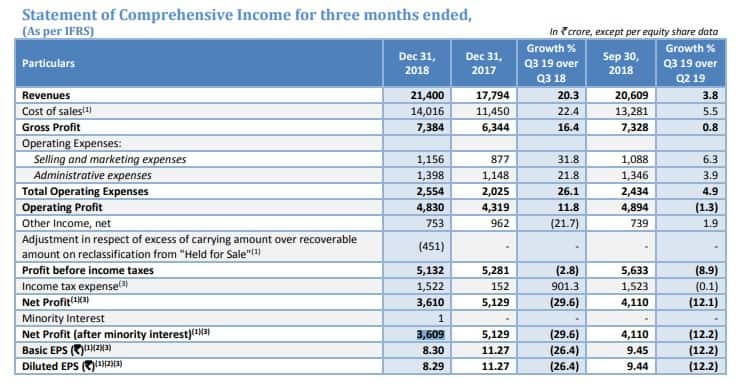

The net profit of the Bengaluru-based software services exporter slipped by nearly 30 percent on a year-on-year (YoY) basis and a little over 12 percent sequentially at Rs 3,610 crore for the quarter ended December.

The net profit number was lower than CNBC-TV18 poll of Rs 4,115 crore. The IT major reported a net profit of Rs 5129 crore in the year-ago period and Rs 4,110 crore in the September quarter.

Remember, TCS on Thursday reported a 24.1 percent rise in YoY profit at Rs 8,105 crore for the December quarter.

Rupee Revenue:

Rupee revenue grew by 3.8 percent on a quarter-on-quarter (QoQ) basis to Rs 21,400 crore for the quarter ended December which was higher than CNBC-TV18 poll of Rs 21,105 crore. The IT major reported revenues of Rs 20,609 crore in the previous quarter.

Revenue in dollar terms rose 2.3 percent to $2,987 million, which was in line or slightly higher than CNBC-TV18 estimate of $2,950 million.

Guidance:

FY19 revenue guidance in constant currency revised upward to 8.5-9.0% while the Operating margin guidance retained at 22-24%

Operating Margin:

Operating margin fell 110 basis points to 22.6 percent which was lower than CNBC-TV18 poll of Rs 23.6 crore. It includes additional depreciation and amortization impact of 0.4 percent due to the reclassification of assets of Panaya and Skava from “Held for Sale”.

EBIT or earnings before interest and taxes (EBIT) which is a measure of a firm's profit that includes all incomes and expenses stood at Rs 4,830 crore for December quarter, lower than the analyst estimate of Rs 4,978 crore.

Dividend:

The board declared a special dividend of Rs 4/- per equity share and fixed January 25, 2019, as the record date for the special dividend and January 28, 2019, as payment date.

Buyback:

The board of Infosys also approved a buyback of Rs 8,260 crore at a price of Rs 800 apiece, which is at a 17 percent premium to its current market price of Rs 683.50. ADS holders are permitted to convert their ADS into Equity Shares, and, subsequently, opt to sell such Equity Shares on the Indian stock exchanges during the Buyback period, the company said in the release.

Revised Compensation:

Grant of annual Restricted Stock Units (RSUs) having a value of Rs 3.25 crores to Salil Parekh, Chief Executive Officer, and Managing Director, in accordance with the terms of his appointment as approved by the shareholders. The RSUs are issued under the 2015 Stock Incentive Compensation Plan (‘Plan’).

The management also issued a grant of 68,250 RSUs to U.B. Pravin Rao, Chief Operating Officer, and Whole-time Director, based on his performance in fiscal 2018, in accordance with the terms of his employment as approved by the shareholders.

Held For Sale:

The company had earlier classified its subsidiaries Kallidus & Skava (together referred to as "Skava”) and Panaya as “Held for Sale”. During the quarter ended December 31, 2018, based on an evaluation of proposals received and progress of negotiations with potential buyers, the Company concluded that it is no longer highly probable that sale would be consummated by March 31, 2019.

On de-classification, the company recognized additional depreciation and amortization expenses of $12 million and a reduction of $65 million in the carrying value for Skava. The impact of the same on the Basic Earnings Per Share was a decrease of $0.02 for the quarter ended December 31, 2018.

Kiran Mazumdar–Shaw reappointed as Independent Director:

Based on the recommendation of the Nomination and Remuneration Committee, considered and approved the reappointment of Kiran Mazumdar Shaw as the Lead Independent Director for the second term from April 1, 2019, to March 22, 2023, subject to shareholders’ approval.

“I am delighted that the Infosys Board of Directors has unanimously recommended Kiran Mazumdar-Shaw for reappointment as the Lead Independent Director.”, said Nandan Nilekani, Chairman of the Board said.

Digital Revenues:

Digital revenues at $942 million (31.5% of total revenues), a year-on-year growth of 33.1% and sequential growth of 5.0% in constant currency terms

Management Change:

The board has appointed Nilanjan Roy as the Chief Financial Officer of the Company effective March 1, 2019.

Jayesh Sanghrajka was appointed as Interim Chief Financial Officer effective November 17, 2018.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.