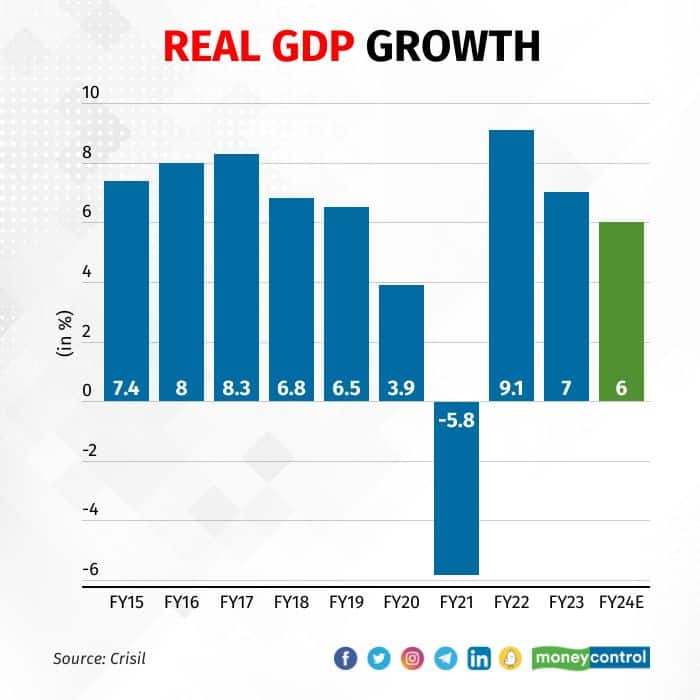

India’s real GDP growth for the next fiscal looks weak, going by CRISIL’s latest report.

Outside of two years, one of which is the pandemic-hit FY21, the next fiscal will see the lowest, real-GDP growth in a decade, according to the rating agency’s report titled ‘Rider in the Storm – Tracing India’s growth in a volatile world’.

Also read: Is economic recovery running out of steam?The economic and capital-market experts have estimated the country’s real GDP to grow by 6 percent, which is 40 bps lower than the Reserve Bank of India’s estimate of 6.4 per cent and 100 bps lower than CRISIL’s FY23 estimate of 7 percent.

“The key challenge to the Indian economy in the coming fiscal is to grow when the world is slowing,” they wrote about the GDP growth in FY24.

The rating agency listed the following reasons for seeing a slow growth: “The challenges have shifted — from the pandemic to the fallouts of the Russia-Ukraine war and aggressive rate hikes by major central banks to fight inflation. Policy rates are at decadal highs across the advanced world. Slowing global growth will put the brakes on India’s exports. Additionally, as policy rate hikes filter through the economy, tighter domestic financial conditions are likely to weaken demand.”

The report added that inflation is expected to moderate to 5 per cent in FY24 but disruptive weather events could “undo the math”.

“After a sharp rise to 6.8 percent in the first 10 months of this fiscal, it is expected to moderate to 5 percent next year, driven by lower global commodity prices, expectation of softer food prices, demand slowdown, easing core inflation, and base effect,” it stated.

“But we need to watch out for disruptions to food production due to El Niño and other extreme weather events (leading to volatile food prices), and continuing geopolitical risks (impacting commodity prices), as that could undo the math,” the report added.

If inflation overshoots these estimates, then real GDP growth could slow even further.

Other key metricsCRISIL forecasts that CPI inflation could moderate to 5 percent (YoY) in FY24 from an estimated 6.8 percent in FY23. This would be on “lower commodity prices, the expectation of softer food prices, cooling domestic demand, and base effect will help moderate inflation”.

The agency forecasts the rupee-dollar exchange rate to touch 83 by the fiscal end. “While a lower current account deficit will support the rupee, challenging external financing conditions will continue to exert pressure next fiscal,” the report stated.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.