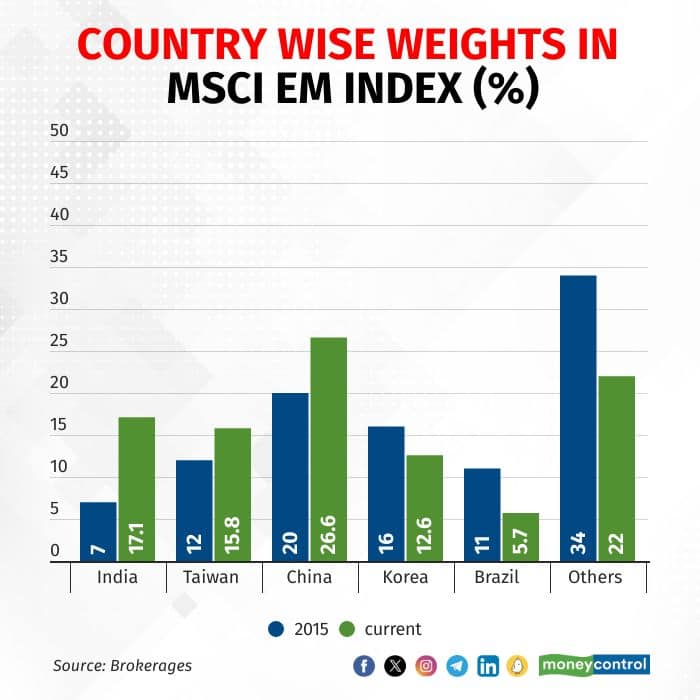

India's weightage surpassed Taiwan in MSCI EM index, now ranking second after China. This solidifies India as a promising investment choice among emerging markets.

India's MSCI Emerging Markets index spiked in eight years, leaping from 7 percent to 17.1 percent. With the ongoing domestic institutional investments and potential steady FII participation, India could surpass a 20 percent weight in the MSCI EM Index by early 2024, according to recent Nuvama report.

Recent Jefferies notes suggest that India is poised to attract more foreign investments in 2024 in the medium term. India's positioning in EM portfolios remains relatively light, but its growing size is making its markets more relevant for global funds. Favourable conditions such as expected political stability, a rising investment cycle, and a peaking US dollar create an ideal scenario for higher foreign flows.

After a significant outflow of $33 billion from 2H21-1H22, FPI flows have reversed, with the highest inflows observed in the last 11 years. India's rising weight in EMs has contributed to these increased flows, with its neutral weight in the benchmark MSCI EM rising by 3.5 percentage point over the past six quarters. However, analysis shows that India's relative position in large EM active funds are closer to neutral now, rather than significantly above the average. Therefore, the potential for FPIs to take a larger position could become a crucial driver for future flows, Jefferies note added.

India's MSCI EM pack share was steady at 8 percent until October 2020, nearly doubling since then. This surge was fuelled by factors like India's introduction of a standardised Foreign Ownership Limit (FOL) in 2020, robust performance in Indian equities (especially in the Midcap segment), and weaker performance in other emerging market packs, notably China.

By 2023, India's stock count in the MSCI Standard index increased to 131, with a net addition of 17 Indian stocks across four reviews, showing an improvement from 2022 inclusion of only nine Indian stocks. Factors contributing to this rise in 2023 include India's substantial market rally compared to other emerging markets and MSCI's transition from semi-annual to quarterly rebalancing.

China's weight in the MSCI EM index has decreased to 26.6 percent from 33.5 percent a year ago, while Taiwan, South Korea and Brazil have seen marginal increase since last year.

Client Associates (CA), India’s largest multi-family office, advocates for increased India representation in MSCI Emerging Market Index (MSCI EM) and MSCI All Countries World Index (MSCI ACWI). The white paper emphasises India's robust economic growth, set to become the world's third-largest economy by the decade's end. It urges a reassessment of India's allocation in global indices, noting the disparity between its potential and current MSCI representation.

Exploring India's market capitalisation/GDP contrasted with MSCI EM and MSCI ACWI allocation, the paper highlights India's potential for diversification and better risk-adjusted returns. It identifies high promoter ownership limiting foreign investment in large firms and India's insufficient market accessibility as key reasons for under-representation in MSCI indices.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.