The Indian market scaled new highs in the week ended November 25, as investors cheered suggestions of the US Federal Reserve slowing rate hike pace, a fall in crude oil prices, a weak dollar and buying by foreign investors.

For the week, the 30-pack BSE Sensex rose 630.16 points, or 1 percent, to end at 62,293.64, while the broader Nifty added 205.15 points, or 1.12 percent, to close at 18,512.80 levels.

During the week, the Sensex and the Bank Nifty also touched all-time highs, while the Nifty is just shy of its life high.

On the sectoral front, the Nifty media index rose 5.4 percent, PSU bank index added 5 percent and oil & gas and information technology 2.5 percent each. The Nifty realty index, however, shed nearly a percent.

The BSE midcap index gained 2 percent, the small-cap index 1.5 percent and the large-cap index rose 0.8 percent.

"Bulls dominated the Dalal Street, with the indices parked near record highs, supported by favourable triggers like FII buying, a drop in crude prices, a falling dollar index and declining bond yields," said Vinod Nair, Head of Research at Geojit Financial Services.

The Federal Open Market Committee (FOMC) meeting minutes hinted that the rate hike cycle may be slowing down. Oil prices dropped over talks of a possible price cap on Russian crude and a rise in US product stockpile. However, the tight COVID lockdown in China negatively impacted the global growth forecast, he said.

"Going ahead, the lack of strong fundamental triggers will limit the upside, keeping the market volatile in the short term. The Fed chair's speech, which is scheduled for next week, and the release of other significant macroeconomic data will influence the market's future trajectory," Nair added.

During the week, foreign institutional investors (FIIs) sold equities worth Rs 1,480.46 crore, while domestic institutional investors (DIIs) bought shares worth Rs 1,781.47 crore.

Also read: Sensex @ all-time high: Is it time to be bullish or bearish?

FII have in November bought equities worth Rs 11,358.48 crore, while DIIs sold equities worth Rs 1,588.43 crore.

It was also a good week for several smallcaps, with the BSE small-cap index adding 1.5 percent.

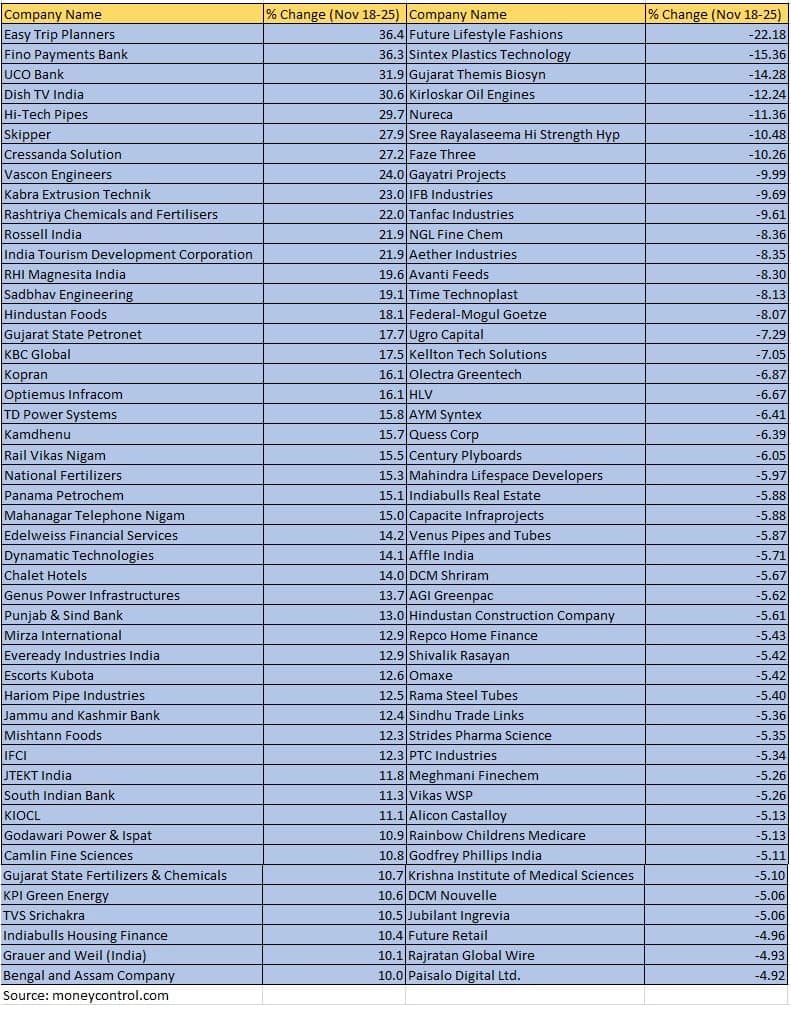

Easy Trip Planners, Fino Payments Bank, UCO Bank, Dish TV India, Hi-Tech Pipes, Skipper, Cressanda Solution, Vascon Engineers, Kabra Extrusion Technik, Rashtriya Chemicals and Fertilisers, Rossell India and India Tourism Development Corporation rose between 21 and 36 percent.

On the other hand, Future Lifestyle Fashions, Sintex Plastics Technology, Gujarat Themis Biosyn, Kirloskar Oil Engines, Nureca, Sree Rayalaseema Hi Strength Hyp and Faze Three shed 10-22 percent.

The BSE 500 index gained 1 percent with Easy Trip Planners, UCO Bank, Rashtriya Chemicals and Fertilisers, RHI Magnesita India, Gujarat State Petronet, Punjab National Bank, Bharat Heavy Electricals, Rail Vikas Nigam and Indian Railway Finance Corporation adding 15-36 percent.

Where is Nifty50 headed?

Gaurav Ratnaparkhi, Head, Technical Research, Sharekhan by BNP Paribas

At the beginning of the week, the Nifty tested the short-term support zone of 18,100-18,200 and moved up as the week progressed. On the weekly chart, the index formed a bullish outside bar, which makes the week’s low of 18,133 a key support.

On November 25, the Nifty had a brief consolidation near 18,500. The benchmark index can hover around the all-time high of 18,604 for a while. This will be the make or break level to be monitored on a closing basis, which will determine further course of action.

The immediate support zone continues to be at 18,400-18,380.

Siddhartha Khemka, Head-Retail Research, Motilal Oswal Financial Services

We expect the northward momentum to continue, buoyed by positive global cues, a fall in crude prices and gradual economic recovery.

Participation of the broader market, too, is encouraging which would help markets scale further highs. We believe that once the Nifty crossed its previous high of 18,604, it will steadily inch up towards 19,000 over the next few weeks.

Ajit Mishra, VP-Technical Research, Religare Broking

With the benchmark at a record high, improvement in the broader participation would play a critical role in shaping the market trend. The performance of global markets, too, will continue to weigh on the sentiment.

We recommend following the trend and focusing on identifying the themes that could unfold ahead along with the present leaders.

Apurva Sheth, Head of Market Perspectives, Samco Securities

On technical ground, the support is placed near 18,250 and any move below it will extend the fall to 18,100. Similarly, 18,650 will be the immediate resistance followed by 18,800.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!