Fin Nifty traded flat on December 12, showing a consolidative momentum in the market. However, the overall sentiment remained positive. On a weekly basis, Fin Nifty Futures have observed a price increment of 0.80 percent, accompanied by a significant increase in open interest, reaching 28.90 percent, indicating a long build-up.

At 12:30pm on December 12, Fin Nifty was trading at 21,214, up 0.051 points.

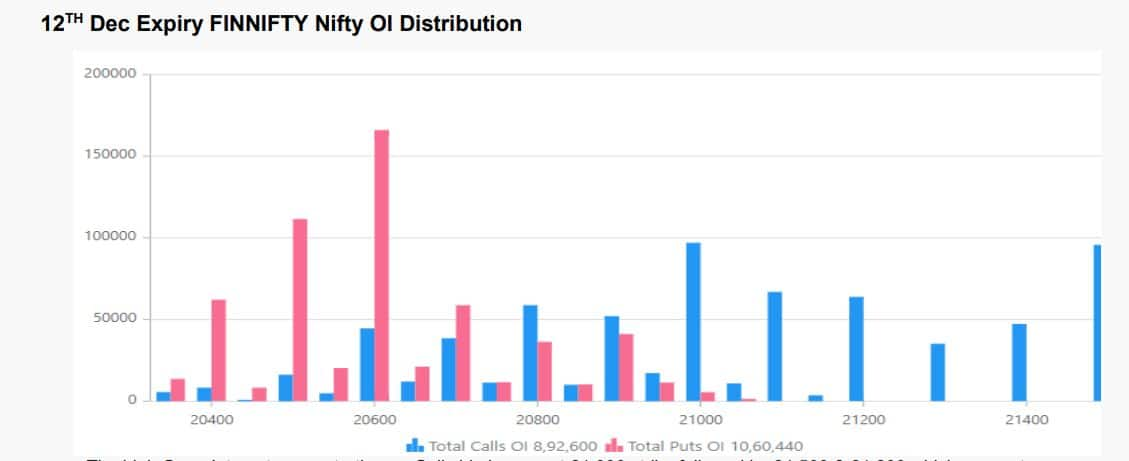

Open Interest (OI) Build Up Finnifty open interest data | Source: Axis Securities

Finnifty open interest data | Source: Axis SecuritiesHigh OI concentration on the Call side is observed at the 21,400 strike, followed by 21,300 and 21,500, which may act as immediate resistance. On the Put side, there is a high OI concentration at the 21,000 strike, followed by 21,200 and 21,100, which may act as immediate support. As per Axis Securities, a probable trading range for the week is of 20,700 to 21,700.

According to Avdhut Bagkar, Derivatives and Technical Analyst at StoxBox, "Fin Nifty has support at the spot 21,200 on its weekly expiry day. However, if the index fails to hold the same, the trend may see exaggerated sell-off. On the upside, 21,260 remains a key barrier. Any breakout of these two levels and sustainability over the same for 10 minutes could propel the rally in that direction," he said.

"The index must scale over 21,250 to draw a bullish momentum. A failure to hold the spot 21,200, the 21,250 CE may see aggressive writing," he added.

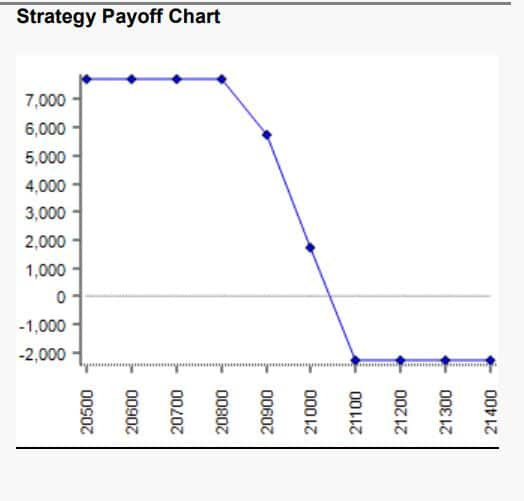

Derivative Outlook for Next Week's ExpiryPut Spread strategy by Axis Securities. "Traders could initiate this spread strategy to make modest returns with limited risk and reward. The suggested spread consists of Buying one lot of the 21,100 strike put option & Selling 20,850 Put Options one Lot Each," stated Axis Securities.

Source: Axis Securities

Source: Axis Securities

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.