The last round of correction, which pushed the index lower by about 9 percent from its August record high, also led to many quality largecap stocks tumble from 52-week highs.

The real challenge for investors now is to look for quality largecaps. Motilal Oswal in a report highlighted 10 stocks which have fallen up to 27 percent from 52-week highs.

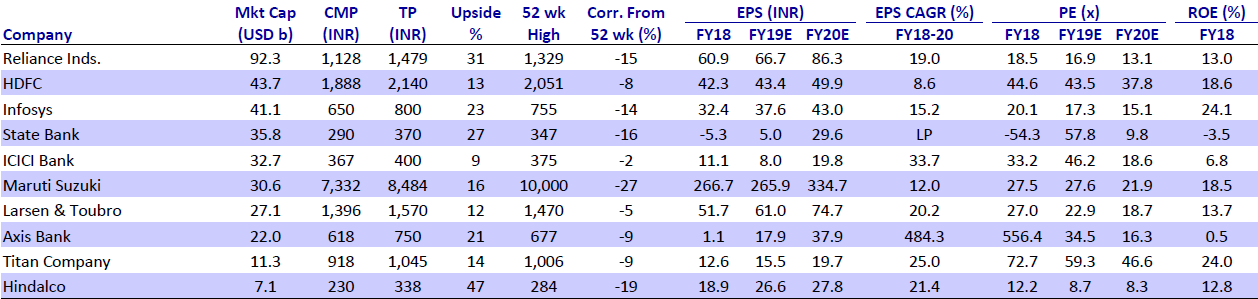

The brokerage firm sees an upside of 9-40 percent on these 10 large-cap stocks which include names like RIL, HDFC, Infosys, SBI, ICICI Bank, Maruti Suzuki, L&T, Axis Bank, Titan Company and Hindalco.

India Inc's September earnings were broadly in line with analyst expectations as far as Nifty companies are concerned. As many as 73 companies saw earnings cut of over 3 percent, while 38 companies saw upgrades of over 3 percent.

“While the underlying earnings story is improving (better revenue growth trends, corporate banks’ asset quality turning around, etc.), new risks to earnings are also emerging (autos, NBFC). Consequently, the direction of the earnings revision is still trending down,” Motilal Oswal said in a report.

Analysts feel that if investors are looking to enter markets on declines, largecaps are still a better bet compared to shaky small and midcaps. Earnings for most of the large-cap names are looking up which is a positive sign.

The EPS estimates of most of the stocks in the table above suggest that the earnings are inching higher in FY19 as well as in FY20.

“The headline large-cap indices are still being held up by few major stocks; however, the market breadth remains weak and the broader markets have seen continued selling pressure,” Sahil Kapoor, Chief Market Strategist, Edelweiss Investment Research told Moneycontrol.

“Small and midcaps usually lead the reaction to down cycles, and as the market sentiment turns sour they are the first ones to decline. In our opinion, the broader market is already pretty overvalued relative to the large-cap indices, and the latest market rout is an opportunity for such indices to come back to better valuations,” he said.

The recent correction in the Indian market might have seen many stocks losing their sheen but from a benchmark point of view the valuations are still slightly on the higher side, suggest experts.

“The Indian market valuations are still on the higher side relative to history and bond yields despite the correction over the past few months. The valuations already factor in 15 percent and 26 percent growth in net profits of the Nifty-50 index for FY19 and FY20,” Kotak Institutional Equities said in a note.

“We find decent value in a few sectors and stocks in financials, energy, metals & mining and power utilities but do not find value in the ‘quality’ stocks. Also, it remains to be seen if their high multiples will hold up in the event of tighter global monetary conditions and higher bond yields,” it added.

As the market is expected to remain volatile for an extended period, investors looking to build portfolio should approach with caution by deploying bottom-up strategy, suggest experts.

“At an aggregate level, we believe that largecaps offer a better risk-return profile. However, some individual stock names among small and midcaps look better. Investors should stick to quality,” Vivek Ranjan Misra, Head of Fundamental Research at Karvy Stock Broking.

“I think investors are well-off doing staggered buying as more volatility is expected in the near term before elections. Our Sensex target for the 2019-end is 45,000. Portfolio strategy: Equities – 40 percent, Debt – 30 percent - Mostly G Secs, Gold – 10 percent, and Cash – 20 percent,” he said.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.