Gokaldas Exports’ acquisition of Dubai's Atraco Group for $55 million will give it access to low-cost, duty-free manufacturing locations and increased production capacity that will allow it to expand its global footprint, especially in the US, brokerages said.

The stock of the garment exporter, which crafts products for brands such as GAP, Abercrombie & Fitch, H&M, and Puma, has run up 25 percent in the past one week.

Shares of Gokaldas Exports surged 20 percent on August 29, a day after the company announced the acquisition of Atraco. Gokaldas will pay $45 million when the deal is finalised and the remaining amount by March 2024. It will use a combination of debt (73 percent) and internal accruals to fund the acquisition.

“Atraco advances our growth strategy, bringing in a well-run apparel manufacturing company with deep experience in the MEA (Middle East and Africa) region,” the company said in an investor presentation.

Acquiring Atraco will speed up the company’s growth, which would otherwise have taken three years.

More about Atraco

Atraco has four manufacturing units in Kenya and one in Ethiopia that produce about 40 million garments annually, almost equivalent to Gokaldas’ capacity. The company gets its raw material from China, Indonesia, India, Pakistan, Taiwan, and the United Arab Emirates.

It specialises in making casual wear. The Atraco Group's revenue came in at about $107 million in 2022 with a profit after tax of $7.2 million.

The Dubai company’s scale of business is equivalent to 40 percent of Gokaldas’ existing business. Peak revenue potential will be about Rs 4,000 crore by FY25 after consolidation, according to Sharekhan.

Atraco exports 95 percent of its products to the US, which will enhance the presence of Gokaldas in North America, the brokerage highlighted.

Read more | A good yarn: Gokaldas Exports’ story of success likely to continue

Is the deal attractive?

Sharekhan said the acquisition is attractive because it is valued at 0.6 times the enterprise value/sales and 7.6 times price-to-earnings, a discount compared to similar textile companies. This deal is also expected to be earnings accretive.

The management anticipates that operating margins of the acquired company will increase by 100-150 basis points by FY25. This is expected to boost the company's revenue to Rs 4,000 crore and add Rs 5-6 per share in FY25, making the acquisition profitable. Gokaldas has cash of about Rs 350 crore on its books.

The stock trades at 27.6 times and 20.6 times its FY24 and FY25 earnings, respectively, the brokerage said. Sharekhan maintained its ‘buy’ rating on the stock with a target price of Rs 865.

On September 4, the stock was trading at Rs 761. Shares of the garment exporter has generated over 65 percent returns for investors in the past three months, and has gained 53 percent in the past one month.

After combining Atraco's financials with those of Gokaldas, it will result in a 36 percent increase in consolidated revenue and a 30 percent surge in EBITDA for FY24, and a 35 percent increase in consolidated revenue and a 35 percent rise in EBITDA for FY25, according to Systematix Shares and Stocks.

The brokerage firm projects a 25 percent increase in EPS for FY24 and a 36 percent increase in FY25. Even though depreciation and interest expenses are higher, they will be partially offset by a lower tax rate.

Other perks

Duty-free access to the US is a key strength. Duties currently range from 11 percent to 28 percent, the company said.

Kenya can export to the US without duties thanks to the African Growth and Opportunities Act (AGOA). Atraco also has duty-free access to the European Union and the UK through the Economic Partnership Agreement, Generalized Scheme of Preference and Least Developed Country status.

Ethiopia, due to its Least Developed Country status, has duty-free access to Japan, the EU, the UK, and Canada. While Ethiopia was previously part of AGOA, it was excluded in 2022. Gokaldas is therefore slated to benefit from a favourable duty structure, said Systematix Shares and Stocks.

In Kenya and Ethiopia, where labour costs are lower, there is a chance to improve efficiency, expand operations, and increase profit, potentially by an additional $30 million, analysts pointed out.

This positions Gokaldas to tap into low-cost, duty-free manufacturing locations, potentially enhancing its competitiveness and margins, said Anirudh Garg, partner and head of research at Invasset PMS.

“With newly acquired African business, the company can focus on scaling up its US business while the India business can focus on gradual expansion in the UK/EU (especially post FTA signing with the UK in the coming months),” said Sharekhan.

Gokaldas expects a strong uptrend in export demand to start in Q3 of FY24. Additionally, Atraco has a strong order book till April 2024.

The company can leverage the nearly mutually exclusive customer base for cross-selling opportunities. It can also look into cost savings due to a larger scale of operations, which can lead to reduced operating expenses.

Read more | Textile stocks: What’s triggering the joyride to new highs?

Well-placed among peers

Gokaldas holds a competitive stance in the textile sector and is positioned favourably relative to peers. It has a PE ratio of 30.07, compared with the industry's higher PE of 38, suggesting potential for growth, said Garg.

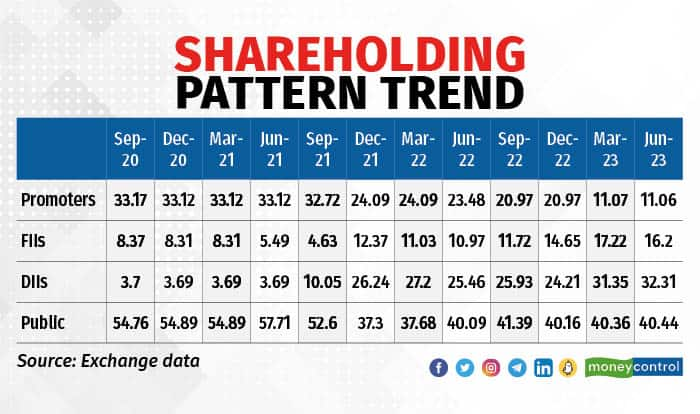

Fundamentally, Gokaldas posted a 49.4 percent compounded annual growth in profit over five years, reflecting effective operational strategies, while its return on capital employed surpassed 20 percent, signifying efficient capital use. However, the decline of 22.1 percent in the promoter holding over three years warrants attention, Garg said.

Sectoral outlook

After a tough FY23 because of low demand, excess inventory with retailers, limited supplies, and snowballing cotton prices, textile companies are hoping a demand revival is around the corner.

They expect demand to pick up as global retailers slash inventories. Trade volumes are likely to improve in the second half of FY24 as global retailers order their summer and spring 2024 collections, some analysts said.

In the long run, the Indian textile industry's future looks bright, with increasing production capacity and higher-value products, the China-plus-one strategy, trade agreements with nations, benefits from the production-linked incentive scheme, and the potential for wider export market share, said Sharekhan.

“Margins are expected to improve in the quarters ahead due to lower raw-material prices and supply costs,” the brokerage firm added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!