Year 2022 has been marked by excessive volatility in exchange rates, forcing central banks in emerging markets to intervene and protect their currencies.

The Reserve Bank of India (RBI) is no stranger to exchange-rate volatility. What was notable was that its intervention morphed over the year -- from a more complex exercise involving heavy forward segment interference to a simpler spot market intervention.

The move, in hindsight, seems to have been prudent, given the fallout of exchange rate intervention in domestic liquidity.

That said, market distortions are an unsavoury outcomes of central bank interventions even though such measures are taken with good intentions. Here is a lowdown on what the RBI did in the forex market and its outcomes:

Here, there, everywhere

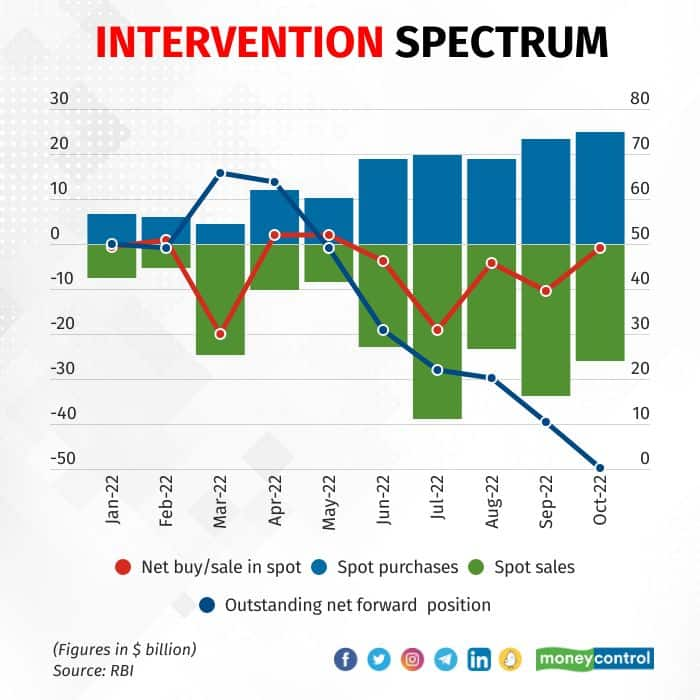

The RBI has been one of the most active among emerging market central banks when it comes to foreign exchange intervention. It has been using both the spot and the forward segment to smoothen volatility and prevent spikes in the Indian rupee. The intensity further increased after Russia invaded Ukraine, setting off a chain of events across markets.

With trade disrupted, exchange rate movements became erratic and the RBI adopted a wider intervention in both the spot and forward segments through swaps. Buy-sell and sell-buy swaps – a scenario where the central bank sells or buys dollars in the spot market and takes a counter-position in the forward market -- became the order of the day.

This changed in the second half of the year when the RBI started to run off its forward book and took a greater participation in the spot market.

The chart above captures the growing intensity of intervention, with the central bank selling and buying dollars in the spot market, and the amount involved increasing progressively.

Forwards and backwards

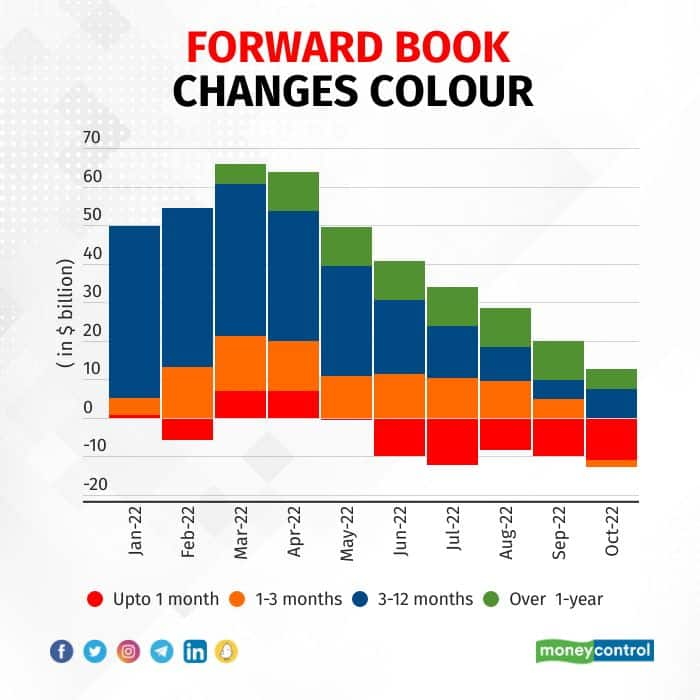

The RBI’s outstanding forward position has progressively reduced from $50 billion in January to a mere $200 million in October. That is because of a combination of maturity and fresh counter-positions. In January, the forward book was more than 90 percent of tenures above three months. The RBI let its forward contracts mature, and, as they came up for delivery, it received dollars from the market.

The tenure of the forward book underwent a change as shown in the chart above. The 3-12 month tenure reduced while near-month forward contracts increased. They were mostly to sell dollars at a future date by the RBI. In the last few months, the central bank bought dollars from the spot and took a counter-selling position in the forward market.

This, in a nutshell, reduced its forward book considerably. At the same time, it helped stabilise the sharp drop in forward premiums, somewhat. But forward premiums fell to decadal lows, mainly because of the RBI’s earlier interventions here.

Rock bottom

One of the straight outcomes of intervention is the impact on premiums. Forward contracts enable companies to buy or sell dollars at a future date. Booking dollars in future requires the buyer or seller to pay a premium to do so. With the Russia-Ukraine war, the US dollar’s relentless rise was a given. The dollar index has climbed relentlessly as investors sought refuge in its safe havens, during the uncertainty of the war.

Ironically, the premium commanded by the dollar against the rupee crashed to decadal lows. Near-month forward premiums dropped massively and the reason is simple. The RBI had promised to supply dollars in the future through its swaps. That meant a guaranteed supply of dollars in the future, which is reason enough for companies to pay lower premiums to secure dollars.

While this augured well for companies looking to hedge their exposure, some suffered because of having taken costly forward contracts on the expectation that the dollar would become expensive. Another unintended painful outcome was the shortage of cash dollars as most participants were beginning to realise that selling dollars to the RBI seemed profitable. This was an additional reason that eventually contributed to the Indian rupee’s sharp fall of the last six months.

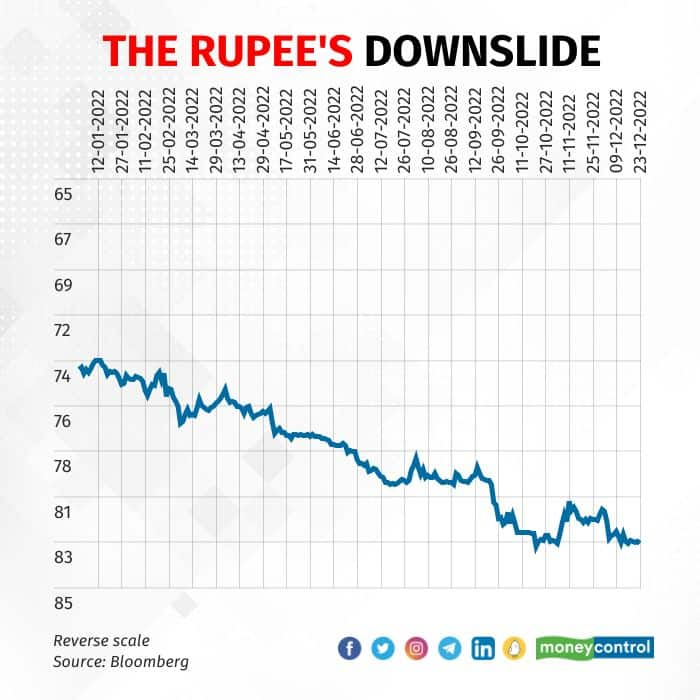

In sync with the world

The rupee, at first, seemed to withstand the dollar’s rise globally and the capital outflows seen from the domestic market. Much of this is attributed to the RBI’s selling in the forex market at the beginning of this year. That said, with most emerging market currencies weakening considerably against the dollar, and the US Federal Reserve going full throttle on tightening, the central bank seems to have made a tactical call to shift its interventions to the spot market. As stated earlier, the RBI’s decision to let its forward contracts mature meant a shortage of cash dollars which pushed the US dollar up and the rupee down in the spot market.

That, along with the persistent outflows and the weak sentiment, explains the more than 6 percent fall of the rupee between June and October. To be sure, the rupee has still remained fairly strong in comparison to most of its emerging market peers that showed a sharper depreciation.

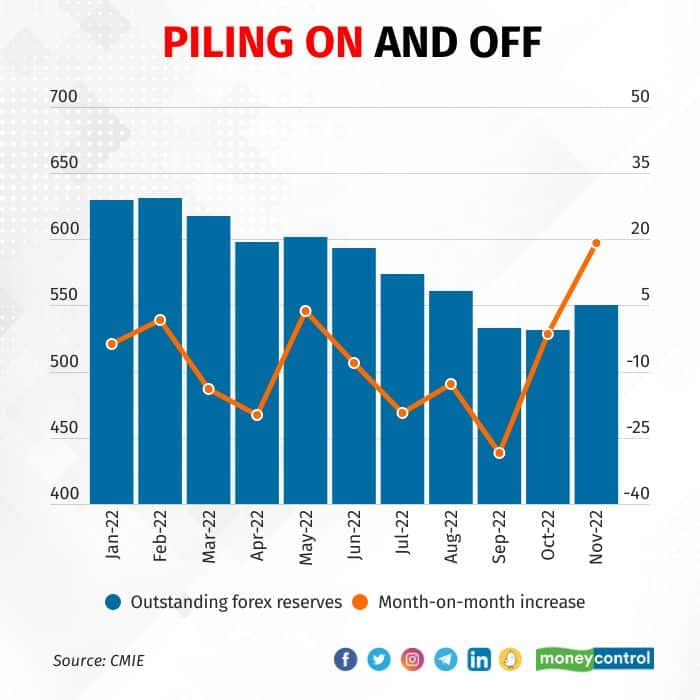

Firepower gone and back

An important outcome of the RBI’s interventions and the tactical changes in its moves has been the movement in foreign exchange reserves. In times of crisis, forex reserves tend to give the much-needed cushion to the RBI for battling volatility. They also provide an optical sentiment boost and confidence to investors about the firepower a country has -- to withstand an onslaught of adverse capital flows.

Given the intense interventions, forex reserves have dipped by more than $100 billion this year. The consistent fall of the reserves has now slowed and the pile has, in fact, risen in the past five weeks. Economists believe that the current level of reserves continue to offer comfort on India’s external sector indicators.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.