Indian benchmark indices are trading higher on June 19 amid a strong surge in banking stocks. At noon, Nifty was trading flat at 23,568 levels, up 10 points, while Bank Nifty surged by 700 points to reach 51,150 levels, nearing the all-time high level touched earlier today.

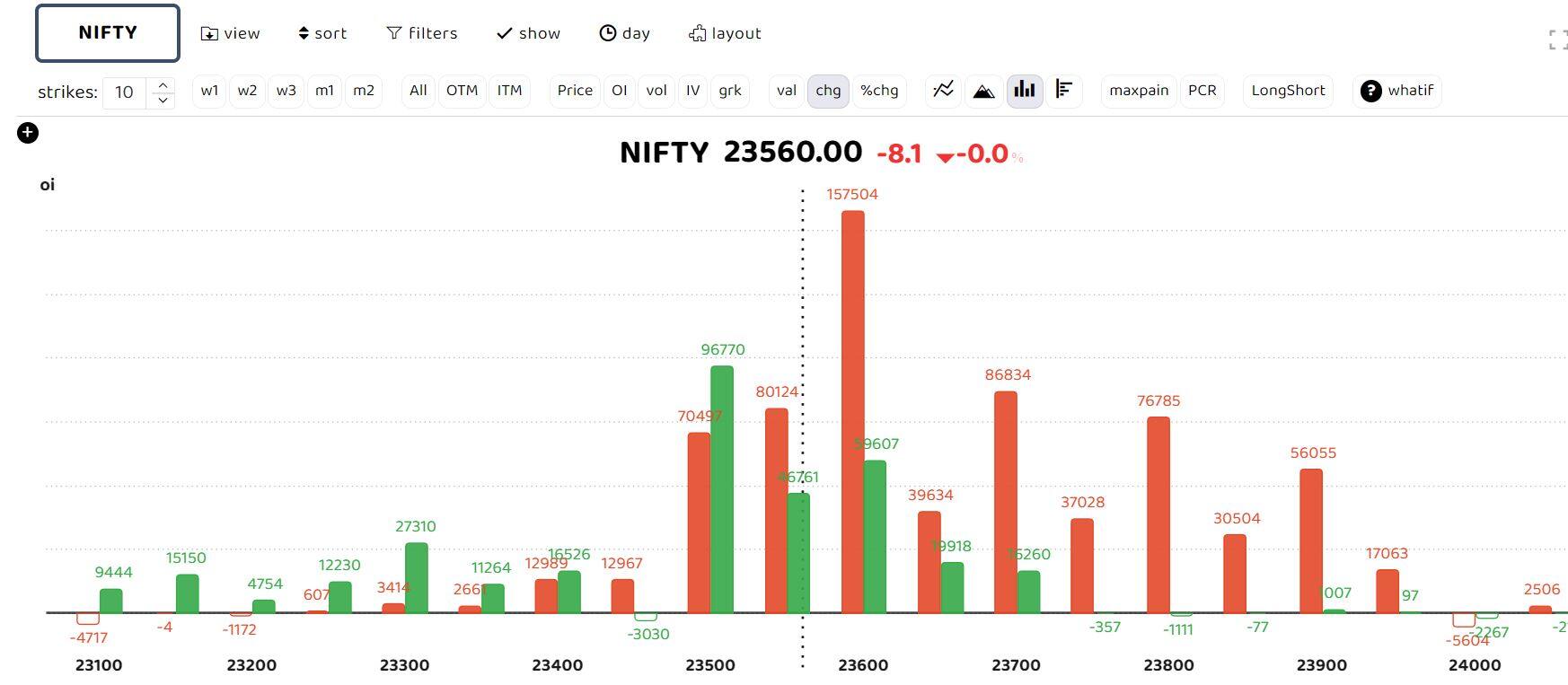

From a short-term perspective, Nifty is likely to test the next resistance zone of 23,750-23,800 in the next few days. On the higher side, immediate resistance is at 23,575-23,600 levels, and the next resistance zone is at 23,750-23,800 levels

Options data suggests heavy call writing across 23,700 to 23,900 levels. According to Tejas Shah, Vice president - Technical research at JM Financial, "The Nifty closed above the critical resistance level of 23,350 last

week and we believe that it is likely to test the next resistance zone of 23,750-800 in the next few days."

"Supports for the Nifty are now seen at 23,500 and 23,300-350 levels. On the higher side, immediate resistance is at 23,575-600 levels and the next resistance zone is at 23,750-800 levels, " said Shah.

Bank Nifty

Sudeep Shah, DVP and Head of Technical and Derivatives at SBI Securities, stated that, "On Wednesday, we have seen follow-up buying interest in banking space. However, it has marked high of 51255 and thereafter witnessed minor profit booking. Currently, it is trading above its short and long-term moving averages. The daily RSI has surged above 60 mark."

Strategy for Bank Nifty

Going ahead, Shah recommends to adopt buy on dips strategy in banking space. "The zone of 50350-50300 will act as immediate support for the index. As long as it is trading above the level of 50300, it is likely to test the level of 51500, followed by 51,800 in the short-term., " he said. While, on the downside, as per Shah, any sustainable move below the level of 50300 will lead to profit booking in index up to the level of 49,800, followed by 48,500 level.

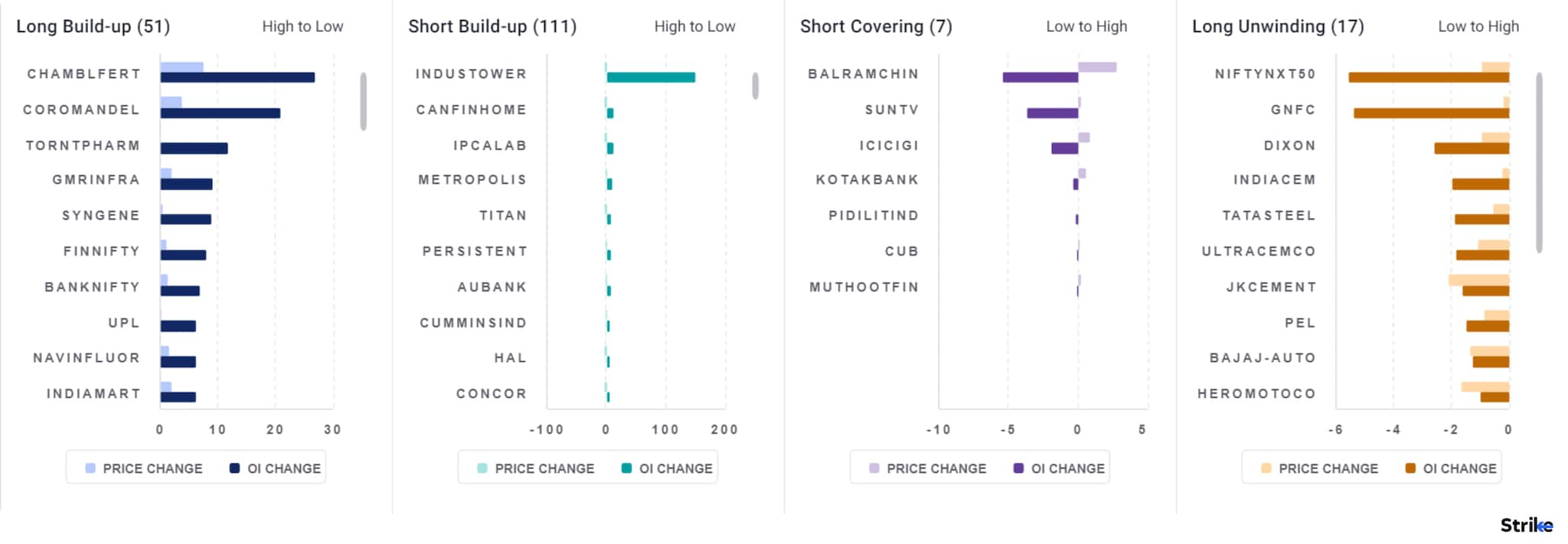

Among individual stocks, long build is observed in Chambal fertilizers, Coromandel, Torrentpharma and GMR Infra. While short build up is seen in Indus Tower, Ipca Labs, Titan and HAL.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.