Investors look for stocks that could not only generate wealth in bull run, but also safeguard capital when market is lower.

Although Sensex and Nifty50 slipped into bear phase in 2020, most of the small & midcaps were already bleeding since 2018.

Indian market made a bottom in March 2020, and since then it has recovered a bit. Nifty, midcap and smallcap indices are all up ~30 percent from the March lows.

Edelweiss Securities, in a report, highlighted that better quality stocks are leading the recovery irrespective of market caps.

“The fact that all indices have recovered ‘equally’ validates our arguments. With this recovery rally, we believe the valuation trade is certainly behind us – almost 70% of the top 350 stocks are back to nearly the same or higher valuations as compared to January 2020,” said the note.

The brokerage firm urges investors to focus on businesses. In the note, Edelweiss ponders over two ideas: 1) Lockdowns have given birth to a new category of businesses-‘Essentials’.

Classic defensives are well known, but these new ‘Virus defensives’ proved to be supply hedges. Maybe, this added predictability to their earnings trajectory makes them re-rating candidates.

And, 2) the note filters out 10-12 sub-sectors where competition may bleed deeply and concede market share to leaders.

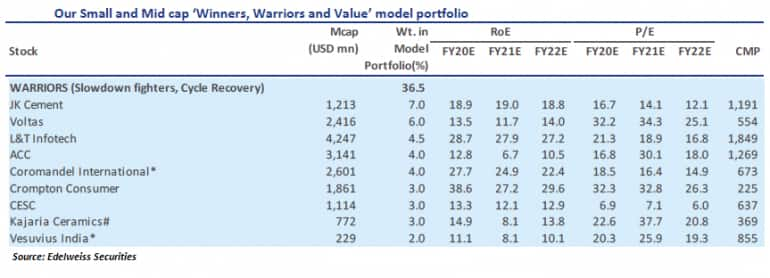

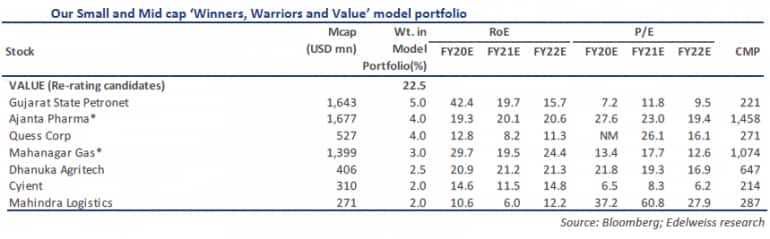

Edelweiss Securities' ‘Winners, Warriors & Value’ model portfolio continues to outperform. Their top picks include JK Cement, Coromandel International, CG Consumer, IEX, SIS India, GSPL, TCI Express, Quess Corp and Dhanuka Agritech.

The most important theme which Edelweiss Securities focused in the report is quality.

“We are raising our weight in the ‘Warrior’ category – leader businesses that are successfully fighting off a tough industry environment,” said the report.

“We marginally raise weights in stocks such as Voltas, JK Cement, ACC, and add Coromandel to this group. In this note, we add Coromandel, Indian Energy Exchange, Mahanagar Gas, Gulf Oil Lubricants, and Vesuvius to our SMID model portfolio,” it said.

‘Winners’ portfolio constitutes of stocks that are quality, have the market leadership, and structural opportunities. The portfolio include IGL, Aarti Industries, PI Industries, Dr. Lal Pathlabs, TCS Express, and Gulf Oil.

The ‘WARRIORS’ portfolio includes companies that can fight the slowdown, and cyclical in nature. It includes names like JK Cement, Voltas, Crompton Consumer, CESC, Kajaria Ceramics, etc. among others.

The ‘VALUE’ portfolio has stocks that are re-rating candidates. It includes names like GSPL, Ajanta Pharma, Dhanuka Agritech, and Mahindra Logistics, etc. among others.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.