In the recent past, independent directors have been vilified and memed for failing to flag corporate governance issues. But an independent director of Modulex Construction Technologies Ltd (MCTL), Sandeep Khurana, seems to have taken matters to the other extreme.

In his 65-page resignation letter, he wrote that he was leaving MCLT “in disgust”, from being “devastated” and for having been “humiliated”, for not being given adequate protection as a whistleblower and for being threatened when he flagged corporate governance concerns.

“I have been intimidated in the performance of my duties,” he wrote in the letter, which was submitted to the exchange by MCTL’s company secretary and compliance officer.

In a March 18 filing, the company responded to Khurana’s letter, in which it also stated that the Listing Compliance of BSE has advised the company to provide clarification on the points raised by him.

MCTL has called the allegations malicious and has stated that they are “mala fide” and “actuated by malice aforethought”. “It has to be also painfully pointed out that by spinning a resignation letter on half-truths and falsities, Mr. Khurana has not approached the BSE with clean hands,” the response added.

According to the company’s statement, factors that “subtracted from the dignity of Mr Khurana’s office” are many and they include “degrading behaviour” towards staff members, “cruel behaviour” to persons with disability, and “vexatious, malicious, and orchestrated complaints to SEBI and other bodies”.

The statement said that he refused to participate in any independent examination of his complaints and that he indulged in social-media stalking of Disciplinary Committee members among other things.

Also read: The fuzzy world of corporate governance lawsContentious rights issue?It all seems to centre around a rights issue.

A rights issue is a way for a company to raise money from existing shareholders by giving them the option of buying additional shares at a discounted price. Modulex’s stated objective for the rights issue was to invest in a group company called Give Viduet Windows and Doors Pvt Limited (GVWDPL) that makes doors, windows; and to finance MCTL’s wholly-owned subsidiary MMBPL’s building of a factory.

Khurana called the issue a “ponzi scheme” and the company's response referred to it as "The Bogeyman".

The rights issue was presented before the Board in March 2022 and Khurana wrote that he found the rights-issue agenda “sketchy”, with not enough details such as the issue’s purpose, date and the number of shares to be issued and at what price. He wrote, in his resignation letter, that on further investigation he found that the money was being raised to buying out investors in GVWDPL, a shell company where money was being raised for onward funding of MMBPL.

Along with his letter, Khurana submitted a copy of an email from MCTL’s chief operating officer. The email said that GVWDPL had raised Rs 24.96 crore of which Rs 18.78 crore was loaned to MMBPL for funding the project. The email further said that the investors (in GVWDPL) were asking for an exit because of the delay in raising debt (for the factory building) and therefore, the rights issue was decided upon to raise capital and buy out these investors.

Khurana then raised questions on the remaining Rs 6.18 crore. Also, why was it being routed through GVWDPL?

Khurana wrote that MCTL’s claims that GVWDPL was a group company and that it was a manufacturer of doors and windows were misleading.

According to him, GVWDPL is a subsidiary of another company called Prashant Developers and Red Ribbon Group (under which Modulex falls) holds just 7.68 percent of the paid-up capital. He also said that the balance sheet of this subsidiary shows it to be a shell company or at most a finance company.

“It has no revenue from operations, neither in 2021, nor in 2020 nor in 2019 and even earlier than that. The income that it generates is only book entries, on account of loans extended,” he wrote.

He noted with amusement, that a company with net fixed assets of Rs 28,265 could make doors, windows and such, and that it had no employee expenses. He asked, “How could manufacture of doors, windows and their frames happen without the employees?" Khurana wrote that the whistleblower’s complaint was never brought to the attention of BSE.

He wrote, “It (GVWDPL) can only boast of an object clause of a Memorandum of Association which claims that it has an object to manufacture windows and doors. On a lighter note, I can incorporate a company with an object to launch satellites.”

In July 2022, Khurana was removed from the audit committee and, in November 2022, the company put another resolution forward to the board — a preferential issue of MCTL’s shares to GVWDPL and for MCTL to be paid in GVWDPL’s shares, or a share swap deal.

According to Khurana, it was just the rights issue in a new format. He wrote that while the rights issue would have meant raising money in MCTL to buy shares of GVWDPL, with the preferential issue, MCTL’s shares would be swapped with the others without a lock-in. That is, the letter implied either way GVWDPL’s shareholders were being compensated with MCTL’s shareholder assets.

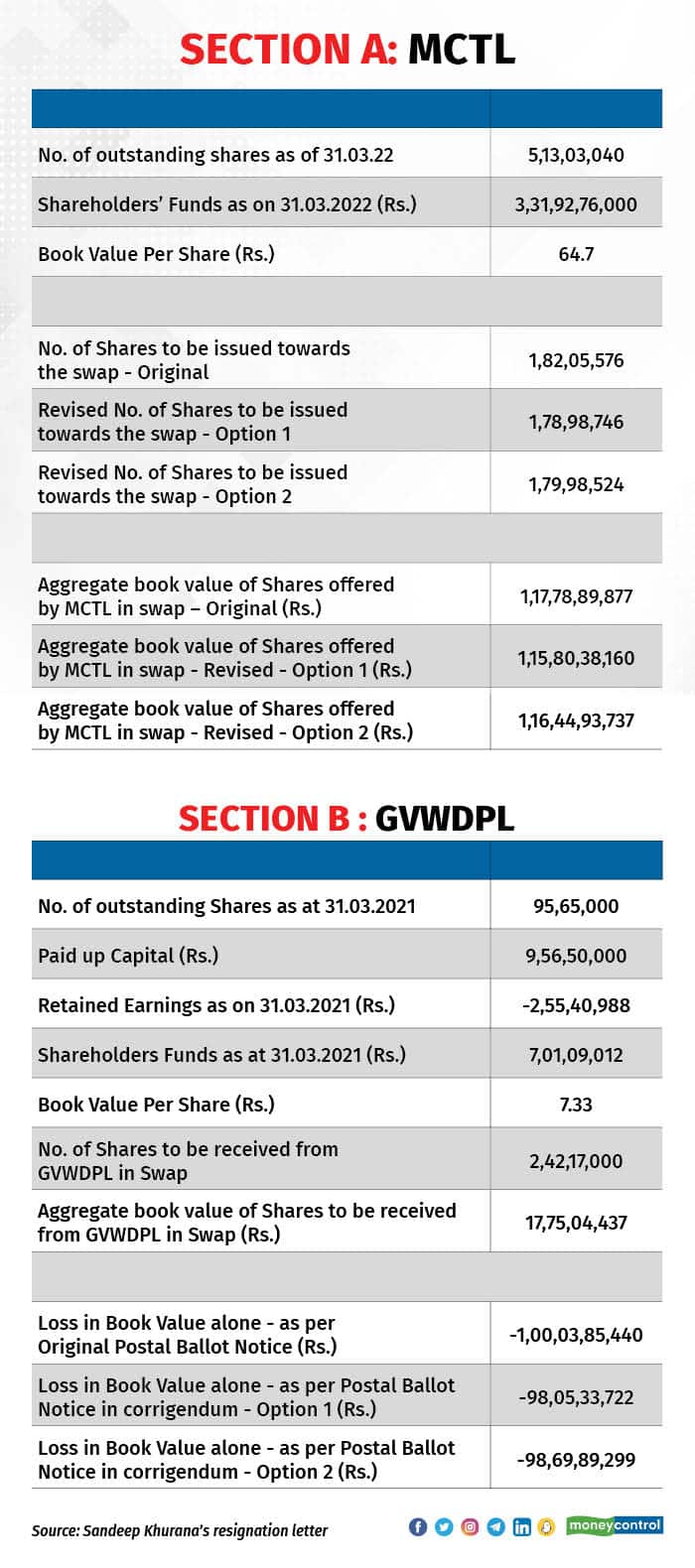

From such a share swap deal, Khurana estimated that the loss to MCTL would be close to Rs 100 crore.

MCTL’s BSE filing stated that calling GVWDPL a shell company was “baseless” and “reckless”. “GVWDPL is a manufacturing company that is yet to commence operations and therefore there is no revenue to be shown,” MCTL’s filing stated.

It added that the rights issue was not pursued and that only a proposal on it and on investment in GVWDPL were made.

The filing also pointed to certain details that it claimed were missing in Khurana’s resignation letter, such as Khurana-chaired audit committee’s approval of loans extended from GVWDPL to MMBPL and MCTL and his issuing invoices to GVWDPL for Rs 32.5 lakh in his own name and another one of Rs 32.5 lakh from Insight Financial Services Pvt Ltd of which he is an owner/director.

According to the company, funds were being raised through the rights issue to complete the construction of MMBPL’s facility. It said that the subsidiary was pursuing a construction technology that would challenge the conventional method.

The new technology, according to the company, would be able to construct entire buildings in a few months and would be a challenge to the existing real-estate industry, and therefore would have its “fair share of enemies/detractors”.

On the fund-raising, MCTL’s BSE filing stated that it had only used a “time-tested strategy” of using both debt and equity sources. “Since the technology itself is new and novel, funding is a challenging aspect. Consequently, MCTL had attempted to raise equity through a rights issue,” it added.

The filing also stated that Khurana was aware of the ultimate objective to acquire GVWDPL as far back as 2019. Then, a proposal to buy equity shares of GVWDPL by way of preferential allotments and pricing as determined by the BSE was “considered” by the Board and that Khurana, being the chairman of the audit committee until July 2022, was fully aware of all material aspects at that time.

It stated that Khurana had initially raised certain concerns about the rights issue and they were “fully addressed by the Board of MCTL at all times”. On the questions raised by Khurana on the details of the rights issue in the March 2022 Board meeting, the filing stated that the questions were not placed in the agenda of the meeting, and therefore, the details were not readily available and that the details were later provided through an email dated April 20, 2022.

Also read: Nykaa's bonus issue: Independent directors' failure is galling: fraud-investigation expertShare-sale troublesAccording to Khurana, he was stopped from selling his shares for 12 months by “using the loopholes and flaws” in the listing guidelines even though they were aware that he needed the money for a family ceremony in July 2022.

He wrote that the company’s management and board members did this by delaying earnings release for four quarters — from the one ending in March 2022 to the one ending in December 2022. The first of these, of the March quarter, was allegedly delayed to prevent the release of the whistleblower complaint he had raised on April 22, 2022.

On March 20, 2023, the company released its unaudited earnings for September 2022 quarter.

Besides causing him grief, the delay in the release of the earnings report cost the company Rs 19,04,960 at Rs 5,000 a day, he wrote.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.