Indices oscillated in a narrow range last week for a major part of the June series. Alternate bouts of buying and selling within the option band provided a lot of opportunities to both call and put writers.

The Nifty remained confined under the trading band of 10,500-11,000 which coincided with the highest option congestion band too. It ended the June series with a loss of 1.4 percent.

Bank Nifty too remained confined to a trading band of 26,000-27,000 after witnessing a stellar rally in the May series. It was down 2.3 percent compared to May expiry closing.

Rollover to the July series was in line for the Nifty and Bank Nifty at 63.6 percent and 71.4 percent, respectively. Stock-specific rollover was relatively lower owing to requirement of additional margins and the onset of quarterly results that led to scepticism among market participants to carry forward trade to the July series.

Trade war worries, depreciating rupee against the dollar and rising crude oil prices led to nervousness among participants and eventual sell-off in small- and midcap stocks.

Pharma index outperformed the broader market with a gain of over 11 percent while infrastructure and metal were beaten down by over 5-8 percent in the June series.

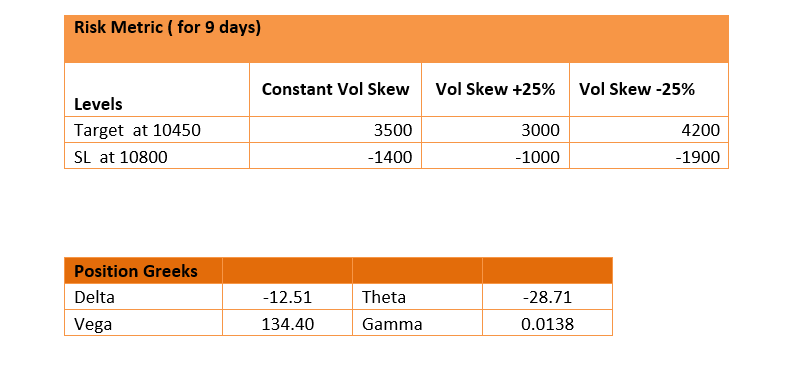

Volatility skew did give early signals of a flattish June expiry as skew remained relatively flat at the beginning of the June series. However, as we move in the July series, the volatility skew is steeper indicating probable directional move on its way.

The July series is starting with a relatively lower open interest base. 10,600 put remains the highest support with an accumulation of 4.5 million shares while calls are distributed across 10,700-11,000, the highest being the 11,000 strikes with an accumulation of 3.3 million shares.

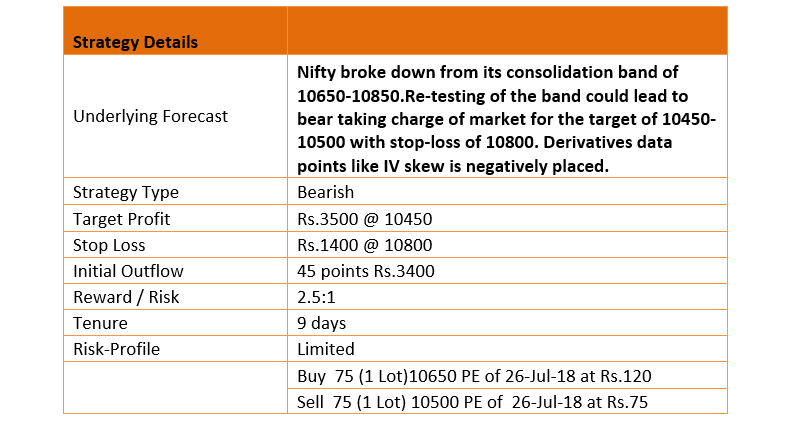

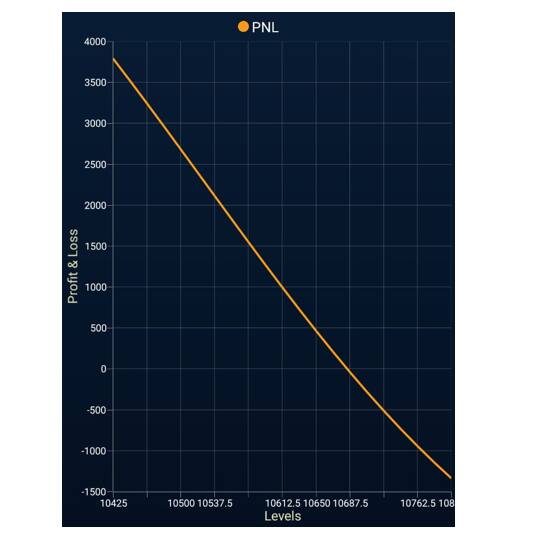

The relatively lower puts compared to calls indicate that resistance is stronger while support remains weak. Thus, low-risk bear put spread is recommended for the next few trading sessions.

Bear put spread is a bearish strategy that is executed by buying a put and selling a lower strike put to fund it. It is a net debit strategy with limited risk and reward. This strategy helps to reduce the cost and break-even point for a medium to long-term bearish trade. Maximum profit on this strategy is limited while loss is capped on the upside.

Disclaimer: The author is CEO & Head of Research at Quantsapp Private Limited. The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.