Titagarh Wagons Limited (TWL) has generated superior returns for its investors, and there is an expectation that more money can be made by lapping up more shares.

In the past three years, the scrip has zoomed 785 percent while it has jumped 180 percent in the past one year. In the last month, the stock is up 15 percent and YTD, it has rallied 30 percent. The wagon maker’s scrip hit its 52-week high of Rs 310 on April 12, reacting to the announcement of an order win.

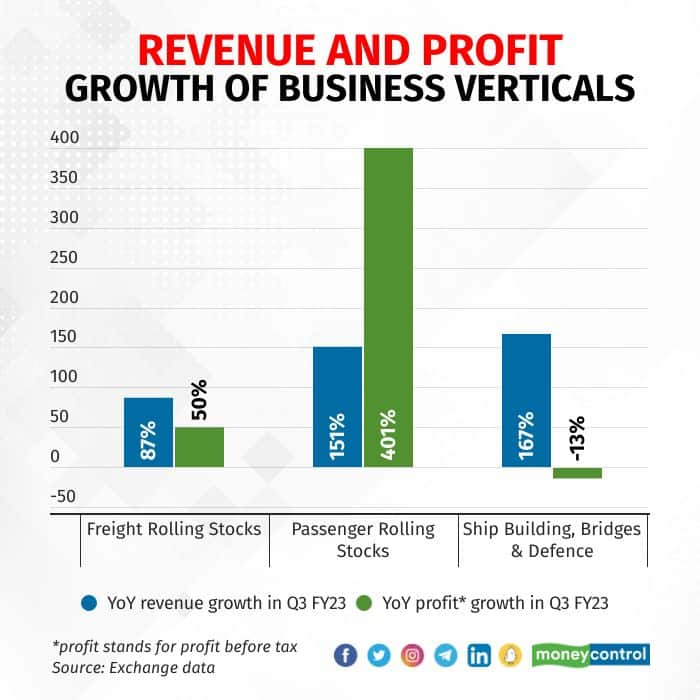

About the companyTWL operates under three business verticals: freight rolling stock, passenger rolling stock and shipbuilding, bridges and defence. Rolling stock includes wagons, coaches and locomotives.

Under freight rolling stock, the company produces wagons, loco shells, bogies, couplers and associated components. It designs and manufactures metro and passenger coaches, electric multiple units (EMUs), train sets, monorail, propulsion equipment, traction motors, and their components under the vertical of passenger rolling stock. In the third segment, TWL is engaged in designing and constructing warships, passenger vessels, tugs and other specialised self-propelled vessels and their components, and specialised equipment for the Indian defence sector, and modular bridging solutions.

The company has four manufacturing facilities: two in Titagarh and one in Uttarpara in West Bengal, and one in Bharatpur, Rajasthan. It has capacity to manufacture 8,400 wagons, 200 metro coaches and 36 EMU coaches, and process around 30,000 tonne of casting steel, per annum.

The wagons manufacturer delivered its highest ever quarterly revenue of Rs 766 crore with growth of 101 percent and 25 percent on an annualised and quarterly basis, respectively. All the business verticals have delivered strong growth on a yearly basis, contributing to profitability with increased contribution from its non-wagons business.

The company’s order book as of December 2022 stood at Rs 10,130 crore. The company executed a large order from the Indian Railways in the freight wagon segment in May 2022 and Pune Metro in line with expectations. The Indian Railway order received in May 2022 provides healthy revenue visibility till fiscal 2026, analysts pointed out.

The new Indian Railways and Pune Metro orders have led to an increase in working capital requirements, which has in turn increased the company’s debt to Rs 279 crore as on December 31, 2022, from Rs 119 crore as on March 31, 2022, according to CRISIL Ratings.

The company has an order book of almost Rs 1,200 crore from private wagons which is in itself a sizeable order book and is also the highest-ever order book in its history for the private wagon market.

“Demand outlook for freight wagons from private customers is very positive and the total order book from the same is around Rs 1,200 crore (approximately 2,900 wagons),” the company said in its latest investor presentation.

During the first nine months of fiscal 2023, operating profit before depreciation, interest and tax (OPBDIT) rose to Rs 169 crore from Rs 116 crore in the corresponding period of the previous fiscal. The operating margin shrank to 9.4 percent from 11 percent, in line with expectations, due to a larger proportion of low-margin orders in the freight segment.

CRISIL Ratings expects the operating margin to sustain over the medium term on account of price variation clauses (meaning that the increase or decrease in raw material prices are passed on either which way) in orders from Indian Railways, which will mitigate any volatility in commodity prices, and execution of private sector order book where margins are generally higher.

Market positionTWL is one of India’s largest wagon manufacturers, with a capacity of 8,400 wagons per annum, according to a report by CRISIL Ratings. It also said that TWL has maintained its leadership position in the segment and accounted for 32 percent (24,177 wagons) of the orders awarded by Indian Railways in May 2022. Further, TWL is scaling up operations in the passenger train segment with its emergence as L2 bidder in Vande Bharat trains order by Indian Railways.

On April 11, the company announced that Technology Partner, a consortium formed by BHEL and TWL, has received an order to supply 80 sleeper-class Vande Bharat trains within 72 months.

Read more | Why state government budgets are reinforcing Jefferies' conviction on FMCG makersBesides, with access to the latest technology from its Italy-based stepdown subsidiary Titagarh Firema, TWL is well positioned to bid for large orders for other metro projects, the ratings agency said, adding, “In the freight wagon segment, too, TWL has improved its order book from the private sector to reduce dependence on IR (Indian Railways).” As far as its presence in the shipbuilding and defence segment is concerned, TWL has successfully launched four ships for the Indian Navy and National Institute of Ocean Technology.

De-risking by moving towards non-wagon businessUmesh Chowdhary, vice chairman and managing director of TWL, said the company will look at being a complete railway solutions provider than just wagons, and will also look at changing the name of the company to Titagarh Ltd from Titagarh Wagons.

To reduce dependence on wagon segment, TWL ventured into the fast-growing coach segment. Acquisition of Firema, an Italian passenger and metro coach maker, has enabled the company to tap the growing metro rail business while similarly, Cimmco fortified its presence in the high-potential defence segment, which is expected to give a fillip to order inflows going ahead, said Nuvama Wealth Management. “This diversification away from the wagon segment shall burnish TWL’s growth prospects,” it said.

A large portion of revenue is currently derived from wagon orders received from Indian Railways. “Although lack of steady orders has constrained the topline and operating performance of wagon manufacturers historically, the new order of 24,177 wagons and Vande Bharat order has enhanced revenue visibility for the next 3-4 years,” said CRISIL Ratings.

Market participants believe TWL is diversifying its order book by increasing orders from the private sector in the freight segment, Pune Metro and Indian Navy orders.

While Indian Railways projects generally have a long execution period and are covered by a price-variation clause to a large extent, private sector orders are generally fixed in nature. Besides, pricing power is restricted as the orders from Indian Railways, which is the company’s main customer, are spread across suppliers and are decided based on bids submitted by wagon manufacturers. Although the quantity is allocated as per the supplier's past performance, TWL has to match the prices of the lowest bidder to receive the final order, CRISIL Ratings explained.

Government’s focus on rolling stock procurement a boonIndian Railways has seen its highest-ever budget allocation to the tune of Rs 2.4 lakh crore last fiscal and a lot of this budget will go into capital expenditure such as Vande Bharat train sets as well as freight wagons, both of which are areas of interest to the company, TWL highlighted in its latest earnings conference call.

“With the new budget allocation that the Railways has seen, the company also foresees further demand for these Vande Bharat train sets, therefore indicating the larger market that will be available in the near future and future opportunities for the company,” Prithish Chowdhary, director, marketing and business development, said in the conference call.

The shift in Indian Railways’ capex towards rolling stock procurement is helping TWL emerge as a full-spectrum rolling stock manufacturer, according to Nuvama Wealth Management.

Even Mahesh Patil, chief investment officer of Aditya Birla Sun Life AMC Ltd, pointed out that along with the focus on infrastructure and road sector in the last budget, the railways also has seen a big increase in rolling stock.

“The outlay for the railways is high, but within that, rolling stock is where there has been a significant increase. The whole allocation is more towards rolling stock and not towards laying of railway tracks, which has more to do with infrastructure. Hence, companies which are manufacturing and selling locomotives and wagons should benefit,” Patil said.

Passenger rolling stock another key growth driverBesides, the company is enhancing its presence in the passenger rolling stock segment through Vande Bharat trains, and entering the forged wheelset business. It also plans to expand annual wagon manufacturing capacity to 12,000 from 8,400 and annual coach manufacturing capacity to 850 from 250 to capitalise on the railway boom, Nuvama Wealth Management noted.

Read more | Why paper stocks are laggards on the bourses despite robust demand and firm pricing“We believe TWL is well placed to make a mark in the passenger business, after having achieved leadership in the freight segment. The ongoing metro rail boom in India and the impending rollout of high-speed rail travel in the country should further cement its position,” the brokerage firm said.

Technical viewNuvama Wealth Management has retained its ‘buy’ recommendation with a target price of Rs 346 on the stock from Rs 273 earlier. This implies about a 19 percent upside from Rs 290, the closing price of April 12.

However, Milan Vaishnav, founder and technical analyst, Gemstone Equity Research and ChatWizard FZE, is of the view that a fresh entry at current levels, after marking a new 52-week high at Rs 310, may not offer a favourable risk-reward ratio.

After staying range-bound and in a trading zone of Rs 90-120 for a couple of months, TWL finally achieved a breakout. This was achieved in July last year when the prices moved above Rs 120. The stock staged a remarkable rally and over the past eight to nine months, it has returned approximately Rs 182 or over 151 percent from the breakout levels, he explained.

“For those who are holding this stock, the best way to approach this is to keep trailing their stop-loss (SL) levels. Currently, investors can hold on to this stock with a trailed SL of 260. Any close below this point should be used to exit,” Vaishnav said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.