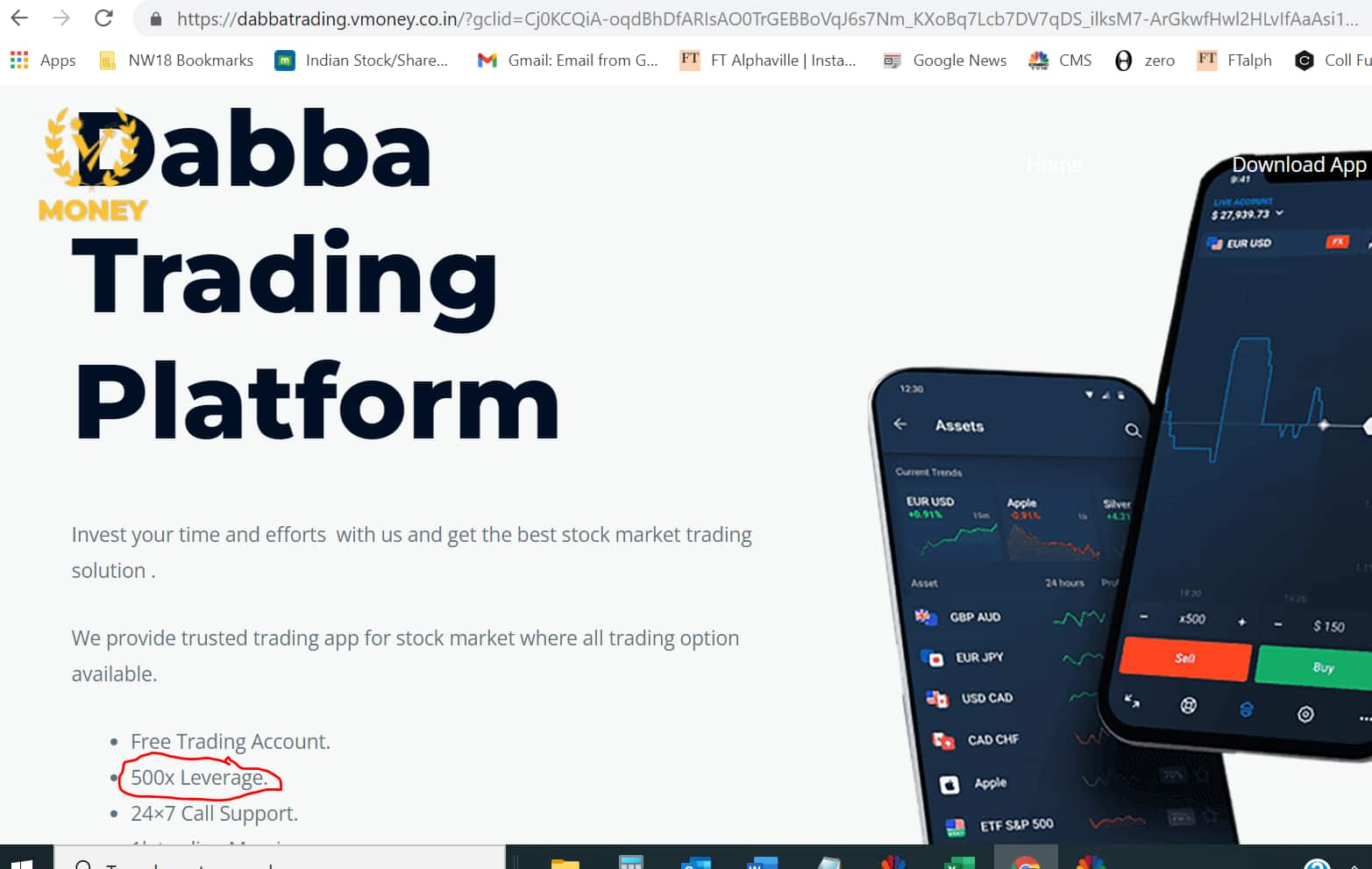

Dabba trading has an air of secrecy about it and conjures images of clandestine calls or WhatsApp messages to a shady operator plying the trade. Till recently, someone looking to trade in the illegal ‘dabba’ market for stocks needed to know a regular who could introduce him to the operator. Not any longer, it seems, now that players specialising in dabba trading openly advertise their services on the internet. Try searching for ‘dabba trading mobile app’ on Google and you will find at least half-a-dozen players offering the service. At least two operators are paying Google Ads to figure right on top in searches for the service.

Dabba is a parallel stock market in which traders can bet on the direction of share prices/stock indices without a trading account, demat account, or providing their KYC (know your customer) details. The operator does the same work as a sports bookie, accepting buy and sell bets from clients and then paying out/collecting the difference in cash, depending on which way prices have moved.

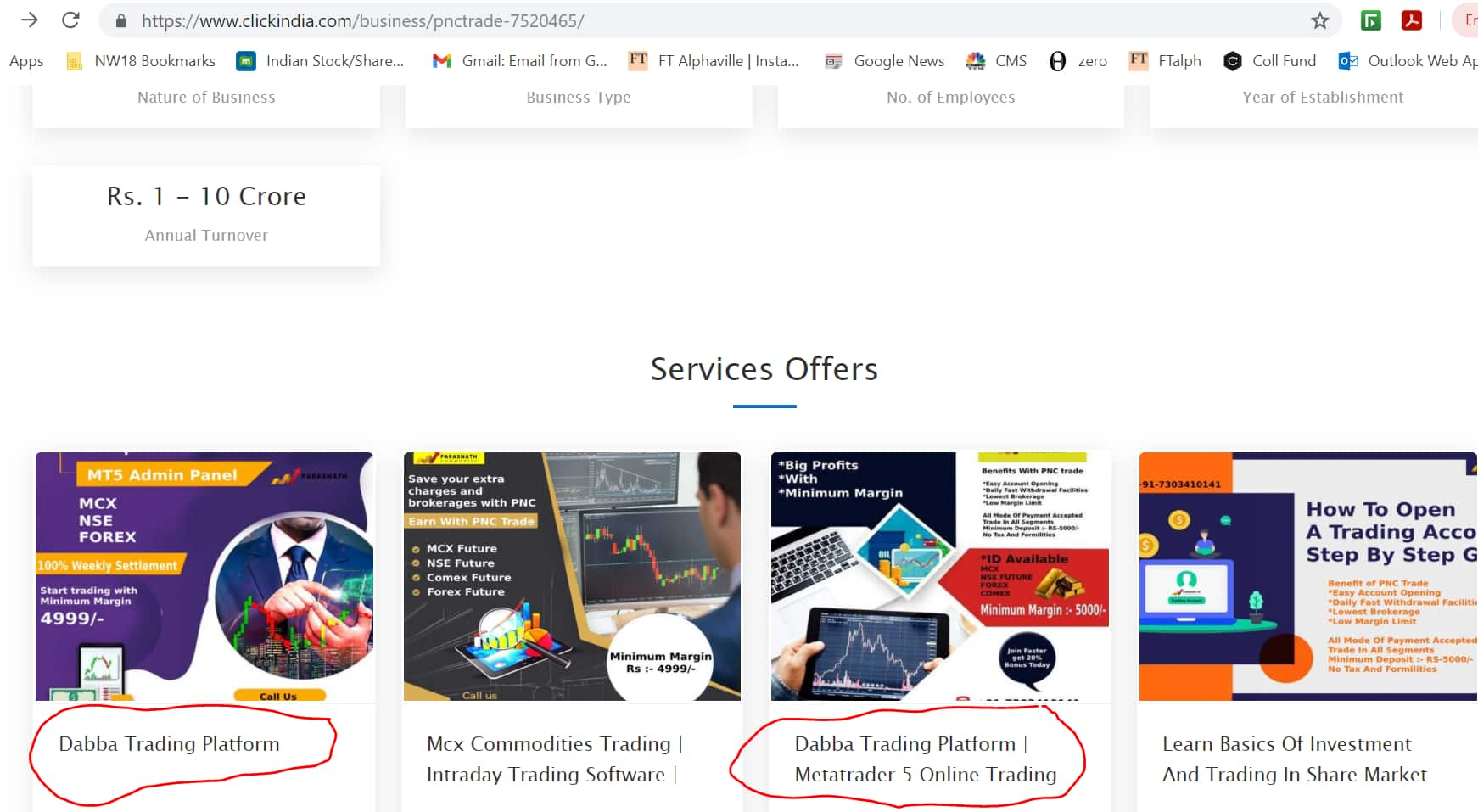

In a way, dabba is a crude version of a globally popular financial product called contract for difference (CFD), an arrangement in which the difference between the opening and closing trade prices of a security, index, currency or commodity is settled in cash. There is no delivery of physical goods or securities.

The main charm of dabba trading is that it requires no upfront margins and does not draw the attention of the tax authorities.

Going mainstream

And dabba appears to have become an accepted term on Google’s Play Store as well. Type ‘dabba trading app’ in the search box on the Play Store and you will find apps of both credible stock brokers as well as fly-by-night operators in the results. Many are downright gambling apps masquerading as stock market education apps, claiming to help traders learn skills in a real-world environment.

“A free and reloadable demo account with Rs 10,000 virtual funds to gain trading experiences under a risk-free environment. Open a real account for free with the same function and profitability whenever you want,” reads the description of one of the apps.

Quite a few of these apps have a common set of instructions for users:

1. Deposit Re (sic) in your account

2. Choose whether price will rise or fall in next 60 secs

3. If your selection is correct, the profit will automatically be credited to your account.

Most apps ask for a minimum deposit of Rs 100 and charge Rs 20 per trade, which is also what discount brokers generally charge.

Some apps follow the fantasy sport model, offering prize money for putting together a portfolio that gives the best returns within a defined period. This is in clear violation of rules by the Securities and Exchange Board of India.

Real-time price feeds

The majority of the trading apps mention ‘real world trading environment’ but users familiar with the apps say that they have access to real-time price feeds from exchanges. SEBI rules bar the use of real-time price feeds if they are purely for simulation because the chances are that they could be misused for dabba trading.

“There are a few authorised firms that buy live price feeds from exchanges and then resell it to others for a price,” a market participant told moneycontrol.com. “It is unlikely that exchanges are completely unaware of this practice.”

Unauthorised trading apps are not the problem of only SEBI and the stock exchanges. In September, the Reserve Bank of India released an alert list of 34 entities – Binomo, eToro, OctaFX, Olymp Trade, and TD Ameritrade, among others – saying they were not authorised to deal in forex or to operate electronic trading platforms for forex transactions. These entities advertised forex trading facilities on social media and OTT platforms, tempting prospective clients with the lure of easy and handsome returns.

What makes the RBI’s task slightly easier is that it can enforce the ban on unauthorised forex trading by asking banks to block money transfers between clients in India and the blacklisted entities. It is much tougher for SEBI, considering that the majority of the entities operating unauthorised trading apps are incorporated outside India. Incidentally, the same dabba service providers also advertise CFDs, which is forbidden by the RBI.

Perfect storm

Veteran players say that dabba has now become much bigger than the official stock market, thanks to a confluence of forces buffeting the landscape. A booming stock market has been the biggest driver, but there are other factors at play—regulatory, technological, demographic, socioeconomic and cultural—that have been building up over time.

It all started when it became easy for investors to sign up with brokerages, thanks to e-KYC, which did away with the need for physically signing multiple forms and then having to wait for days for a trading account to get activated. When stocks plunged and then rebounded dramatically from pandemic lows, a throng of first-time investors—mostly millennials—stampeded into the market. As share prices continued to rise, it triggered a virtuous cycle in equity markets worldwide as rising prices attracted more buyers and sent stocks soaring further.

Over the years, SEBI has been tightening margin requirements, particularly in the futures and options segment, in a bid to reduce systemic risks and ensure that retail investors who do not understand equity derivatives stay out and so do not lose money. However, it was still cheaper to trade in options, and that was where the action shifted. Young traders found that they could easily double or treble their money in a very short time–even hours–if the options they bought rose in value. In a market that rose almost one way for the most part between March 2020 and October 2021, many youngsters hit the jackpot just by buying call options and selling put options. For a while, it did not seem like one needed a lot of knowledge or experience to trade something as complex as derivatives.

And then there were the financial influencers and stock market trainers who seemed to make trading look easy and stoked the narrative that understanding a few basic concepts was all it took to mint millions in the market.

The dramatic change in the profile of the average retail investor because of these factors is evident from the trading statistics.

While the average daily turnover in the cash market has just about doubled between FY20 and now, the average daily turnover in the derivatives segment has jumped almost 10-fold to about Rs 130 lakh crore during the same period. In previous bull runs, the majority – if not all – of new investors started their stock market journey by first dabbling in stocks and then moving to futures and options. But this time around, there was a sizeable crowd of newcomers who realised early on that quick money was to be made in futures and options.

Of course, many newbie traders lost heavily when the market peaked in October last year and turned volatile over the next six-eight months. But having tasted easy money in the early part of the pandemic bull run, trading had become a way of life for most newcomers and some old-timers, even if it was not their day job.

And that gap is being filled by dabba traders and scores of other online trading apps.

Lure of dabba

Dabba operators offer leverage as high as 500 times (if their claims are to be believed), meaning for every rupee that a client is willing to put, he will get exposure to Rs 500 worth of shares or derivatives. Also, since these transactions are settled in cash, there is no hassle of dealing with the taxman. But these shady services come at a huge risk as well. If the dabba operator reneges on his word and refuses to pay up, there is no recourse for the customer. One can’t complain of being duped when one is willingly part of an illegal activity.

“Most of the dabba operators who advertise openly should be doubted,” said a veteran trader familiar with the working of the dabba market.

“The actual dabba market is for the high rollers of the financial services industry, and it is a by-invitation-only club. The members are mostly high-flying executives who are looking to avoid either the taxman or the compliance department at their place of work,” the trader said.

He said trades were placed through what seemed like simulation trading apps provided by the dabba operator. And these apps can be accessed only through approved IP addresses.

“You punch in your orders and the data is captured on the servers of the dabba operators. He will then net off the orders with other clients if there are opposite trades. For the portion of shares that cannot be netted off, the operator may sometimes choose to take the risk on himself by becoming the counterparty to the trade. Or he may put through the order through his proprietary account, going by the track record of the client he is dealing with,” said the trader.

“Occasionally, some dabba operators are also known to get themselves raided to avoid paying money to their clients. If a dabba operator gets raided, clients are scared that the trail could lead to them, and so back off,” said the trader.

The losers

Every trade bypassing the stock exchanges is a revenue loss for the stock exchanges and the tax department. The stock exchanges lose out on turnover tax and the tax department on securities transaction tax (STT).

There is no clear estimate about how much business is lost to these unofficial channels. Some industry veterans say the dabba market has become much bigger than the official market. The average daily turnover in the cash market is about Rs 0.7 lakh crore and the notional value of the average daily turnover in the equity derivatives segment is about Rs 130 lakh crore. Even adjusting for the derivatives number based on the value of premium paid on option contracts, it still works out to about Rs 1.3 lakh crore daily – definitely no small change for the exchanges or the government.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.