FMCG stocks have also seen major correction in current market weakness after strong run up for almost couple of years. High valuation is the main cause of correction as experts always say whenever the market sees steep fall, it takes everything in its stride.

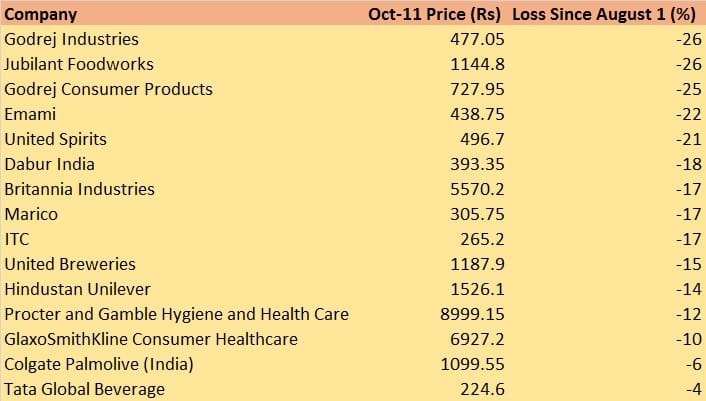

The Nifty FMCG index fell nearly 17 percent from September month 2018 after rising 22.5 percent between January-August this year and 29 percent in 2017.

So considering this rally, the correction was long overdue. The rally seen in FMCG space was due to strong rural demand, normal monsoon, product price hikes and stable earnings after GST implementation, analysts said.

Credit Suisse said while FMCG pack has corrected 15-40 percent from its 52-week high, most stocks still continue to trade at 1 standard deviation above historical mean P/E levels.

HUL is still at 2 standard deviation above mean, he added.

Hence, the global research firm is most positive on Nestle, Dabur, Marico & Colgate Palmolive.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.