Shares of public sector undertakings (PSUs) have seen a stupendous rally in the five years that the Bharatiya Janata Party (BJP)-led National Democratic Alliance government has been in power, with persistent capex in growth verticals such as railways, infrastructure, power and defence. This rally across the PSU pack will in the immediate future be determined by the upcoming interim budget, given the government’s capex allocation for each pocket, said analysts.

However, they warned investors to exercise caution while putting their money in these state-controlled entities as valuations in some stocks look overheated compared with their private peers. In the past one year, one out of every three PSU stock has more than doubled, helping the BSE PSU Index surge over 65 percent.

Shrikant Chouhan, head, equity research at Kotak Securities, expects this rally to extend but become more stock-specific once the budget capex outlay is announced. He said that investors’ confidence in the PSU pack increased after the state election results reinforced the expectation of stable government formation.

ALSO READ: Budget 2024: Nirmala Sitharaman second finance minister to present budget 6 times in a row

Privatisation switch: Investors’ newfound faith in PSUs

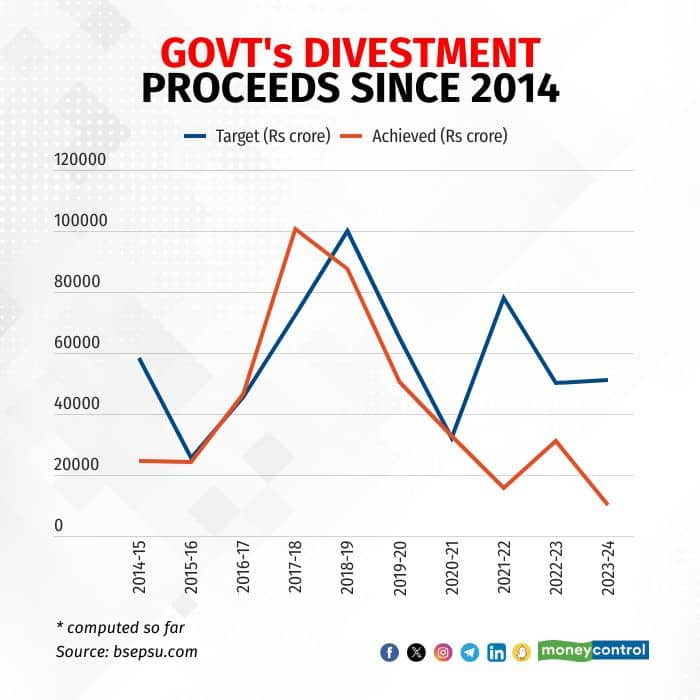

The BJP-led NDA government made an effort to push divestment of PSUs when it came into power in 2014, but only two—Air India and Neelanchal Ispat Nigam—have been sold to private owners so far. In other strategic disinvestments, the government would simply sell its entire stake in one PSU to another. The ones in pipeline - Bharat Petroleum Corporation (BPCL), Container Corporation of India (Concor), IDBI Bank and BEML—also look like a distant dream now.

While the disposition of selected PSUs has lagged, investors’ newfound faith in these companies comes amid the government’s efforts to run them more professionally, said analysts.

AK Prabhakar, head of research at IDBI Capital, said that several PSU companies like NHPC, NMDC, Mazagaon Dock, Rail Vikas Nigam, NTPC and Ircon International are now running more efficiently than they ever had. “Employee cost and efficiency have improved across all PSU companies,” he added.

The reality of ‘privatisation’: Can delays, overvalued OFS suppress value of PSUs?

Analysts at Kotak Institutional Equities find the Street’s hopes about PSU privatisation quite misplaced. “The government’s stated policy on privatisation of PSUs, practical issues seen in previous attempts to privatise PSUs and high prices of PSUs should provide plentiful caution against making privatisation as an investment thesis for PSUs," the brokerage firm noted.

ALSO READ: India Inc eagerly awaits FM's Feb 1 Budget for growth boosting measures

Several practical challenges have in the past stymied the government’s privatisation efforts. Concor is a noteworthy example, as the government had to rework several agreements between the port-hinterland link operator and its parent Indian Railways to enable privatisation. However, it is yet to take place despite it being cleared for privatisation in November 2019. BPCL, too, did not see much interest among potential bidders given the sunset nature of the oil refining and marketing sector. Market experts believe the delay could widen as finding the right buyer and price takes time.

Moreover, the government wants disinvestment to be strategic. An indiscriminate offer-for-sale (OFS)—the preferred route for disinvestment—could depress the value of PSU stocks. The government believes that if investors are less prepared to subscribe to an OFS, it leads to further discounts, eventually suppressing the right value of the said PSU.

Will the govt extend its divestment target this budget or keep it tempered?

According to analysts at ratings agency ICRA, the government is likely to keep disinvestment proceeds below Rs 50,000 crore in this interim budget. "Given the uncertainties involved in market transactions, it will be prudent to set a moderate target of sub-Rs 50,000 crore for FY25, instead of a higher aim. This is to avoid any disruption in budget math or large shortfall," they said.

In the current fiscal, the government mopped up around Rs 10,000 crore from PSU disinvestments, substantially below the targeted Rs 51,000 crore.

What should PSUs expect from this interim budget’s capex layout?

The interim budget could see some moderation in capex due to the government's focus on fiscal consolidation, but roads and railways will continue to command a higher share of the total allocation, predicted analysts at Nirmal Bang. "Railways may see the highest increase in allocation, with spending up by nearly 40 percent year-on-year in FY24 year-to-date," the brokerage firm underlined.

The government has been prioritising capex post-pandemic in order to bolster the economy. Since 2020-21, the capex allocation has seen a consistent rise, first by 35 percent on-year to Rs 5.5 lakh crore, then a further 35 percent hike to Rs 7.5 lakh crore in 2022-23, and finally a marked over-37 percent increase to touch a record high of Rs 10 lakh crore in 2023-24.

ALSO READ: Budget 2024 Highlights: Govt must continue to lay major thrust on public capex, says FICCI

With capex surpassing budget projections for three years, market experts remain bullish on PSU stocks but advise investors to keep an eye on the political front.

"Though the outlook for PSUs remains positive for 2024, we advise investors to selectively invest as their performance hinges largely on political developments and policy continuity," said Trivesh D, COO at Bengaluru-based trading platform Tradejini.

How should investors approach PSU stocks? Stay wary of richer valuations, experts warn

Several PSU stocks have been commanding premium valuations compared to their private sector peers. A PSU stock like Concor, for instance, is trading at 36.4 times one-year forward price-to-earnings (PE) ratio, much above Adani Ports and SEZ's 26.4 times PE multiple, pointed out analysts at Kotak Institutional equities.

Metals and mining major Steel Authority of India, too, is trading at 13.4 times one-year forward PE ratio, higher than Tata Steel's 13.1 times. Besides, National Aluminium Company was at 14.2 times one-year forward PE ratio, higher than 11.7 percent of Hindalco, they added.

How have PSU stocks fared in the last five years of the regime?

In the past five years, shares of Fertilisers and Chemicals Travancore and Gujarat State Financial Corporation emerged the biggest gainers on the BSE PSU Index, surging over 1,800 percent and 1,300 percent, respectively.

Others like Orissa Mineral Development Company, Garden Reach, Bharat Electronics, BHEL, Ircon International and Tamilnadu Telecommunications delivered over 500 percent returns. On the flipside, RITES was the only loser in the BSE PSU Index, slipping 5 percent over the same period.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.