In the holiday shortened week, the broader indices underperformed the main indices amid concern over high valuations. However, the main indices also remained under pressure amid continued foreign outflows as investors remained worried over US tariff uncertainty.

During the week, the BSE Large-cap Index shed 3.4 percent, BSE Mid-cap Index declined 4.4 percent and the BSE Small-cap index shed 6 percent.

In February, BSE Mid and Smallcap indices shed 10.4 percent and 13.7 percent, respectively, while Largecap index shed 6.5 percent.

This week, the Nifty50 index shed 671.2 points or 2.94 percent to close at 22,124.7 and BSE Sensex declined 2,112.96 points or 2.80 percent to close at 73,198.1. However, for the month of February, both the indices fell more than 5.5 percent each.

All the sectoral indices ended in the red with Nifty IT index shed 8 percent, Nifty Media index declined 7 percent, Nifty Realty index shed 5.5 percent, Nifty PSU Bank index shed 5.3 percent and Nifty Energy index fell 5 percent.

"The Indian equity market closed the holiday-shortened week on a significantly weaker note, as investor sentiment deteriorated due to escalating trade tariff concerns and unfavourable global cues. The IT sector faced the sharpest decline amid fears of a weakening U.S. business environment, leading to deal deferrals. Additionally, concerns over high valuations continued to weigh on small and mid-cap stocks. Meanwhile, declining U.S. bond yields signal a flight to safe-haven assets, while FII flows have shifted toward more affordable markets," said Vinod Nair, Head of Research, Geojit Financial Services.

"India’s Q3 FY25 GDP data met expectations, with a slight upward revision to 6.5% for the fiscal year. The agriculture sector posted steady growth in Q3, indicating a likely improvement in the kharif crop, which could support rural consumption. Investors will be closely watching key upcoming events, including the tariff policy, U.S. Core PCE Price Index, and jobless claims."

"In the near term, market conditions are expected to remain weak, with a gradual recovery anticipated as earnings improve from Q1 FY26 and global trade policy uncertainties subside," he added.

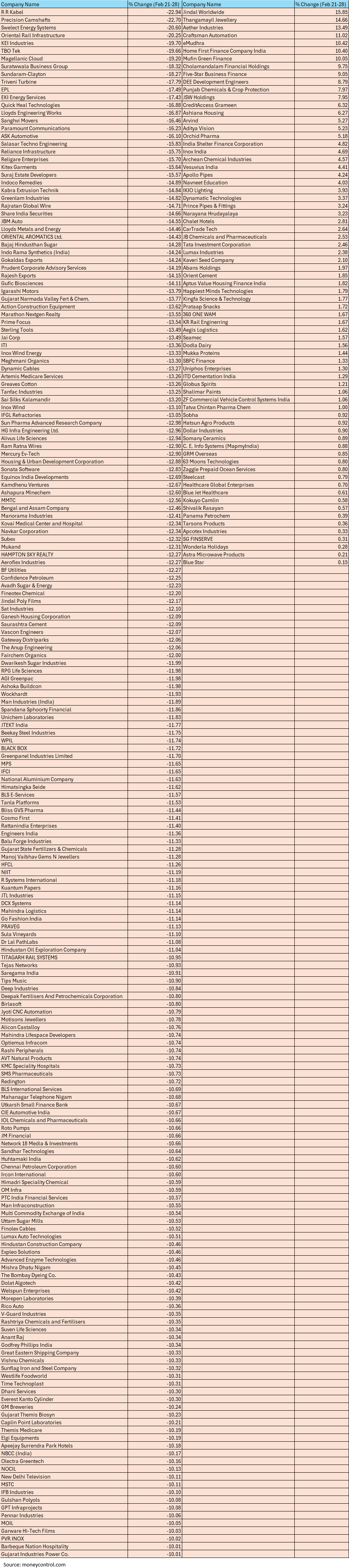

The BSE Small-cap index shed 6 percent with 200 stocks fell between 10-23 percent.

R R Kabel, Precision Camshafts, Swelect Energy Systems, Oriental Rail Infrastructure, KEI Industries, TBO Tek, Magellanic Cloud, Suratwwala Business Group, Sundaram-Clayton, Triveni Turbine, EPL, EKI Energy Services, Quick Heal Technologies, Lloyds Engineering Works, Sanghvi Movers, Paramount Communications, ASK Automotive, Salasar Techno Engineering, Reliance Infrastructure, Religare Enterprises, Kitex Garments, Suraj Estate Developers down between 15-23 percent.

As long as Nifty remains below 22,500, the bearish momentum is likely to persist, with 22,000 acting as immediate support, followed by 21,850 where the 100-Weekly Simple Moving Average (100-WSMA) is placed. Thus, traders are advised to follow sell on rise strategy.

Rupak De, Senior Technical Analyst at LKP SecuritiesNifty experienced a significant decline on Friday, shedding over 400 points after a consolidation breakdown. The RSI remains bearish but has entered the oversold zone.

In the near term, Nifty is expected to find support around 21,800-22,000. A sustained move above 21,800 could lead to a significant recovery, while failure to hold this level may trigger another sharp decline.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesA long bear candle was formed on the daily chart which is signaling a decisive downside breakout of range movement. We also observe unfilled opening downside gaps in the last few sessions which is indicating a formation of bearish runaway gaps. These unfilled down gaps are normally formed in the middle of the trend. Hence, more weakness to go for next week.

The underlying trend of Nifty is sharply down and one may expect more declines in the short term. Having moved below the immediate support of 22400 (20-month EMA), Nifty could now slide down to the next lower supports of 21800-21700 levels (swing lows of Mar-Apr 24) in the coming week. Immediate resistance is placed around 22300.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.