State-run oil marketing companies (OMCs) had to bear heavy losses in 2022 because crude prices were elevated, but retail prices weren’t allowed to go up as the government tried to keep inflation in check.

Petrol and diesel prices were deregulated in 2010 and 2014. Unofficially, the government expects OMCs to keep prices low when needed and it can influence pricing through its nominees on OMC boards, said an industry expert who did not want to be named.

Also Read: Budget 2023: All eyes on these 10 stocks

OMCs reported losses of around Rs 27,000 crore in the first half of FY23. Under-recoveries from the sale of diesel and petrol have been estimated to be around Rs 1.1 lakh crore over the same period, but profit from other products such as aviation turbine fuel (ATF) furnace oil and naphtha seems to have helped.

“The rest of the products cross-subsidise petrol and diesel,” said the industry expert cited above.

Industry insiders are hoping the coming Budget will offer some relief and that the government will compensate OMCs for under-recoveries. Experts don’t believe that will happen because of the way the market is structured now and some positives in favour of the sector now.

“The government’s deregulation policy is clear; it does not provide for compensating public or private sector OMCs. Integrated companies (that both refine and market oil products) may have made margins in refining, but lost them in diesel,” said Deepak Mahurkar, Partner and Leader of the Oil and Gas practice at PwC India.

According to another industry expert who did not want to be named, the integrated companies will only have bearable losses because the refining profits will cover money lost in marketing to an extent.

As for standalone companies (that only do marketing), the government wants them to negotiate with the refiners for a discount and not approach the government for compensation.

The year that was

In 2022, although toplines of all the three PSU OMCs improved considerably, their profits weakened significantly.

It was understandable that two of three corrected sharply. Hindustan Petroleum Corp. Ltd (HPCL) fell by almost 20% over 2022 and Bharat Petroleum Corp. Ltd (BPCL) by nearly 10%. Indian Oil Corporation (IOC) did better by gaining about 1%.

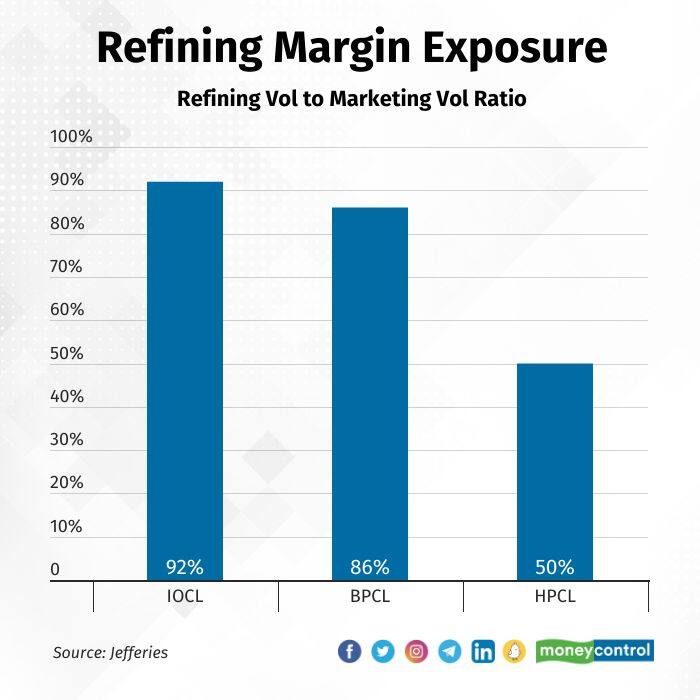

IOC’s relative resilience could be because it is less sensitive to changes in marketing margins and because a larger part of its business comes from refining.

HPCL has the highest exposure to marketing margins.

BPCL suffered after the government announced that it was putting off the divestment of the OMC in May 2022. The stock fell by nearly 8% over the next month.

The OMC may still be a better bet than the other two, according to Jefferies, because of its high refining to marketing ratio, and better capital allocation and Return On Capital Employed (ROCE) than peers.

Kotak Institutional Equities’ analysts seem to be more positive about IOC, and have only upgraded that OMC to ‘reduce’ from ‘sell’, retaining the ‘sell’ call on the other two.

Going ahead

Things are looking up for OMCs currently with better refining margins. Oil prices have been falling on weaker global growth and gasoline cracks (the difference between crude oil and wholesale petroleum products) have been reducing.

Also, after the government imposed export taxes on refiners from July 1, 2022, Indian OMCs have had more leverage to negotiate better refinery transfer prices, as analysts at KIE pointed out. Refinery transfer price is what OMCs pay refiners for the cost, transfer and refining of crude oil.

But analysts aren’t completely confident that these positives are lasting.

“We believe that if oil prices remain low for longer, the chorus will rise for retail price cuts. In our view, there is some risk, given its constrained fiscal, which rather than price cuts, the government may opt for raising excise duties/cess to increase its own revenues,” wrote KIE analysts in a recent report on the sector.

Also Read: Budget 2023| Motley disinvestment pack has little to look forward to

China, US effect

China’s reopening and the US trying to refill its depleted strategic reserves may cause crude prices to rise again, according to analysts at Jefferies.

Global oil demand has already risen to pre-pandemic levels of 100 million barrels per day (mb/d) and the International Energy Agency has forecast that oil demand will go up significantly in 2023, to 101.7 mb/d. This spike will be mainly driven by demand in China.

Oil prices had been expected to shoot up when sanctions were imposed on Russian oil exports after its invasion of Ukraine.

Since the flow of oil simply got redirected from developed to developing countries, the heat of the sanctions was not felt on the oil market in 2022.

According to KIE analysts, this will change going forward when sanctions are imposed on Russia product exports from February and when a cap of $60 per barrel is imposed on Russia crude exports. The oil market will then become tighter.

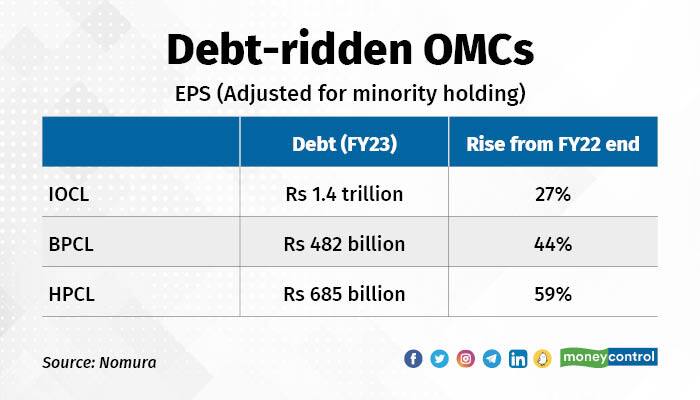

Analysts have also pointed to the higher debt levels OMCs have accumulated in the first half of FY23.

In fact, debt levels for the OMCs are at record highs.

These debt levels, increasing crude prices and “unyielding capex” will significantly impact OMCs cash flows, according to Nomura.

Will OMCs be able to raise prices and reduce losses?

No, according to analysts, who do not see the government allowing market-driven price rises for petrol and diesel at the retail end because five state elections are due in 2023, leading up to national elections next year.

Analysts also do not see Budget 2023 providing much relief by compensating OMCs for losses suffered from under-recoveries.

KIE analysts said this is unlikely because petrol and diesel markets are officially deregulated, and because the OMC refining margins are improving and they have leverage with refiners after the imposition of export taxes.

Jefferies analysts said the government may partially compensate for the losses incurred on Liquid Petroleum Gas (LPG) sales, but they “do not bake in any support for losses in deregulated (petrol and diesel) products.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.