BlackRock Inc. is boosting its exposure to US equities across its $185 billion model-portfolio platform at a time when investors are questioning the staying power of this year’s artificial intelligence-fueled rally.

The world’s largest asset manager is increasing its overweight positioning on equities to 3%, according to an investment outlook viewed by Bloomberg, after stepping up risk in September. Billions of dollars flowed between corresponding BlackRock exchange-traded funds on Tuesday as a result of the adjusted allocations, data compiled by Bloomberg showed.

BlackRock is throwing its model portfolio muscle behind a stock market has started to buckle under the weight of lofty AI valuations and ebbing conviction that the Federal Reserve will cut rates as quickly as anticipated. While the S&P 500’s six-month rally has frayed in November, Corporate America continues to post impressive earnings and cooling inflation should allow the Fed to keep lowering interest rates, BlackRock’s letter said. One leg of that thesis will face an early test on Wednesday evening, when semiconductor giant Nvidia Corp. is scheduled to report quarterly results.

“A strong recent earnings season, an easing Fed, and a generally friendlier liquidity backdrop make the case for staying constructively tilted toward risk,” Michael Gates, lead portfolio manager for BlackRock’s Target Allocation ETF model portfolio suite, wrote in the outlook.

Model portfolios, which package together funds into ready-made strategies to sell to financial advisers, have soared in popularity in recent years. With about $185 billion in model assets — up from $150 billion earlier this year — BlackRock’s allocation changes can drive massive inflows and outflows among its products.

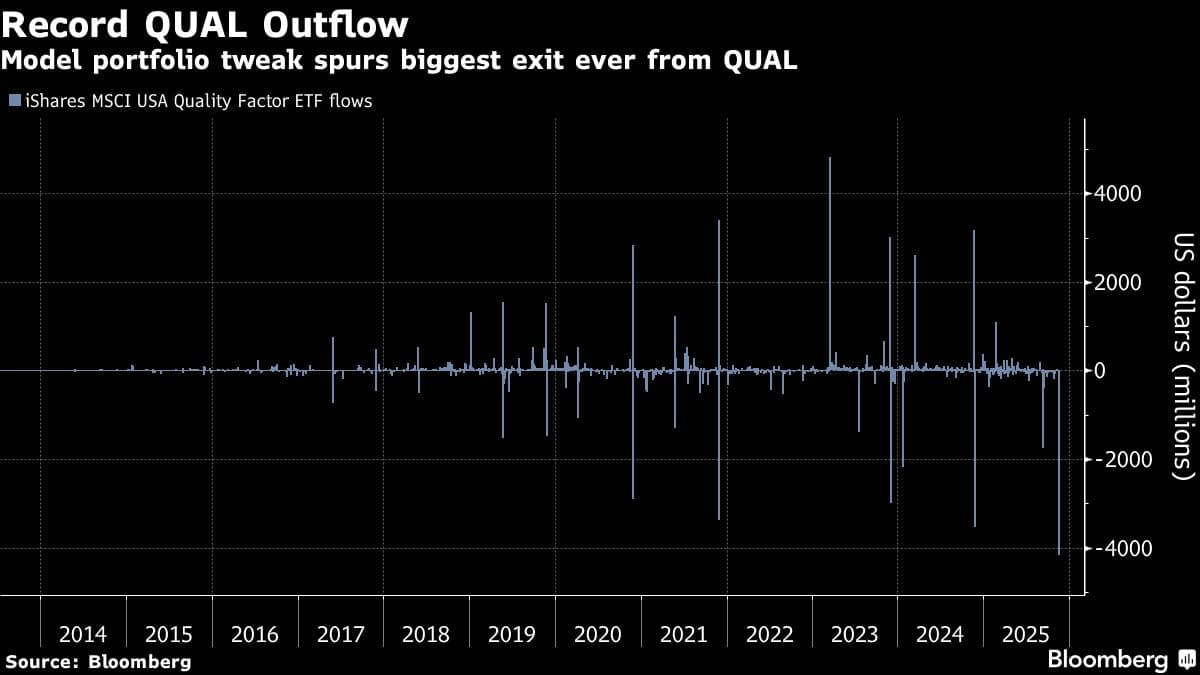

The asset manager is also “refreshing” its model platform’s factor-level tilts as part of increasing its overweight to US stocks, favoring value and momentum equities at the expense of growth-oriented shares. A record $4.2 billion exited the iShares MSCI USA Quality Factor ETF (ticker QUAL) in the most recent session, while $3.2 billion and $1.3 billion flowed into the iShares S&P 500 Value ETF (IVE) and the iShares MSCI USA Momentum Factor ETF (MTUM), respectively, according to data compiled by Bloomberg.

“Market leadership has continued to rotate, with momentum strategies capturing recent trends and value exposures providing important balance,” Gates wrote. “While growth remains a vital theme, we are deliberately reducing some overweight to growth by adding to value, and pivoting from quality to momentum.”

The tweaks extended to fixed income as well, where valuations also sit near recent extremes. BlackRock’s model added the iShares Systematic Bond ETF (SYSB), according to the outlook, spurring a $175 million inflow in the latest session and more than doubling the fund’s assets in the process.

“Bond valuations remain stretched, with spreads near historical tights and limited compensation for credit risk,” Gates wrote.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.