Investors are in a fix. Most portfolios are trading in the red and the investors don’t know what to do next as fear of a recession, fanned by an escalating trade war between the US and China, grows by the day.

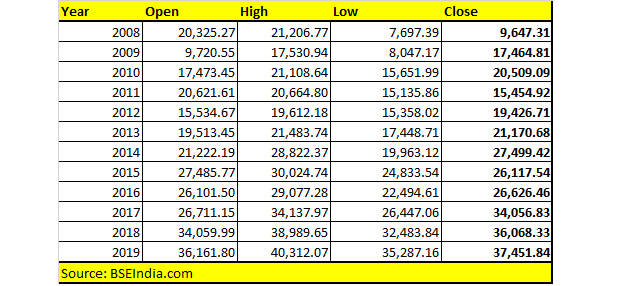

Anecdotal evidence suggests that the 2008 global financial crisis, triggered in the US, wiped out almost half of the Sensex and the Nifty value in a month.

But, is not all gloom and doom.

First of all, it will be wrong to compare the 2008 crisis with what we are seeing in 2019. And, any fall owing to external factors could lead to a big rebound once the economy starts to recover.

Recent measures introduced by the government are small steps in the right direction to boost consumer and investor sentiment and kick-start the economy that is showing signs of slowing down.

Anecdotal evidence also suggests that the Sensex has almost tripled since the 2008 recession and many individual stocks have generated wealth for investors in the last decade.

Markets usually bottom out before the economy does. The fact that India is still one of the fastest-growing economies, markets will bounce back quickly.

“Historically, it has been observed that global markets, including India, have collectively taken a hit during the recession. Even in 2008 wherein India’s economy had slowed but it did considerably better than other major economies,” Ajit Mishra, Vice President, Research, Religare Broking, told Moneycontrol.

“In the current scenario, the temporary slowdown in India notwithstanding, we believe Indian economy is poised for healthy growth driven by increased government spending, low-interest rates and revival in private capex,” Mishra said.

Looking to invest for the long term? This is the time to activate risk-on sentiment, suggest experts. The holding period could range from three to five years. If you have a 10-year horizon, then there is nothing to worry about.

Driving home the point, Arun Thukral, MD & CEO, Axis Securities cited the slowdown of 2010-12. The Nifty was down by 15 percent and the midcap 100 index slipped (from its then high of 9,782 in November 2010) almost 40 percent to 6,115 in November 2012, he said.

“By May 2014, Midcap-100 had recovered completely and reached 9,908, giving (anybody who had invested during the correction period) a handsome return of greater than 40 percent in 1.5 years,” Thukral said.

Another four-five years and the investor would have seen a stupendous CAGR of 25 percent over six years (2012-18), he said.

This is not the first time, or the last, that the equity markets have hit a roadblock.

If the world does slow down, India will not be immune from it. Most of the global rating agencies have already slashed or downgraded India’s growth forecast, primarily driven by a slowdown in consumer demand and uneven monsoon.

The Fitch Group company on August 28 said it expected 2019-20 GDP growth to tumble to a six-year low at 6.7 percent, down from the earlier estimate of 7.3 percent.

The global bond markets, too, are pointing to a risk of recession, with the US spread between the widely watched 10-year and two-year sovereign bond yield inverting briefly, while the spread between the three-year bill rate and 10-year has been inverted since May.

“The increasing market value of negative-yielding bonds has soared to $16.5 trillion in a $56 trillion bond market. Literally, 50% of the sovereign bonds are now fetching sub-zero yields,” Yes Securities said in a report.

India would feel the impact of a global recession, Umesh Mehta, Head of Research, SAMCO Securities, said. “India is currently trading at a higher valuation compared to its average and with time mean reversion is inevitable,” he said.

Investors should remain investors and not become traders when markets were not favourable, Mehta said. “If the stocks in your portfolio are fundamentally sound and investors have confidence in them then they should hold them. However, if the stocks are bought without knowing the fundamentals then it is better to be safe and sell rather than regret a larger loss,” he said.

India can’t escape the fallout of a global slowdown but there will be resilience because India is more of a domestic consumption economy, feel experts. The trade war, too, could have some positives for some sectors such as textiles and chemicals in India.

“While the global slowdown does have some effect on growth, India unlike most of the developed world and many key EMs (emerging economies), is a case of domestic & inward-looking growth story,” Pankaj Pandey, Head Research, ICICIdirect.com, told Moneycontrol.

“We believe that volatility essentially opens an opportunity to build a good long-term portfolio. In fact, period like this should be utilised to accumulate such stocks through SIP to build up a long-term equity portfolio for wealth creation,” he said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!