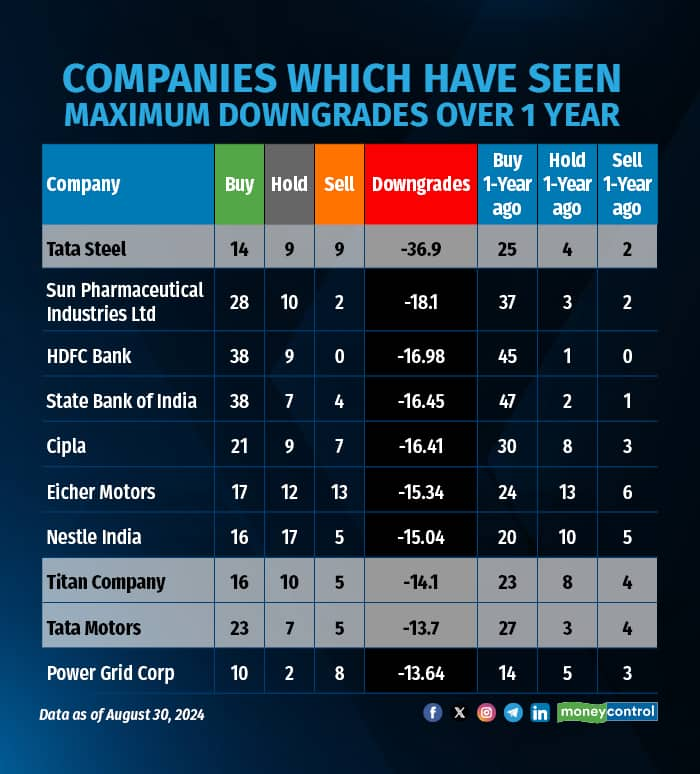

Are Tata stocks losing their appeal? Data from Moneycontrol's analyst call tracker suggests so. Three Tata Group companies feature among the 10 most downgraded stocks by brokerages in August over the past year. Leading the list is Tata Steel, with 'buy' ratings dropping from 25 to just 14. Titan Ltd. and Tata Motors also saw significant downgrades in the past 12 months.

Tata Steel: Squeezed margins and regulatory uncertaintyMargin squeeze, limited returns: Cheaper exports from China have pressured steel prices globally, leading to a margin squeeze for Tata Steel. With the stock up 32% since November, analysts now see an unfavorable risk-reward scenario.

Regulatory overhang: A Supreme Court ruling granted states the power to levy taxes on mineral rights, with Tata Steel facing a potential Rs 17,347 crore liability from Odisha. This will remain an overhang until a potential amendment in the MMDR Act caps state tax levies.

Rising debt and challenges: Tata Steel's net debt rose by Rs 4,600 crore to Rs 82,160 crore, with a net debt to EBITDA ratio of 3.3x. While Indian expansion may drive profitability, capex for Tata Steel UK, Tata Steel Netherlands, and Indian projects amid subdued steel prices poses a challenge.

Demand Impact: JP Morgan has cited short-term demand challenges due to high gold prices and moderating growth in studded jewelry. The brokerage downgraded Titan to 'neutral' from 'overweight,' lowering its target price to Rs 3,450 from Rs 3,850.

Margin Pressure: Increased competition and intensified promotional activity are expected to further impact Titan’s margin profile and customer acquisition.

Competitive Pressure: Goldman Sachs notes that Titan's jewelry margins may face pressure, despite achieving its FY25 guidance. Morgan Stanley concurs, emphasizing that Titan's margins are likely to be squeezed due to heightened competition and market dynamics.

Muted Demand: Tata Motors faces immediate hurdles with its Jaguar Land Rover (JLR) division, including muted global demand and production disruptions.

Supply Constraints: Supply constraints from summer plant shutdowns and flood-related issues at a key aluminium supplier have added to the challenges.

Limited Upside Potential: After a 62 percent stock surge over the past year, surpassing Nifty's 28% rise, analysts see limited further upside.

Debt and cash flow concerns: ICICI Securities identifies risks such as higher-than-expected volume growth at JLR and potential shortfalls in cash flow generation and debt reduction, which could impact Tata Motors’ financial outlook.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.