After a horrid March, the month of April felt like a breath of fresh air as both Sensex and Nifty50 rallied over 14 percent in April. Over 30 Portfolio Management Schemes (PMS) outperformed the index in the same period.

Indian market saw a relief rally as central bankers across the globe eased their monetary policies and governments announced fiscal stimulus packages ranging from 0.3 percent to 20 percent of GDP.

Expectations of relaxation of lockdown in parts of the world helped ease pressure from the equity markets, and one sector which remained in focus was pharma amid the COVID-19 outbreak.

As many as 33 PMS schemes managed to outperform the index with Kotak AMC’s Pharma fund topping the list, returning 26 percent during the month gone by, data collated by PMSBazaar.com, an online portal used for PMS comparison, showed.

The investment objective of the Kotak AMC Pharma sectoral fund is to generate capital appreciation through investments in equities with a medium to long-term perspective. The strategy is to invest in pharma and healthcare-related companies with 10-20 stocks.

Investors flocked to buy pharma shares on sector’s relative resilience to coronavirus disruption, favorable currency tailwinds, and stable outlook for India and the US business, suggest experts.

Portfolio Management Services cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. The professional fee charged by them is slightly higher than regular mutual funds (MFs).

Equirus Securities Long Horizon Fund, which is a mid & smallcap fund, registered a return of 24 percent in April, followed by Green Portfolio’s Special Multicap Fund which rose 20 percent in the same period.

Ambit Capital’s Emerging Giants which is a Smallcap fund recorded a return of 19 percent. The portfolio aims to invest in Smallcap companies with market-dominating franchises and a track record of clean accounting, governance, and capital allocations.

From the largecap space, there are as many as 6 funds which rose 15-19 percent that include PMS Schemes like Aditya Birla’s Top 200 Core Equity Portfolio, Motilal Oswal’s Value Fund, Right Horizon’s India Business Leader, Nippon India’s Absolute Freedom, ACEPRO Advisors Largecap strategy, and ICICI Prudential’s Largecap Portfolio.

In the Smallcap space, there are as many as 4 funds that outperformed Nifty50 in April that include names like Crest Wealth Management’s Smallcap fund, Right Horizon’s Minerva India Under-Served Fund, Marcellus Little Champs, and Ambit Capital’s Emerging Giants.

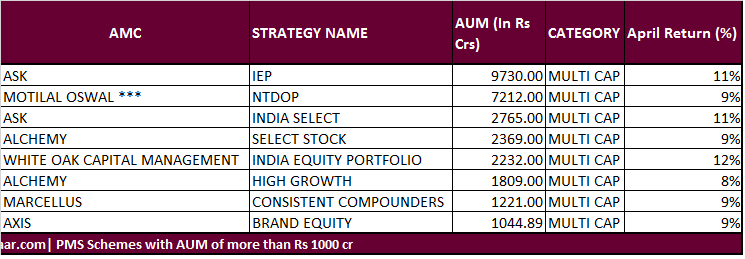

And, from the Multicap space, there are as many as 18 stocks that rose 15-19 percent, data from PMSBazaar.com showed. The list includes names like Solidarity Advisor’s Prudence fund, Crest Wealth Management Emerging Bluchip fund, and Anand Rathi’s IMPRESS PMS top the charts.

Performance of fund based on AUM:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.