On September 24, the Nifty50 hit a fresh high of 17947.65, and has since gained nearly 3 percent. It broke the 18,000-level on October 11.

The biggest performers in September, however, were the schemes run by portfolio management services (PMS) in the small and midcap space.

The Nifty Midcap 100 and Nifty Smallcap 100 indices outperformed the Nifty50, rising 7 percent and 6 percent, respectively, in September. Most schemes that outperformed the Nifty50 were from the smallcap, midcap and multicap space.

As many as 140 PMS schemes, out of the 261 tracked by PMSBazaar.com, an online portal for comparing PMS, outperformed the Nifty50 in September.

What is PMS and which are the best performers?

Portfolio management services cater to wealthy investors with portfolio size exceeding Rs 50 lakh. The fee structure is different from that of mutual funds. PM services invest in quality businesses and companies through Indian equities with an objective to grow wealth over the long term.

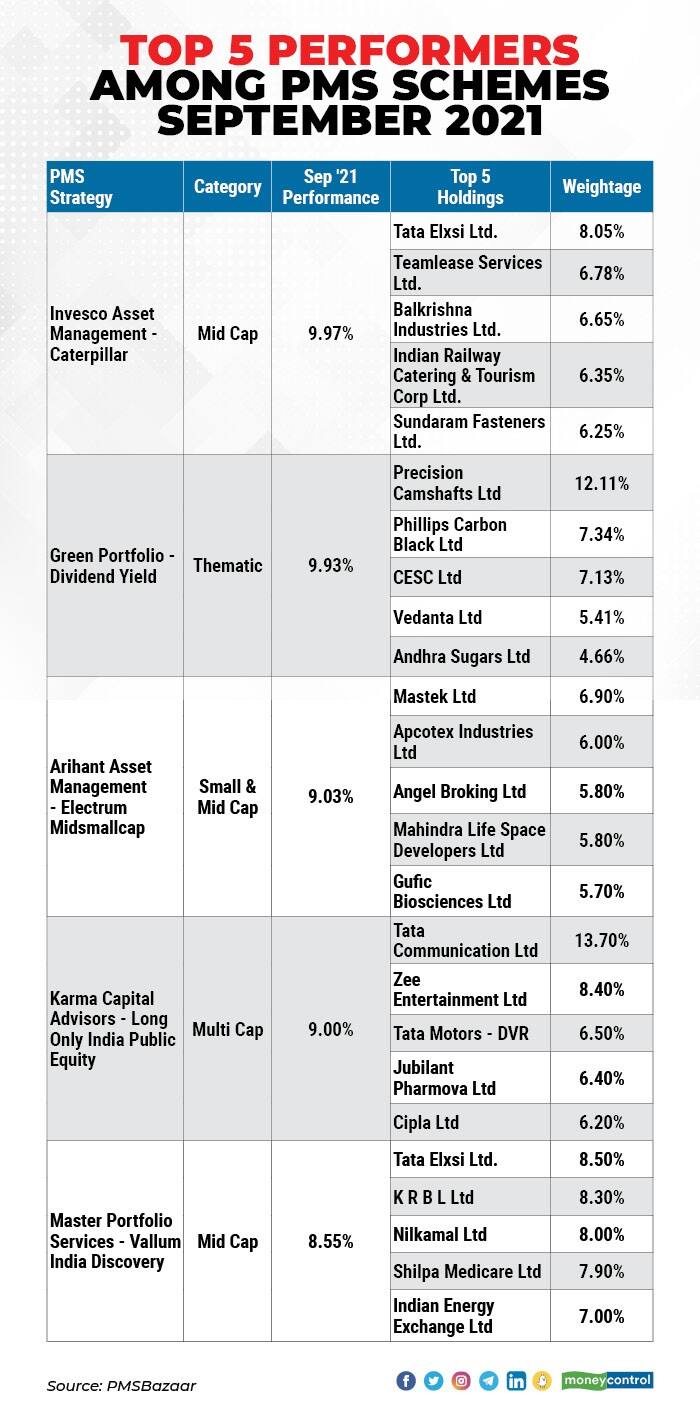

The top five schemes that outperformed the Nifty50 were Invesco Asset Management's Caterpillar Fund (over 9.97 percent returns), Green Portfolio's Dividend Yield Fund (9.93 percent), Arihant AMC's Electrum Midsmallcap Fund (9.03 percent), Karma Capital Advisors' Long Only India Public Equity Fund (9 percent), and Master Portfolio Services's Vallum India Discovery Fund (8.55 percent).

A look at the top holdings of these funds give a peek into the stocks fund managers are betting big on. The list should only be considered as a reference and should not be treated as buy recommendations.

We have collated a list of 25 stocks – five each from the top 5 schemes– based on the returns delivered in June. Data has been collected from PMSBazaar.com.

The top holdings of Invesco Asset Management’s Caterpillar fund are Tata Elxsi, TeamLease Services, Balkrishna Industries, Indian Railway Catering & Tourism Corporation, and Sundaram Fasteners.

Arihant Asset Management's Electrum Midsmallcap primarily invests in small and midcap stocks. Its top holdings include Mastek, Apcotex Industries, Angel Broking, Mahindra Life Space Developers and Gufic Biosciences.

Karma Capital Advisors' Long Only India Public Equity is a multicap fund. Its top holdings are Tata Communications, Zee Entertainment Enterprises, Tata Motors - DVR, Jubilant Pharmova and Cipla.

How should investors approach small, midcap space?

The Nifty Midcap 100 and Smallcap 100 indices have outperformed the benchmark indices in 2021, surging 51 percent and 58 percent, respectively, in the same period, compared to the about 31 percent rise seen in the Nifty.

"Midcaps and smallcaps have smaller capitalisation as compared to largecaps. Considering these businesses estimated less than largecaps, they are more volatile and carry more risks, but at the same time, they offer great future rewards. Their upside growth potential is unmatched by large companies," said Ankit Yadav, Wealth Manager (USA), Director of Market Maestro.

He advised investors to remain cautious and invest only in those midcap and smallcap firms that have strong balance sheets, well-built cash flows and almost debt-free.

"These kinds of stocks have the potential to convert themselves into largecap or blue chip stocks. If investors select such stocks, they can enjoy witnessing their midcap stocks turn into blue chips, but they have to keep one thing in mind—time. Good things and compounding require time. So they have to remain invested in them via SIP," he said.

Disclaimer: The views and investment tips by experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before making investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.