Last week, Kitex Garments managing director Sabu Jacob announced that his company was withdrawing from an agreement with the Kerala government to develop an apparel park and three industrials parks, claiming harassment by the official machinery. The projects involved investment worth Rs 3,500 crore and would have created some 20,000-35,000 jobs. The statement came as the company reported a near 40% drop in its unaudited revenue from operations to Rs 455.38 crore from Rs 739.20 crore due to disruptions caused by the Covid19 pandemic.

Kitex Garments is a leading apparel maker and belongs to a diversified Anna-Kitex Group of companies with interests in cookware, fabrics and food products. Jacob’s troubles with the government appear to have a genesis in a decision to field eight candidates to contest the 2021 Assembly elections.

Also Read: ‘Sheer harassment’ forced withdrawal of Kerala investment plan: Kitex Garments MD

These candidates represented Twenty20, a non-profit that he founded. Twenty20 has previously won seats in local body elections. The state government has denied any connection with its action.

A Graveyard For BusinessesNonetheless, the Kitex MD’s announcement brought back memories of years of militant trade unionism that drove businesses away from the southern state several decades ago and stoked scepticism about the commitment of the state government to attract fresh investments. Jacob now has offers from several other states to develop the projects there.

Kerala can ill-afford to lose any project, given the large pool of the educated and skilled working-age population, high levels of unemployment and thin presence of large industrial and services companies in the state.

The state was home to just 7,696 factories, according to provisional estimates of the 2018-19 Annual Survey of Industries. That’s about 3.2% of all the factories in operation in the country that year.

Factory Scene In The StateA decade ago, the state had 5,868 factories, or about 3.8% of all the factories in the country. The growth of factories in the state lagged the growth at the national level.

While the number of factories grew by 56% between 2008-09 and 2018-19 at the national level, it grew at a slower 31% in Kerala. In contrast, neighbouring state Tamil Nadu was host to the largest number of factories – a total of 38,131 – in the country.

Also Read: Explained | Why Kitex Garments pulled its proposal to invest Rs 3,500 crore in Kerala

Almost every sixth factory in the country was located in Tamil Nadu, and it posted a 46% decadal growth. States such as Haryana and Punjab, with a similar sized economy, had many more factories than Kerala. Interestingly, Gujarat has more factories than Maharashtra.

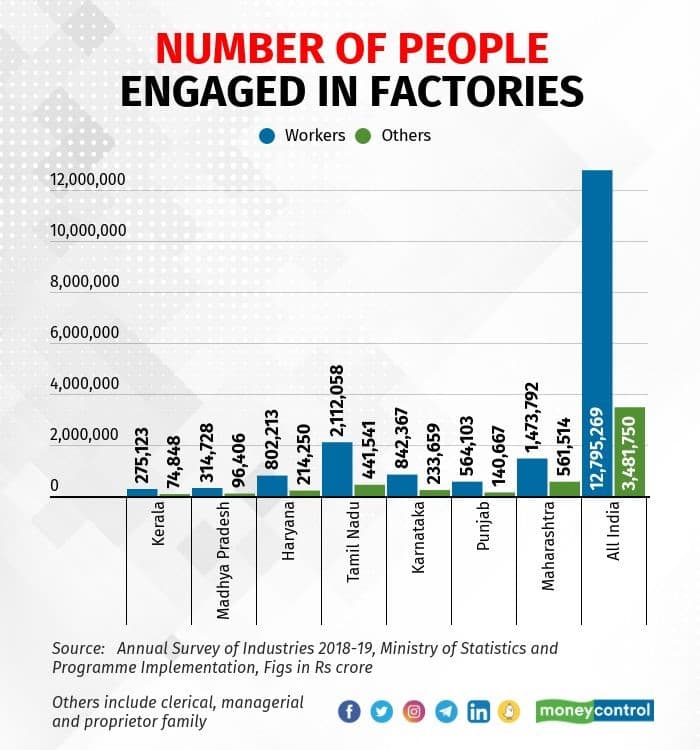

The ASI numbers also show that collectively factories in Kerala were relatively low employment generators and therefore diversion of any investment away from the state can prove detrimental for employment creation in the organised sector of the state. The state’s share in the number of people engaged – factory workers, clerical and managerial staff – was lower than the share in the number of factories.

Kerala’s factories together employed just 2.5% of all the people working in the factories across the country. In comparison, Tamil Nadu’s share was 15.7%, about the same as its share in the total number of factories.

A factory in Kerala provided 45.5 jobs on average, of which 35.7 were those for workers. The national average in comparison was 67.1 jobs per factory, including 52.8 jobs for workers. The corresponding numbers for Tamil Nadu were 67 and 55.4 and for Haryana, 85.9 and 67.8.

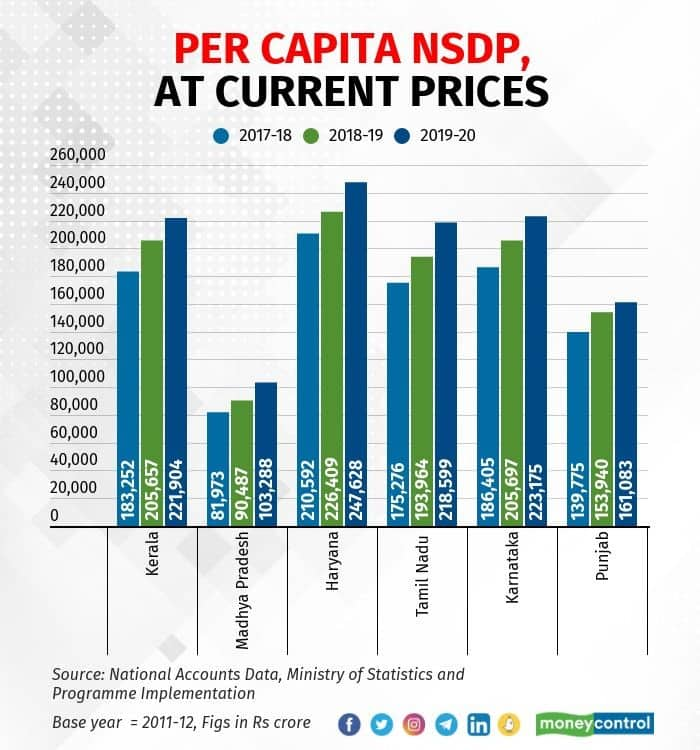

The Remittance FactorThe relatively low presence of industry, notwithstanding, per capita income of Kerala at Rs 2.22 lakh in 2019-20 was about 63% higher than the national average of Rs 1.36 lakh. Kerala’s per capita income, derived from the state’s net state domestic product, was almost at the same level as that of Karnataka and Telangana which have a larger industrial base.

This is because Kerala received a strong flow of remittances from its overseas workers that helped boost the local economy, particularly home construction. Delhi, with a dominating services sector, had a per capita NSDP of Rs 3.76 lakh in 2019-20. Goa, a favourite holiday destination among domestic and foreign tourists, reported the highest per capita income at Rs 4.67 lakh.

Kerala’s economy was about the same size as that of Madhya Pradesh and Haryana, and just a little smaller than Delhi’s, measured in constant 2011-12 prices. At Rs 5.16 lakh crore, at constant 2011-12 prices, the state’s economy was nearly a quarter the size of Maharashtra’s and a little more than 40% of Tamil Nadu’s economy. Maharashtra and Tamil Nadu were the largest state economies and their economies were powered by industrial activity for several years before the services sector became dominant.

Kerala’s growth decelerated in 2019-20, hurt by the two consecutive years of devastating floods and overall contraction of demand in the Indian economy. The economic slowdown in the Gulf nations also had its repercussions for the local economy as jobs were lost and the flow of remittances affected.

Kerala grew only 3.4% in 2019-20, at constant 2011-12 prices, slipping from 6.5% growth in the previous year. The slippage in growth in Kerala was greater than the slowdown seen in the Indian economy.

Let’s Take A Look At GrowthThe Indian economy expanded by 4% that year after reporting a 6.5% expansion in 2018-19. Growth trends across states were mixed that year. States such as Andhra Pradesh, Haryana, Madhya Pradesh and Delhi experienced an acceleration in growth while Maharashtra, Gujarat, Karnataka and Uttar Pradesh skidded. Tamil Nadu’s growth rate remained constant at about 8%.

Gross value added slowed considerably from 6.2% in 2018-19 to 2.6% in 2019-20, as agriculture was impacted by floods and construction activity by domestic factors and the economic slowdown in the oil-dependent Gulf nations. The growth of the gross value added in the construction sector slowed to 3.7% from about 10% in 2018-19, data published by the Kerala government show.

Construction contributes over 14% to the gross value added at basic prices of the state. The contribution of agriculture has been on a decline and it was about 8% in 2019-20.

The slowing of growth took its toll on the finances of states and the Union. Kerala was no exception. The state’s tax revenues shrank 4% in 2019-20 to Rs 66,724.19 crore from Rs 69,682.27 crore in 2018-19.

It is estimated to have shrunk another 17% in 2020-21 according to the revised budget estimates of the state government. Its collection from state goods and services tax fell 3% from Rs 21,014.71 crore to Rs 20,446.95 crore and is estimated to contract by another 7% to Rs 18,999.57 crore.

Tamil Nadu too reported a decline in its state GST collections in 2019-20, down about 2% to Rs 38,376.19 crore from Rs 39,136.59 crore in 2018-19. But it was confident of a turnaround in 2020-21 and has projected a 7% rise to Rs 41,249.40 crore in the revised estimates of the budget.

Its total tax revenues shrank just 2% in 2019-20 and it was expected to shrink another 1% in 2020-21 as per the revised estimates for that year. The Union government’s revenues have also been under stress.

A shortfall in revenues requires states to borrow to provide for various expenditures. The outstanding liabilities – debt accumulated over the past – of states was estimated at 26.6% of their GSDP.

The outstanding liabilities of states have been creeping up over the past few years. In 2014-15, the aggregate outstanding liabilities of states were estimated at 21.7%. Kerala and half a dozen large states had outstanding liabilities over 30% of its GSDP at the end of 2020-21.

Others being Uttar Pradesh, West Bengal, Rajasthan, Punjab, Himachal Pradesh and Andhra Pradesh. Kerala’s outstanding liabilities to GSDP was estimated at 30.3% while it was 35.7% for Himachal Pradesh.

Among the expenditure that has risen the most in Kerala is spending on social welfare and nutrition. Two successive years of devastating floods in 2018 and 2019 followed by two years of economic disruption caused by the Covid-19 pandemic necessitated that the government spend more on providing free meals and rehabilitating the affected.

The Left Democratic Front government led by Pinarayi Vijayan spent Rs 3,758.8 crore on social welfare in 2019-20. The spending was increased by about 2.5 times to an estimated Rs 9,859.81 crore in the revised budget got 2020-21 and to Rs 10,529.16 crore for the current fiscal year.

The Kerala government needs to find tax resources to pay for the welfare scheme instead of depending on borrowings. Tax revenues will grow only when there is more economic activity in the state, unemployment brought down and demand stimulated.

That requires crore of rupees of investment by businesses. And that will happen only if the state government adopts a business-friendly approach.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.