Yatharth Hospital & Trauma Care Services plans to repay its entire debt using a part of the proceeds from its upcoming initial public offering (IPO).

The Rs 686-crore issue comprises Rs 410 crore worth of fresh shares and Rs 276 crore through an Offer for Sale (OFS) by existing shareholders.

The company has bank loans of Rs 245 crore on its books and the entire amount would be repaid, Yatharth Tyagi, the company’s whole-time director, told Moneycontrol in a pre-IPO interview.

Of the remaining amount, Rs 133 crore would be allocated for buying medical equipment for the company's four existing hospitals. The equipment includes oncology machines, surgical robots, and other state-of-the-art medical tools. Additionally, around Rs 65 crore would be set aside for potential hospital acquisitions in the future.

The management of the company also expects 2-3 percent more growth in EBITDA margin mainly from its existing facilities as occupancies rise.

Improving Occupancy:

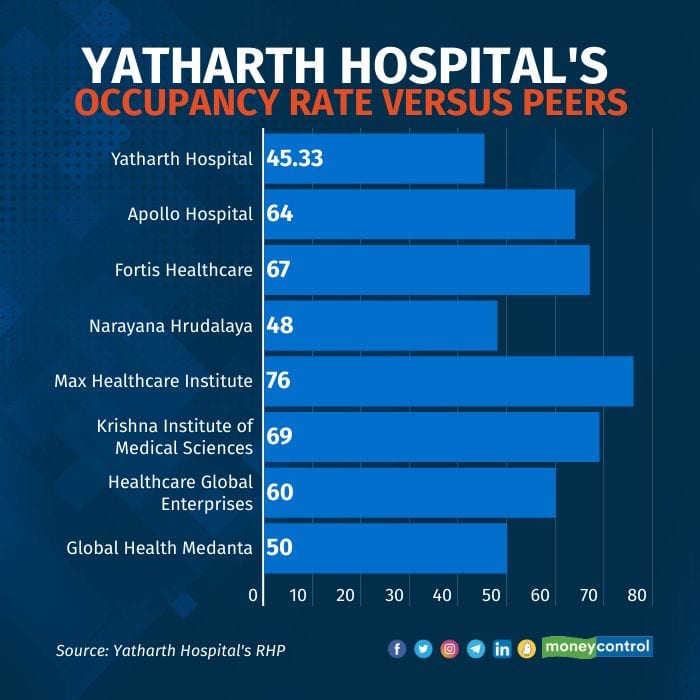

Yatharth Hospital’s occupancy rate is lower as compared to Apollo Hospitals Enterprise, Fortis Healthcare, Narayana Hrudayala and Max Healthcare.

However, Tyagi said that the number isn’t a fair representation due to the recent addition of two hospitals. He expects to improve the overall revenue per occupied bed (ARPOB) at around 60-65 percent in the coming two financial years. He also sees the newer hospitals gradually reaching occupancy levels of their mature and older counterparts.

Fully subscribed:

The IPO of Yatharth Hospital & Trauma Care Services was subscribed 1.08 times as of 5:00 pm on Wednesday, the first day of subscription.

The retail portion was subscribed 1.25 times, and non-institutional investors subscribed 1.77 times. Only the Qualified Institutional Buyer (QIB) portion was not fully subscribed, with bids received for 0.26 times the shares on offer.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.