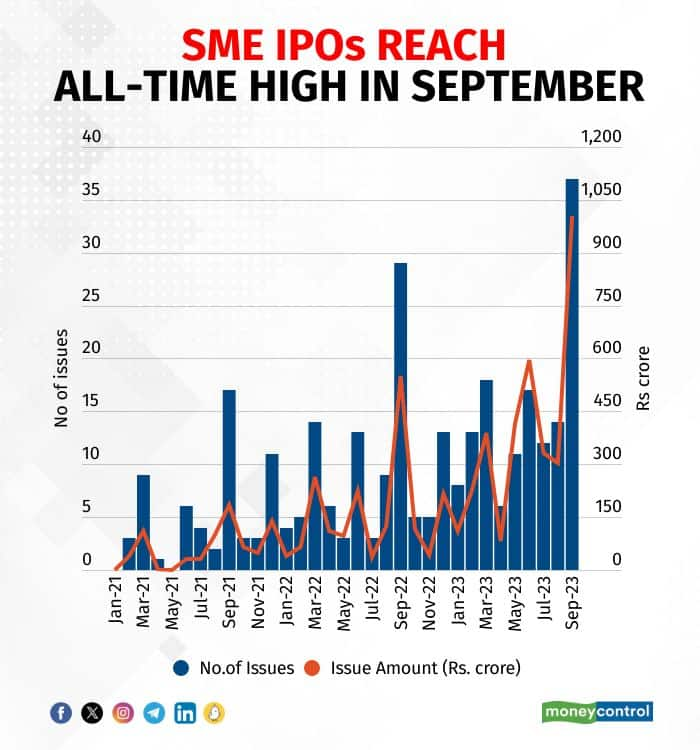

During the month of September, there was a record-breaking surge in initial public offerings (IPOs) for small and mid-sized enterprises (SMEs), coinciding with a flourishing mid- and small-cap stock rally.

In September, a record number of small and mid-sized enterprises went public, with 37 companies raising more than Rs 1,000 crore, the highest since SME IPOs began in 2012, as per Prime Database data. In the current year, 136 companies have launched SME IPOs, raising around Rs 3,457 crore.

Among these SMEs, around 16 have already been listed, and 21 are yet to be listed. Of the listed firms, Kundan Edifice Ltd had a negative listing day, while Unihealth Consultancy Ltd and Master Components Ltd opened flat. On the positive side, Basilic Fly Studio Ltd saw a remarkable 193 percent surge on the listing day, and Meson Valves India Ltd advanced by nearly 99 percent on its listing day.

Follow our market blog for live updates

Analysts said SME IPO's will continue to hit the market given the overall market strength and see good response from investors given reasonable valuations and excellent returns.

"It is a gateway to bet on the "Emerging India " story. However, investors need to differentiate between real growth and quality from fads. SEBI's ASM framework would help keep manipulation and price rigging in check and discourage promoters from listing stocks with the objective to rigging prices", said Shrey Jain, Founder & CEO, SAS Online – a deep discount stock brokerage platform.

Meanwhile, recently SME stocks saw corrections as BSE and NSE introduced Additional Surveillance Measures (ASM) and trade-to-trade settlement to control volatility. This aims to curb speculative trading in the SME segment, which has seen rising retail participation. Both exchanges and SEBI decided to extend these frameworks to SME stocks with some modifications.

SME stocks in 2023 have become incredibly popular, with an average subscription rate of 67 times and some reaching up to 713 times, driven largely by retail investors. According to Prime Database, 136 SME stocks listed this year have averaged a 77 percent return, with some showing fourfold gains in just a few months, and only 19 stocks are in the red.

In the mainboard segment, 14 companies have conducted IPOs, the highest since September 2010, raising about Rs 11,868 crore. In total this year, 34 firms have raised around Rs 26,913 crore through IPOs.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.