Public issuances by small and medium enterprises (SME) in 2025 has seen sharp contrasts, swinging between headline-grabbing debuts and a broader trend of underwhelming performances.

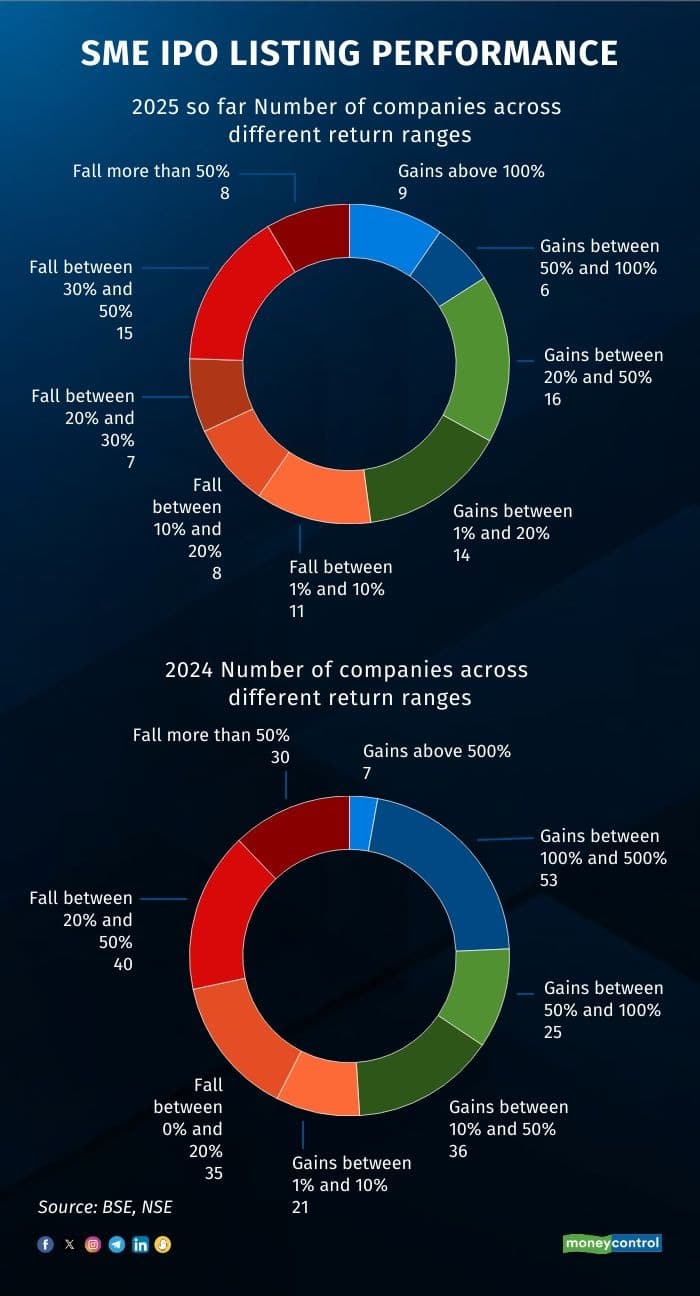

Out of the 94 SME IPOs launched so far this year, only nine delivered gains of over 100 percent while six rose between 50-100 percent as of July 7. Another 16 recorded gains in the range of 20-50 percent and 14 of them posted modest increase between 1-20 percent.

A significant number of listings have failed to sustain their early momentum.

Around 15 IPOs slipped between 30-50 percent since debut, while 8 declined by more than 50 percent. Another 7 lost between 20 and 30 percent, 8 between 10 and 20 percent, and 11 fell in the range of 1 to 10 percent.

The data highlights the trend that despite strong investor enthusiasm, most SME shares struggle to maintain gains in the days following their listing.

Trivesh D, COO at Tradejini has cited limited liquidity, aggressive profit-taking and valuations bereft of earnings support as key reasons behind this trend. He said many investors enter SME IPOs for listing gains without sufficient conviction in the long-term business prospects, making the segment vulnerable to sharp reversals after debut.

Among the biggest gainers since listing, Fabtech Technologies surged 360 percent, followed by Srigee DLM and Indobell Insulation, which rose 164 percent and 161 percent respectively. Other notable performers include Solarim Green Energy, Tankup Engineers, and Sat Kartar Shopping, each of which delivered returns above 100 percent.

On the other end, Super Iron Foundry stood out as the worst performer with a 68 percent decline. Swasth Foodtech India and Citichem India lost over 60 percent, while Infonative Solutions, Davin Sons Retail, Ken Enterprises, and Arunaya Organics each shed 52 percent since listing.

Ajay Bagga, an independent research analyst called the SME IPOs as the ‘wild west of investing’, where volatility is high and investor protections thin. He added that the amounts involved are not large enough to disturb broader market dynamics, but they are still significant for individual investors. He has suggested that such issues should ideally be limited to accredited or institutional investors, to prevent retail participants from taking heavy losses in a space prone to price manipulation and promoter-driven speculation.

The regulatory landscape is set to evolve in July with new norms aimed at improving quality and investor participation. These include increasing the minimum application size from one lakh to two lakhs, removing the cut-off price mechanism, raising the minimum number of allottees to ensure wider distribution, and tightening eligibility norms for companies looking to list.

According to Ranjit Jha, Founder and CEO of Rurash Financials, these steps are intended to encourage more fundamentally sound businesses to access public markets and ensure that better-informed investors are the ones participating.

While the SME segment continues to draw attention, sustained success depends on a shift in investor mindset from short-term speculation to long-term business evaluation, experts added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.