Vadodara-based Ratnaveer Precision Engineering decided to launch its public issue on September 4. The price band for the book-built issue is expected to be announced next week.

The initial public offering (IPO), which closes on September 6, comprises a fresh issue of 1.38 crore equity shares by the company, and an offer-for-sale (OFS) of 30.4 lakh shares by the promoter Vijay Ramanlal Sanghavi. The anchor book will open for a day on September 1.

The total fundraising amount via IPO could be in the range of Rs 165-166 crore, sources told Moneycontrol on condition of anonymity.

The company will utilise net fresh issue proceeds majorly for working capital requirements amounting to Rs 85 crore, of which it will deploy Rs 55 crore in the current financial year and the remaining Rs 30 crore in FY25. The balance of fresh issue proceeds will be used for general corporate purposes.

Also read: Mono Pharmacare to launch IPO on August 28, price band at Rs 26-28 per share

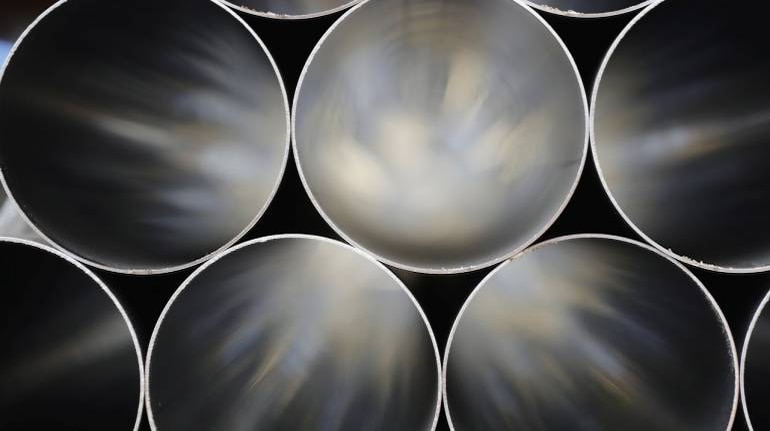

With four manufacturing units, the Gujarat-based stainless steel products maker focuses on producing finished sheets, washers, solar roofing hooks, pipes and tubes, which are used by several industries, including automotive, power plants, oil & gas, pharmaceuticals, electromechanics, building & construction, electrical appliances, and kitchen appliances.

Ratnaveer Precision Engineering has recorded a massive 164.3 percent on-year growth in net profit at Rs 25 crore for the year ended March FY23, backed by robust operating performance. Revenue from operations for the year gone by was at Rs 480 crore, increasing 12.4 percent over the previous year, comprising more than 80 percent contribution from domestic business and the remaining from exports.

On the operating front, EBITDA (earnings before interest, tax, depreciation and amortisation) grew by 65.7 percent on-year to Rs 45.6 crore with a margin expansion of 306 bps at 9.51 percent for the financial year 2022-23.

Also read: Aeroflex Industries targets four-fold revenue growth in 5 years

The return on capital employed as well as return on equity remained strong in FY23 at 12.62 percent and 29.12 percent, increasing significantly from 9.67 percent and 15.46 percent respectively in the previous year.

However, the borrowings on its books increased to Rs 230 crore during the last financial year, up from Rs 190.7 crore in FY22, resulting in an increase in finance cost to Rs 123 crore against Rs 116.7 crore during the same period, but the debt-to-equity ratio improved to 2.17, from 2.89 in the same period.

Ratnaveer Precision will debut on the BSE and NSE on September 14, as per the IPO schedule.

Click Here To Read All IPO News

Unistone Capital is the merchant banker to the issue, while Link Intime India is the registrar.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!