PB Fintech, the operator of India's largest online insurance aggregator Policybazaar, has filed draft red herring prospectus with capital markets regulator Sebi, to raise funds through initial public offering.

Kotak Mahindra Capital Company and Morgan Stanley India Company are global co-ordinators and book running lead managers to the issue. Citigroup Global Markets India, ICICI Securities, HDFC Bank, IIFL Securities and Jefferies India are the book running lead managers to the offer.

Here are 10 key things to know about the IPO of operator of Policybazaar and Paisabazaar platforms:

1) Public Issue

The company plans a public issue of Rs 6,017.5 crore which comprises a fresh issue of Rs 3,750 crore and an offer for sale of Rs 2,267.5 crore by existing selling shareholders.

The offer for sale consists of a selling of Rs 1,875 crore worth of shares by investor SVF Python II (Cayman), and Rs 392.5 crore by other selling shareholders.

2) Pre-IPO Placement

PB Fintech, in consultation with the merchant bankers, may consider a further issue of equity shares up to Rs 750 crore, by way of a private placement. If the pre-IPO placement is undertaken, accordingly the fresh issue size will be reduced by the amount raised from the pre-IPO placement.

To Know All IPO Related News, Click Here

3) Objectives of the Issue

The company proposed to utilise the fresh issue proceeds, after deducting the offer related expenses, for enhancing visibility and awareness of brands (including but not limited to Policybazaar and Paisabazaar) (Rs 1,500 crore); new opportunities to expand consumer base including offline presence (Rs 375 crore); strategic investments and acquisitions (Rs 600 crore); expanding presence outside India (Rs 375 crore); and general corporate purposes.

4) Company Profile

PB Fintech has built India's largest online platform for insurance and lending products leveraging the power of technology, data and innovation, according to Frost & Sullivan.

The company launched Policybazaar, the flagship platform, in 2008 to respond to consumers' need for more awareness, choice and transparency and create a consumer-pull based, provider-neutral model for insurance distribution. In FY20, Policybazaar was India's largest digital insurance marketplace with a 93.4 percent market share based on the number of policies sold, and 65.3 percent of all digital insurance sales in India by volume was transacted through Policybazaar.

As of March 2021, over 4.8 crore consumers have registered on Policybazaar platform and purchased over 1.9 crore policies from insurer partners. In FY21, the annual umber of visits on Policybazaar website was 12.65 crore.

In 2014, it launched Paisabazaar with the goal to transform how Indians access personal credit by accentuating ease, convenience and transparency in selecting a variety of personal loans and credit cards. Paisabazaar was India’s largest digital consumer credit marketplace with a 51.4 percent market share, based on disbursals in FY20. During FY19, FY20 and FY21, Paisabazaar enabled disbursals of Rs 5,101.5 crore, Rs 6,549.6 crore, and Rs 2,916.8 crore, respectively.

The platforms also facilitate insurer and lending partners in the financial services industry to innovate and design customised products for consumers leveraging its extensive data insights and data analytics capabilities.

Also read: Policybazaar files DRHP: Losses, commissions, litigation among key risks

5) Competitive Strengths

a) The company has created strong, consumer-friendly brands offering wide choice, transparency and convenience.

b) The company's proprietary technology stack helps it design user-friendly consumer journeys across all of processes by automating various aspects across the product value chain.

c) It is a collaborative partner for insurer and lending partners.

d) Policybazaar and Paisabazaar platforms have large, efficient and intelligent networks, providing consumers with the ability to browse financial services products offered by 51 insurer partners and 54 lending partners.

e) Its high renewal rates are providing clear visibility into future business and delivering superior economics.

f) Policybazaar and Paisabazaar platforms serve consumers with varied needs, credit profiles, demographics, employment types and income levels. Micro-segmentation has helped grow the product offerings on platforms, streamline transaction processes, deepen partnerships with insurer and lending partners, and offer tailor-made financial services solutions for varied segments.

g) It has capital efficient model with low operating costs.

h) Its founders have a deep understanding of consumers' pain points and the structural problems in the insurance and financial services industry. They each have almost two decades of experience and commitment to solve those problems, along with a deep understanding of consumer insights and technology.

6) Growth Strategy

a) PB Fintech endeavours to attract new consumers while deepening relationship with current consumers for both Policybazaar and Paisabazaar platforms.

b) The company plans to leverage execution capabilities, expertise in the Indian financial services sector and relationships with insurer partners and lending partners to continue to design and offer products for SME and corporate clients.

c) It will continue to invest in brand building activities to educate consumers about insurance and personal credit needs and increase brand awareness while maintaining proposition of neutral advice.

d) The company aims to co-create and design innovative products to address evolving consumer needs, enable underserved segments to access credit, build lifetime engagement with consumers and create annuity revenue streams.

e) The company will continue to invest in platforms to ensure a seamless experience packed with convenience, speed and choices for consumers, while providing finer data insights to insurer partners and lending partners to further improve their service delivery.

f) The company intends to pursue strategic investments and acquisitions which are complementary to its business to enhance product and service capabilities, which will help it scale faster.

g) It plans to scale up operations and brand presence in Dubai and in the broader Gulf Cooperation Council region. It may pursue similar opportunities in select Southeast Asian countries by replicating its proven business model in India along with exploring inorganic growth opportunities.

7) Market Opportunity

The market for insurance products in India is estimated to be Rs 7.6 lakh crore ($102 billion) in total premium in FY20 across life and non-life insurance and is expected to grow to Rs 39 lakh crore ($520 billion) by FY30 at a CAGR of 17.8 percent.

The Indian insurance market is highly underpenetrated, with the life insurance market penetration in terms of sum assured as a percentage of GDP of only 24.6 percent, as compared to 265 percent in USA and 95.4 percent in China in FY20.

In FY20, 1.0 percent of the total premium was sold through online channels in India, which was much lower compared to 13.3 percent in USA and 5.5 percent in China.

India's consumer lending market was Rs 32.8 lakh crore ($437 billion) in FY20 in terms of outstanding loan balance and is estimated to reach Rs 78.1 lakh crore ($1,041 billion) by FY30, representing a CAGR of 9.1 percent. Despite the large market size, India's lending market is highly under penetrated and stood at 16.7 percent of nominal GDP, much lower as compared to USA at 79.2 percent and China at 55.6 percent. In FY20, only 0.9 percent of disbursals were through digital marketplaces in India. This represents a meaningful market opportunity for Paisabazaar’s current digital lending offering to tap, in collaboration with lending partners.

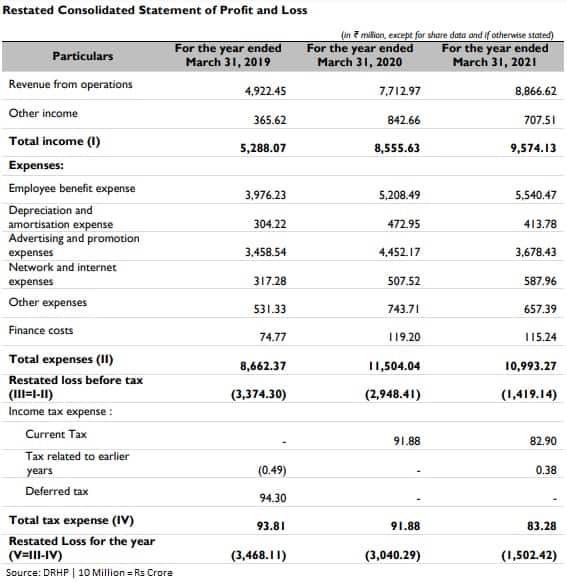

8) Financials

PB Fintech recorded a consolidated loss of Rs 150.24 crore in FY21 against loss of Rs 304 crore in FY20 and loss of Rs 346.81 crore in FY19. In the same periods, revenue from operations increased to Rs 886.66 crore, from Rs 771.29 crore and Rs 492.24 crore respectively.

9) Principal Shareholders and Investors

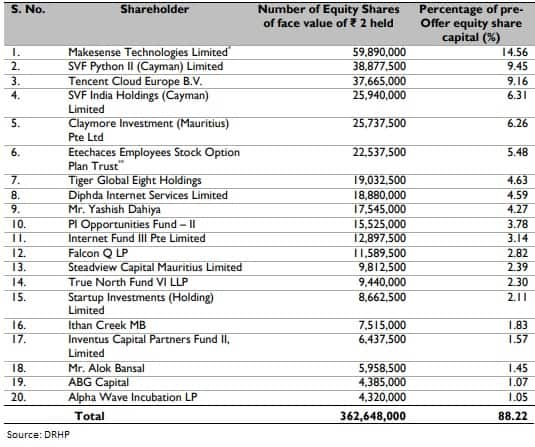

PB Fintech is a professionally managed company and does not have an identifiable promoter. Currently the company has 192 shareholders.

PB Fintech has a long list of shareholders including Makesense Technologies, Tiger Global Eight Holdings, PI Opportunities Fund, SVF Python, Tencent Cloud Europe, Claymore Investment, Falcon, Steadview Capital Mauritius, True North Fund, Startup Investments, Inventus Capital Partners Fund, ABG Capital, and Alpha Wave Incubation LP.

Once National Company Law Tribunal (NCLT) approval in respect of the Amalgamation Scheme has been obtained and it becomes effective, the company will allot its equity shares on a proportionate basis to Info Edge (India) and Macritchie Investment Pte Ltd, while all equity shares held by Makesense in the company will stand cancelled.

10) Management

Yashish Dahiya is the Chairman, Executive Director and CEO of the company. He holds a bachelor's degree in technology from Indian Institute of Technology, Delhi, a post-graduate diploma in management from Indian Institute of Management, Ahmedabad and a master’s degree in business administration from Institut Européen d'Administration des Affaires (INSEAD), France. He was previously associated with ITW Signode India, Bain & Company Inc. (London), eBookers PLC (UK) and CI2I Investments.

Alok Bansal is a Whole-time Director and CFO of the company. He holds a bachelor's degree in technology from Shri Shahu Ji Maharaj University, Kanpur and a post-graduate diploma in management from Indian Institute of Management, Calcutta. He was previously associated with Voltas Limited, General Electric International Operations Co. Inc. (India), iGate Global Solutions, Mahindra & Mahindra, and FE Global Technology Services.

Kitty Agarwal is a Non-executive Director of the company. She holds a bachelor's degree in business management from Bangalore University and a post-graduate diploma in agri-business management from Indian Institute of Management, Ahmedabad. She is currently associated with Info Edge Ventures as a partner and was previously associated with Info Edge (India) as head of corporate development.

Sarbvir Singh is the President of Policybazaar and Non-executive Director of the company. He holds an integrated master's degree in mathematics and computer applications from Indian Institute of Technology, Delhi and a post-graduate diploma in management from Indian Institute of Management, Ahmedabad. He has previously served as Managing Partner of WaterBridge Capital Management LLP

and as Managing Director of Capital18, a part of the Network18 group.

Munish Ravinder Varma is a Non-executive Director of the company. He has completed his master's in business administration from Cornell University. He currently serves as a managing partner at SoftBank Investment Advisers. He was also associated with Deutsche Bank AG.

Kaushik Dutta, Veena Vikas Mankar, Lilian Jessie Paul, Nilesh Bhaskar Sathe, and Gopalan Srinivasan are Independent Directors on the board.

Naveen Kukreja is the co-founder and CEO of Paisabazaar. He holds a bachelor's degree in engineering from University of Delhi and a post-graduate diploma in management from Indian Institute of Management, Kolkata. He was previously associated with Citibank N.A. (India), Capital One (Europe) Plc and Aviva Life Insurance Company India.

Sharat Dhall is the chief operating officer of Policybazaar. He holds a master of management studies degree from Birla Institute of Technology and Science, Pilani and a post-graduate diploma in business management from XLRI, Jamshedpur. He was previously associated with Hindustan Lever, Times Internet, and Yatra Online.

Saurabh Tiwari is the chief technical officer of Policybazaar. He holds a bachelor's degree of technology from Indian Institute of Technology, Kanpur, a master’s degree in technology from National University of Singapore and has completed an executive programme in business management from Indian Institute of Management, Calcutta. He was previously associated with myMBSC.com (Singapore), IBM India and GEP Solutions.

Manoj Sharma is the director of finance and Principal Officer of Policybazaar. He holds a bachelor's degree in commerce from Kurukshetra University, has qualified as a chartered accountant with the Institute of Chartered Accountants of India and has also qualified as an associate with the Insurance Institute of India. He was previously associated with Fiamm Minda Automotive, Ericsson India and FE Global Technology Services.

Disclaimer: Network18 is a subsidiary of Network18 Media & Investments Ltd which publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.