Specialty chemicals manufacturer Chemplast Sanmar is set to launch its initial public offering (IPO) for subscription in the current week. Earlier, the stock was listed on BSE and NSE, and was subsequently delisted in June 2012.

Here are key 10 things to know before subscribing the issue:1) IPO DatesThe public offer will open for subscription on August 10 and the bidding will continue till August 12.

2) Price BandThe company, after in consultation with merchant bankers, has fixed a price band at Rs 530 to Rs 541 per equity share.

3) Public Issue DetailsThe company plans to raise Rs 3,850 crore through its public offer that comprises a fresh issue of Rs 1,300 crore by the company, and an offer for sale of Rs 2,550 crore by promoters, Sanmar Holdings and Sanmar Engineering Services.

4) Objectives of IssueThe company is going to utilise net proceeds from the fresh issue for early redemption of non-convertible debentures (Rs 1,238.25 crore); and general corporate purposes. The company will not receive funds from offer for sale as the offer for sale money will go to selling shareholders i.e. promoters.

5) Lot Size and Investors' Reserved PortionInvestors can made a minimum investment of 27 equity shares and in multiples of 27 equity shares thereafter. Retail investors can invest a Rs 14,310-14,607 per lot, and the maximum investment by them would be Rs 1,86,030-1,89,891 for 13 lots at a lower-higher price band of Rs 530-Rs 541 per share, respectively.

Up to 75 percent of the total offer is reserved for qualified institutional buyers, 15 percent for non-institutional investors, and the remaining 10 percent shares are reserved for retail investors.

6) Company ProfileChemplast is a specialty chemicals manufacturer in India with focus on specialty paste PVC (poly vinyl chloride) resin and custom manufacturing of starting materials and intermediates for pharmaceutical, agro-chemical and fine chemicals sectors. It is one of leading manufacturers of specialty paste PVC resin in India on the basis of installed production capacity, as of December 2020.

In addition, it is also the third largest manufacturer of caustic soda and the largest manufacturer of hydrogen peroxide in the South India region, on the basis of installed production capacity as of December 2020 and one of the oldest manufacturers in the chloromethanes market in India.

After the acquisition of CCVL, it acquired 100 percent equity interest in CCVL that is the second largest manufacturer of suspension PVC resin in India and the largest manufacturer in the South India region, on the basis of installed production capacity as of December 2020.

It has four manufacturing facilities, of which three are located in Tamil Nadu (Mettur, Berigai, and Cuddalore facilities) and one is located in Puducherry (Karaikal facility).

It has a coal-based captive power plant of 48.5 MW at Mettur facility in Tamil Nadu and two natural gas-based captive power plants of 8.5 MW and 3.5 MW respectively, at Karaikal facility in Puducherry.

It is a part of the SHL Chemicals Group, which in turn is a constituent of the Sanmar Group. Fairfax India Holdings Corporation, a well-known international investor led by Prem Watsa, based in Canada, has invested, through FIH Mauritius Investments, in the SHL Chemicals Group since 2016.

7) Competitive Strengths and Strategiesa) It is well-positioned to capture favourable industry dynamics.

b) It has leadership position in an industry with high barriers to entry.

c) It has vertically-integrated operations for manufacturing of its products.

d) It has quality manufacturing facilities with a strong focus on sustainability.

e) Its intention to invest Rs 256 crore by FY24 to develop the specialty paste PVC resin manufacturing facility and investment of Rs 113 crore in FY20 to purchase plant, machinery and technology for hydrogen peroxide plant positioned the company well to capture future market growth and its commitment to operational excellence would allow it to remain an industry leader.

f) It has strong parentage (a part of the SHL Chemicals Group) and strong management team with extensive experience in the chemicals industry and a track record of operational excellence.

Strategiesa) The company continues to seek to develop or improve products and processes to meet demands of existing customers, to further enhance the performance of specialty products and to respond to increasing compliance requirements under the environmental regulations.

b) The company is proposing to expand operations by increasing the installed production capacity of specialty paste PVC resin by 35 kt; setting up a multipurpose facility with two blocks for custom manufacturing operations; and increasing the installed production capacity of suspension PVC resin by 31 kt by de-bottlenecking the suspension PVC resin plant.

c) The company is committed to prudent balance sheet management and maximizing free cash flow through continued disciplined approach to financial management.

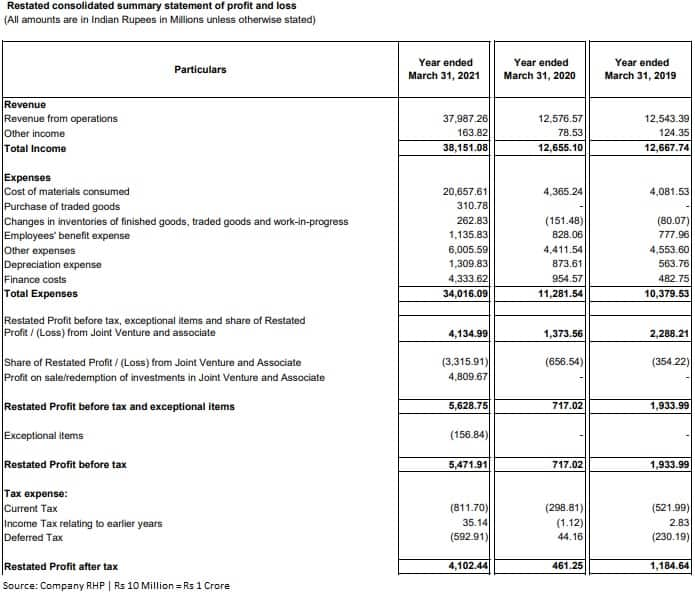

8) FinancialsChemplast reported profit at Rs 410.24 crore on revenue of Rs 3,798.73 crore in the financial year FY21 post acquisition of CCVL, and profit of Rs 46.12 crore on revenue of Rs 1,257.65 crore in FY20. The profit in FY19 was at Rs 118.46 crore on revenue of Rs 1,254.34 crore in FY19.

Promoter Sanmar Holdings holds 98.81 percent stake in the company and the rest is held by Sanmar Engineering Services (promoter group. It is 100 percent owned promoter and promoter group.

Vijay Sankar is the Chairman and Non–executive Director of the company. He has been associated as Director of company since April 2021. He was on the board of directors of the company during the period from June 1999 to July 2004. He is an industrialist and has several years of experience in managing several businesses. He is on the boards of companies such as The KCP, Oriental Hotels, Kaveri Retreats and Resorts, and Transport Corporation of India.

Ramkumar Shankar is the Managing Director of the company. He has been associated as the Managing Director of the company since February 2021. He is also the managing director of CCVL since April 2020 and has been heading the chloro – vinyl business of company since 2013. He has several years of experience in the chloro-vinyls business.

Chandran Ratnaswami is a Non – executive Director of the company. He has been associated as a Director of the company since April 2021. He is the chief executive officer of Fairfax India Holdings Corporation, a company listed on the Toronto Stock Exchange, and a managing director of Hamblin Watsa Investment Counsel Limited.

Amarnath Ananthanarayanan is a Non – Executive Director of the company. He has been associated as a Director of the company since March 2019. He has several years of experience across various sectors such as financial services, manufacturing, and academics.

Lakshmi Vijayakumar, Aditya Jain, Sanjay Vijay Bhandarkar, and Prasad Raghava Menon are Independent Directors on the board.

ManagementN Krishnamoorthy is the executive director (commercial) of the company. He has been associated with the company since 1993. He has approximately 37 years of work experience and was previously associated with Reliance Industries and Southern Petrochemical Industries Corporation.

Dr. Krishna Kumar Rangachari is the executive director (business operations) of the custom manufacturing plant at Berigai Facility. He has been associated with the company since March 2021. He has approximately 30 years of work experience and was previously associated with Cabot Sanmar and Rayonier Performance Fibres Division, USA and has exposure to managing global teams and managing global customer relationships.

S Sayi Subramaniyan is the Senior Vice President (strategic sourcing) of CCVL. He has been associated with the company since 2010. He has approximately 32 years of work experience and was previously associated with Dalmia Cement (Bharat), and Shasun Chemicals & Drugs.

S Gajendiran is the Executive Vice President (operations) of the company and is the location head of Mettur facility. He has been associated with the company since 2005. He has approximately 30 years of work experience and was previously associated with Thirumalai Chemicals, SIP Resins and SIP Industries.

N Palanisamy is the Senior Vice President (operations) of CCVL. He has been associated with the company since 1995. He has approximately 32 years of work experience and was previously associated with South India Viscose, SIV Industries and Engineers India.

S Mathivanan is the Vice President (operations) of the company in charge of the operations at Karaikkal facility. He has been associated with the company since 2009. He has approximately 37 years of work experience and was previously associated with Durgapur Chemicals, Indian Petrochemicals Corporation and Chemfab Alkalis.

M Chandrasekar is the Chief Financial Officer of the company. He has been associated with the company since 1995. He has approximately 26 years of work experience and was previously associated with Reliance Industries.

10) Allotment, refunds and listing datesAfter closing the issue on August 12, the company will finalise the IPO share allotment on August 18 and will initiate refunds to ineligible investors on August 20.

Eligible investors will get their shares in demat accounts on August 23. And the trading in shares will commence with effect from August 24.

At the time of publishing this copy, Chemplast Sanmar shares traded at a premium of Rs 25-35 in the grey market which translated into 4.6-6.5 percent gains over issue price of Rs 541, the higher price band, IPO Watch and IPO Central data showed.

Equity shares are proposed to be listed on the BSE and NSE.

ICICI Securities, Axis Capital, Credit Suisse Securities (India), IIFL Securities, Ambit, BOB Capital Markets and HDFC Bank are the global co-ordinators and book running lead managers to the offer. IndusInd Bank and YES Securities (India) are the book running lead managers to the offer.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.