Delhi-based high-end computing solutions (HCS) provider Netweb Technologies is set to launch its initial public offering (IPO) on July 17. The IPO aims to raise Rs 631 crore, with fresh equity of Rs 206 crore and an offer for the sale of 8.5 million shares, amounting to Rs 425 crore at the higher end of the price band. The price band for the issue has been set at Rs 475-500 per share.

The company did a pre-IPO placement of 1,020,000 equity shares at a price of Rs 500 per (face value Rs 2) , totalling Rs 51 crore. Equirus Capital and IIFL Securities are the lead book runners of the IPO.

About the company

Netweb is the country’s leading OEM in the space of high-end computing solutions. They provide supercomputing systems, private cloud and hyperconverged infrastructure (HCI), data centre servers, AI systems, enterprise workstations, and high-performance storage (HPS) solutions.

The company obtains more than 39 percent of its revenue from supercomputing solutions, 33 percent from private cloud and HCI, 7 percent from AI systems and enterprise workstations, 7 percent from HPS solutions and data centre servers, 5 percent from the sale of spares, and the remaining 2 percent from software and services for its HCS offerings. (this totals 93 percent, what makes up the remaining 7 percent.)

Selling shareholders

The selling shareholders are the promoters, including Sanjay, Navin, Vivek and Niraj Lodha, and Ashoka Bajaj Automobiles LLP.

Objective of the offer:

The company will be spending Rs 128 crore for funding its long-term working capital requirement; Rs 23.2 crore will go towards purchase of equipment / machinery for the company’s new surface mount technology (SMT) production line; Rs 22.5 crore will be used to repay certain outstanding borrowings, and Rs 9 crore will be spent on constructing the building for the SMT line and on interior development.

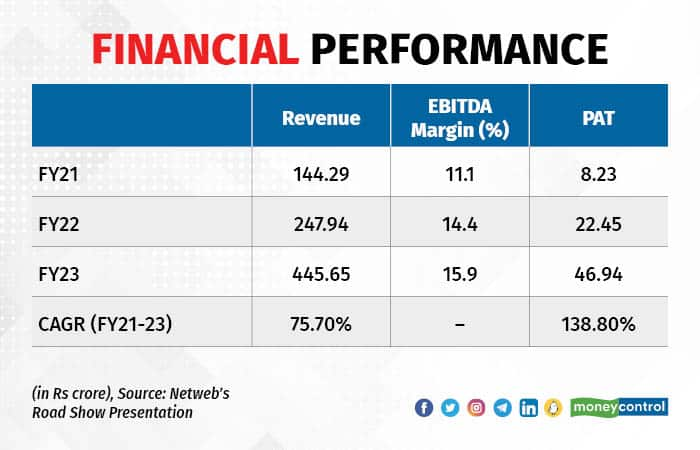

Financials:

The company's revenue has grown at a CAGR (compounded annual growth rate) of 75 percent from FY21 to FY23, and its profits have grown at a CAGR of about 138 percent in the same period. The margins have risen from 11 to 15 percent.

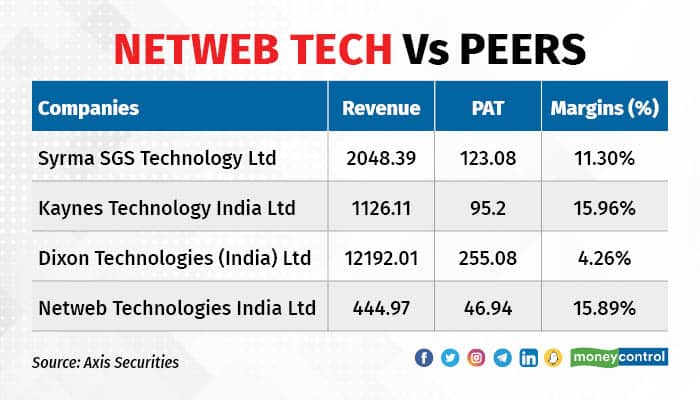

Netweb Technology vs peers

Netweb Technologies does not have any directly comparable listed peer, in India or internationally. However, according to Axis Securities, some comparable companies include Syrma SGS Technology, Kaynes Technology, and Dixon Technologies, among others. Though not directly comparable all these companies belong to the electronic manufacturing system (ESM) business.

Netweb Technology's margins are more or less in line with Kaynes Technologies and higher than other counterparts. However, the company's revenues and profits are lower than its counterparts.

Netweb Tech IPO Peer financials

Netweb Tech IPO Peer financials

Valuation: Netweb vs peers

Netweb’s valuation is more or less in line with that of Syrma SGS and Kaynes. However, it is way lower than the market leader, Dixon Technologies.

Netweb Tech valuation profile

Netweb Tech valuation profile

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.