India’s primary market is bracing for a blockbuster week, with 22 initial public offerings—eight on the mainboard and 14 in the SME segment—looking to collectively raise close to Rs 5,000 crore. The deluge reflects surging retail interest, steady institutional participation, and buoyant sentiment in secondary markets.

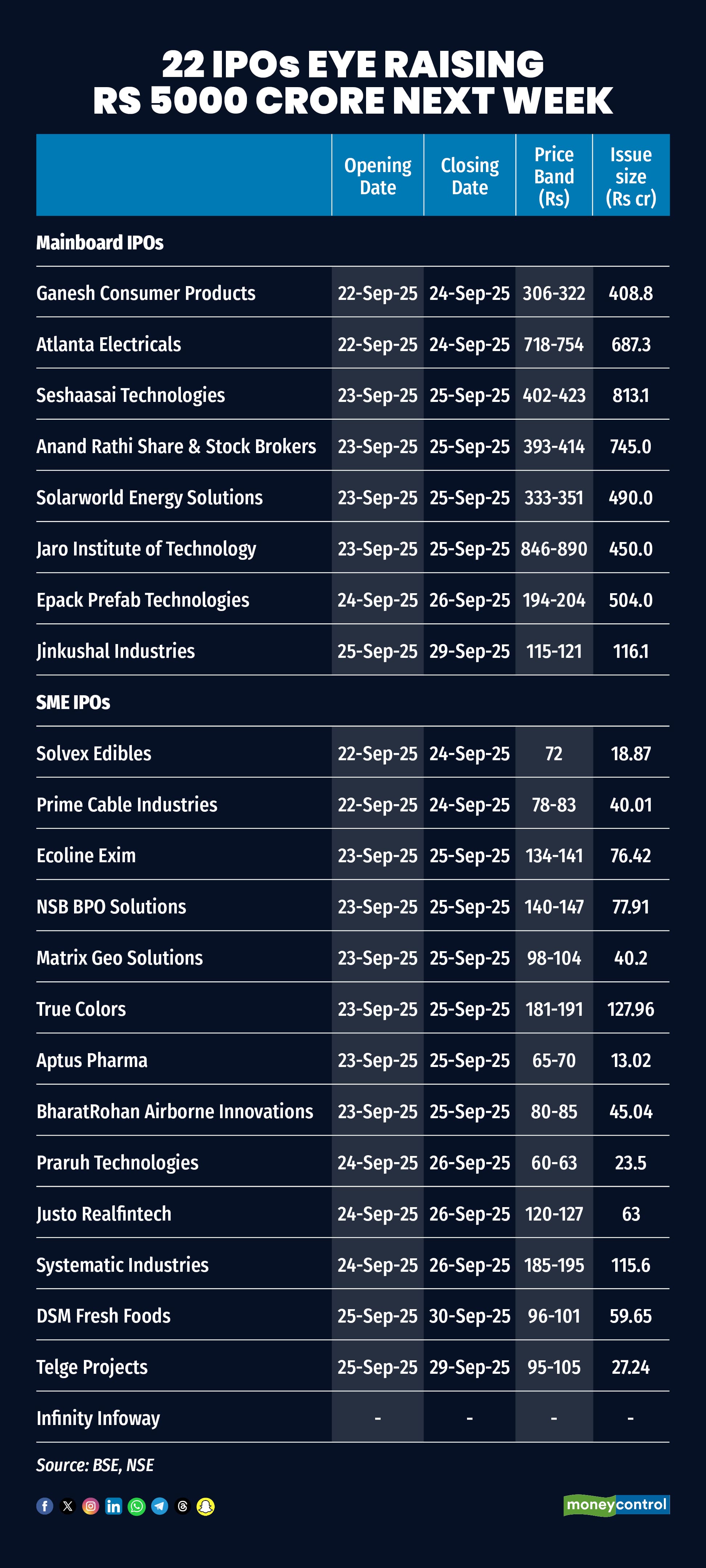

On the mainboard, Seshaasai Technologies leads the pack with a Rs 813 crore issue, followed by Anand Rathi Share & Stock Broking at Rs 745 crore and Atlanta Electricals at Rs 688 crore. Other notable offerings include Epack Prefab Technologies (Rs 504 crore), Solarworld Energy Solutions (Rs 490 crore), Jaro Institute of Technology (Rs 450 crore), Ganesh Consumer Products (Rs 409 crore), and Jinkushal Industries (Rs 116 crore).

The subscription window will open in phases. Atlanta Electricals and Ganesh Consumer Products launch on September 22. Jaro Institute, Solarworld Energy, Anand Rathi Broking and Seshaasai Technologies follow on September 23, closing September 25. Epack Prefab Technologies will run from September 24–26, while Jinkushal Industries is slated for September 25–29.

The SME segment is equally active, with 14 companies jostling for investor attention. Prime Cable Industries and Sovex Edibles will open their books from September 22–24. Six others—including BharatRohan Airborne Innovations, Aptus Pharma, True Colors, Matrix Geo Solutions, NSB BPO Solutions and Ecoline Exim—are lined up for September 23–25.

Systematic Industries, Justo Realfintech and Praruh Technologies will open September 24–26. Telge Projects and DSM Fresh Foods are scheduled for September 25–29 and September 26–30 respectively. Infinity Infoway is also preparing to list, though dates remain unannounced.

Analysts attribute the IPO rush to multiple tailwinds. Retail investors, lured by listing gains, are flocking to new offerings. Domestic institutions are providing depth, while foreign institutional investors—despite being net sellers in the secondary market—have put more than Rs 41,000 crore into IPOs this year, according to NSDL data.

High-growth sectors dominate the pipeline, further fuelling demand. Experts believe this wave of participation will persist through late 2024 and could carry into 2025. With retail enthusiasm at a peak and FIIs selectively backing new issuances, the upcoming week is expected to keep the IPO momentum firmly intact.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.