India's video streaming market reached nearly 100 million subscriptions in 2022, as companies ramped up their spending on original content in local languages and extensively marketed them, according to a FICCI-EY report released on May 3.

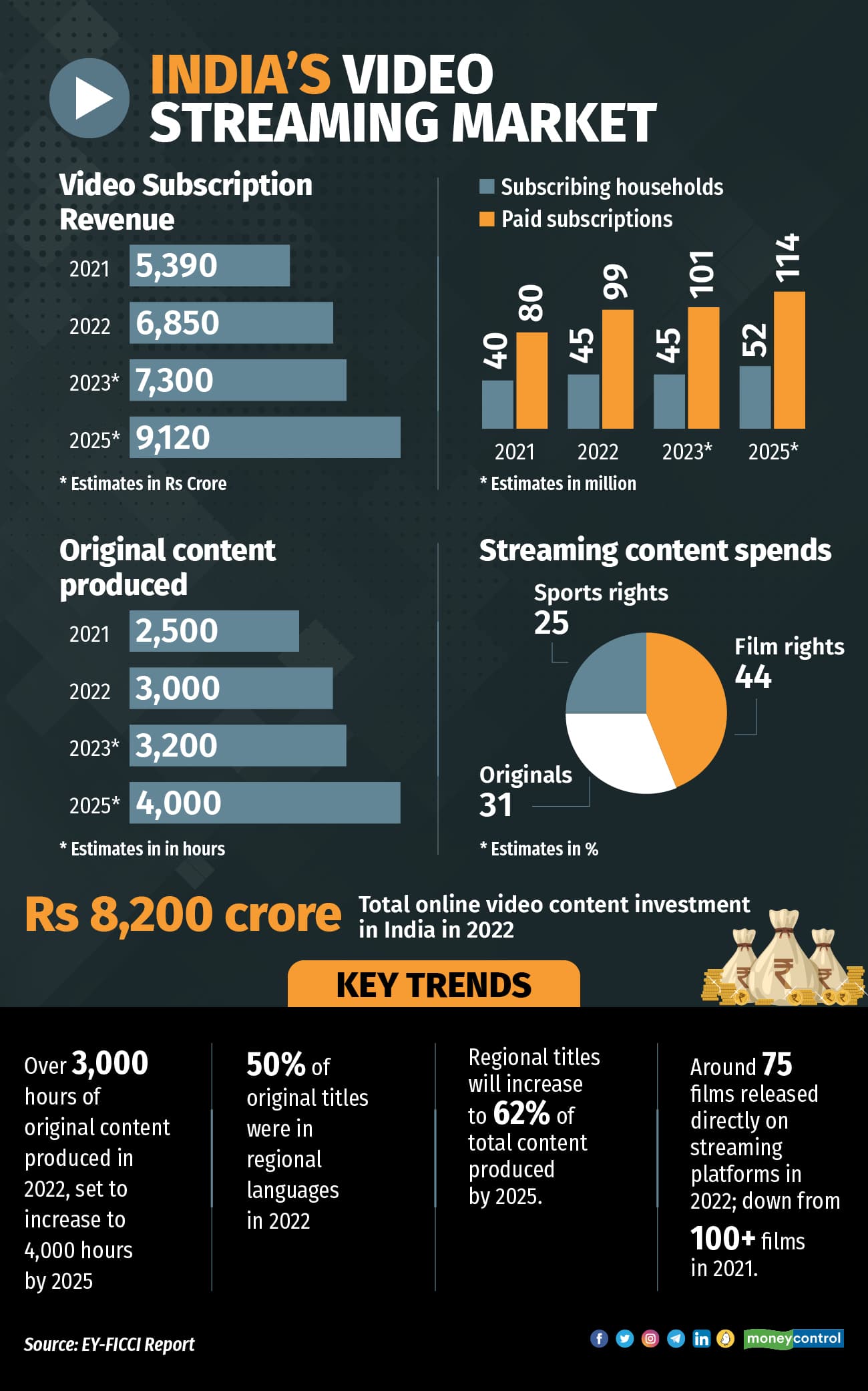

About 45 million Indian households paid for 99 million video streaming subscriptions in 2022, as compared to 40 million households paying for 80 million subscriptions in 2021, the report said. India's top six metro cities accounted for 33 percent of the total paid subscriptions in the country.

However, since people tend to share their subscriptions with family members and friends, the actual video streaming audience is estimated to be 135 million to 180 million individuals in the country, it noted.

The growth in paid members has resulted in a 27 percent increase in revenue generated from video subscriptions in India, from Rs 5,390 crore in 2021 to Rs 6,850 crore in 2022. This amount represents over 60% of the broadcasters' share of television subscription revenues, the report said.

It projects the revenue from video subscriptions will reach an estimated Rs 9,120 crore by 2025, as the paid subscriber base grows to an estimated 114 million subscriptions from 52 million households.

"A consumer subscribing to three large video subscriptions today will spend around Rs 3,000 per year. If large platforms launch more affordable packages or aggregators bring the bundled price down to Rs 1,500 or so per year, we estimate the number of households paying for one or more SVOD (Subscription video on demand) service can reach 100 million and total revenue increase to around Rs 11,000 crore by 2025," the report said.

That said, JioCinema's move to stream the crucial Indian Premier League (IPL) cricket tournament to consumers for free, could impact the growth of paid subscriptions in the country in 2023, it notes.

The overall video viewers in India saw a more modest 6 percent growth to reach 527 million in 2022 and it is estimated to touch 620 million by 2025. This excludes YouTube users in India.

Read: Netflix's co-CEO Ted Sarandos sees India as a 'big prize'

What is driving the growth?

One of the main factors driving the increased demand for video subscriptions was the rise of original content programming, particularly in local languages, and its extensive marketing.

Almost 3,000 hours of original content was produced for streaming platforms in 2022, registering a 19% increase year-on-year. About 50 percent of the originals produced in 2022 were in local languages excluding Hindi, a jump from 30 percent in 2020. The remaining 50 percent was produced in Hindi in 2022, down from 70 percent in 2020. In terms of genres, about 72 percent belonged to the drama, crime or action genres, as per the report.

That said, the increased content programming has also resulted in the production cost rising by 11 percent year-on-year to Rs 2,550 crore with an average price of Rs 0.83 crore per hour, it noted.

It further stated that the total investment in online video content in India was Rs 8,200 crore in 2022. Out of this, 44 percent was spent on film rights, followed by 31 percent on original content and 25 percent on sports rights.

A snapshot of India's video streaming market

A snapshot of India's video streaming market

Most of the large platforms have added support for eight languages (Hindi, four southern languages, Bengali, Marathi, and English) or more with dubbing and subtitling of movies and original content becoming the norm, leading to viewers being more open to sampling content from different languages and accepting movies across state and cultural boundaries.

To be sure, fewer films were released directly on digital platforms in the past year as theatres made a full-fledged comeback post the pandemic across the country.

According to the report, about 75 films were released directly on streaming platforms in 2022, many of which were smaller budgets, specifically commissioned films. In comparison, over 100 movies were released directly on digital platforms in 2021.

Most large films have reinstated the theatrical window of at least eight weeks, which has resulted in the rationalisation of digital rights spend to Rs 3,600 crore in 2022, from Rs 4,000 crore in 2021. That said, the trend of consumers watching new films on streaming platforms is here to stay, the report noted.

In 2023, the original content production is expected to increase 8 percent to 3,200 hours. By 2025, the demand for original content will increase to over 4,000 hours by 2025, with the share of local languages set to increase to 62 percent, it said.

Other growth drivers for video subscriptions in India include pricing changes, live sports, bundling, and exclusive digital content for popular reality television shows, it added.

Last month, Netflix stated that its price cuts in India helped grow engagement in the country by nearly 30 percent year-on-year while revenue growth increased to 24 percent in 2022 versus 19 percent in 2021. The company now plans to refine its pricing strategy to offer a range of price points and feature sets to customers across the world.

Rise in digital sports media spends

More people consuming sports on video streaming platforms has also led to a significant rise in spending related to digital media rights in the past year.

Spends on digital media rights grew 112 percent to Rs 2,410 crore for 2022, from Rs 1,140 crore in 2021. The segment accounted for 27 percent of the overall sports media spend in 2022, a jump from 16 percent contribution in 2021.

These spends are likely to jump further in the forthcoming years. Viacom18 had secured the consolidated IPL digital streaming rights for the Indian subcontinent for Rs 23,758 crore for the 2023-2027 period in June 2022. The company also won the Women's Premier League media rights for five years starting 2023 at Rs 951 crore in January 2023.

Read: TV revenues grew marginally in 2022, digital and live events emerge strong performing segments

Other monetization models

A new form of content windowing may emerge wherein old streaming content gets syndicated to television, the report mentions, stating that it could induce more trials among television and ad-supported customers.

It also mentioned that the bundling of video streaming services by internet service providers (ISPs) and telecom operators will grow further. "They will in effect play the role that DPOs (Distribution platform operators) played in the television sector – but the customer will need to be provided with the choice of choosing different OTT platforms to bundle," it said.

Transactional video-on-demand (TVOD) or pay-per-view services will also gain scale to bring in audiences from a trial perspective, starting with sports, events, and movies. The segment could generate Rs 1,000 crore in revenue by 2025, the report notes.

Meanwhile, advertising-based video services will evolve to include increased advertiser-funded content since break-even on pure advertising platforms can only be achieved if content cost is extremely low, it said.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.