India's goods and services tax mop-up for March 2024 at Rs 1.78 lakh crore is the second highest collection ever, registering a 11.5 percent year-on-year growth, the finance ministry said in a release on April 1.

For the entire fiscal year 2023-24, gross GST collection stood at Rs. 20.18 lakh crore, a 11.7 percent increase compared to the previous year.

"The surge was driven by a significant rise in GST collection from domestic transactions at 17.6 percent. FY 2023-24 marks a milestone with total gross GST collection of Rs. 20.18 lakh crore exceeding Rs 20 lakh crore," Finance Ministry said in a statement.

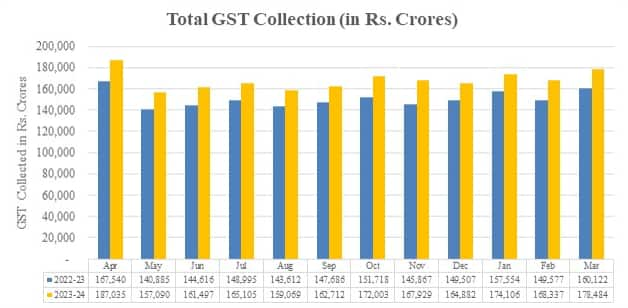

The average monthly collection for this fiscal year stands at Rs 1.68 lakh crore, surpassing the previous year’s average of Rs 1.5 lakh crore.

GST revenue net of refunds as of March 2024 for the current fiscal year is Rs 18.01 lakh crore which is a growth of 13.4 percent over same period last year.

Breakdown of March 2024 CollectionsThe Central Goods and Services Tax (CGST) for March stood at Rs 34,532 crore while the State Goods and Services Tax (SGST) was at Rs 43,746 crore. The Integrated Goods and Services Tax (IGST) for March was at Rs 87,947 crore, including Rs 40,322 crore collected on imported goods while the cess stood at Rs 12,259 crore, including Rs 996 crore collected on imported goods.

Inter-Governmental SettlementIn the month of March, 2024, the Central Government settled Rs 43,264 crore to CGST and Rs 37,704 crore to SGST from the IGST collected.

"This translates to a total revenue of Rs 77,796 crore for CGST and Rs 81,450 crore for SGST for March, 2024 after regular settlement. For the FY 2023-24, the central government settled Rs 4,87,039 crore to CGST and Rs 4,12,028 crore to SGST from the IGST collected," it said.

Trends in GST Collection

Trends in GST Collection Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.