“Meine aisa time kabhi dekha nahi (I have never seen such a time),” said the 85-year-old Chinubhai D. Shah, who runs a business unit that makes corrugated boxes, cartons and duplex boards in Mumbai’s Kandivali Industrial Estate.

Shah was referring to a steep fall in his business over the last year when a price crisis hit his family trade. The business the Shahs have been running for three generations is at a crucial juncture now. Revenue has halved because of a combination of factors but primarily due to high inflation and an unprecedented collapse in demand.

“Prior to Covid-19, our full-year revenue was up to Rs 4 crore,” said Shah. “Now it is down to Rs 2.5 crore per annum.” What initially hit the family-run business, which employs 25-odd workers, was a surge in the price of raw materials used for making craft paper and duplex board, which went up by 40-50 percent in just the last six months. That spiked the cost of production significantly. But what accompanied the price hike was an even bigger challenge—a steady but visible fall in demand as small businesses and distribution companies, which constitute the majority of Shah’s clientele, stopped ordering stock.

“There is no demand,” said Shah, pointing to the pile of old stock in his adjoining warehouse.

“Those days when we used to get orders in good quantity seem to have gone. And there is no sign of an improvement any time soon,” said Shah. The stock of unsold goods testified to his words.

Shah’s situation is hardly unique. Moneycontrol spoke to at least half a dozen small businesses across the country, and theirs is a similar story.

It is a tale of being buffeted by a series of blows ranging from the devastating fallout of demonetisation, the hasty rollout of the goods and services tax, a crippling pandemic and resultant lockdowns, and a prolonged slowdown in the Indian economy. The sustained retail and wholesale inflation seen lately could be the proverbial last straw.

India has approximately 633.88 lakh registered micro, small and medium enterprises (MSMEs), according to the 73rd round of the National Sample Survey (NSS) conducted by National Sample Survey Office, Ministry of Statistics & Programme Implementation.

Some 5,577 MSMEs have shut shop in the last two years following the onset of the pandemic, MSME Minister Bhanu Pratap Singh Verma informed Parliament earlier this year.

MSMEs are vital to India’s $3-trillion economy, having contributing over 11 crore jobs and 30.2 percent to the GDP in FY21, as per government data.

The impact on business is already visible. “It is like your salary was Rs 1 lakh per month. It went down to Rs 20,000 during Covid-19 and has now improved to Rs 40,000. We are just happy to keep our business afloat and keep focusing on our path from here on,” said the owner of a small lens manufacturing firm in Mumbai, requesting anonymity.

External factors too have been contributing to the price spike.

“Costs have been rising since the last three months across all products due to the Russia-Ukraine war,” said the owner. “No one has an exact answer where the market will be tomorrow.”

Other small business owners Moneycontrol spoke to also expressed worries about consistent price rises. Many are even planning to wind up their businesses if there is no improvement in coming months as cash reserves run dry.

“As compared to before pandemic, our production has fallen to 20-25 percent of capacity. Raw material prices have doubled globally due to rise in international freight rates by 5 to 8 times,” said Ravindra Laddha, the owner of a small business and president of Plastic Pipe Manufacturing Association, Jalgaon Maharashtra.

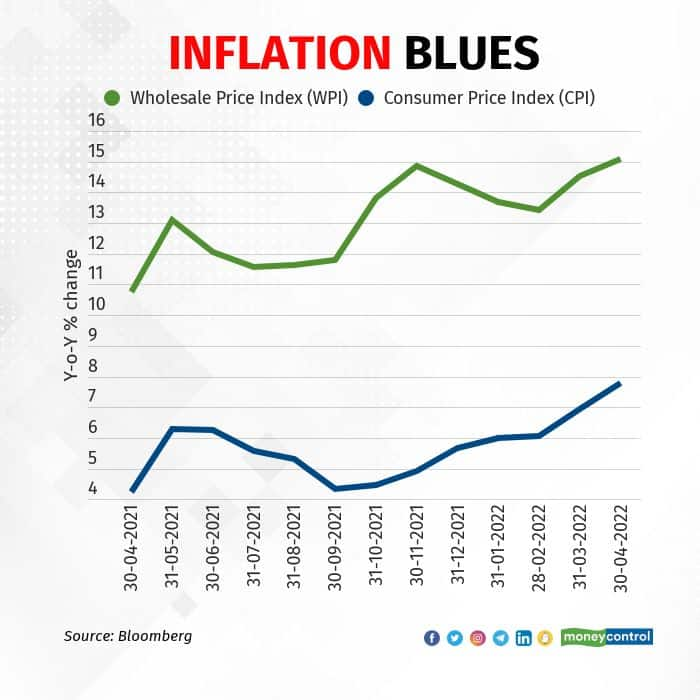

Inflation in numbersData released on May 12 by the Ministry of Statistics and Programme Implementation showed that Consumer Price Index (CPI) inflation rose to a 95-month high of 7.79 percent in April, the 31st consecutive month in which it had come above the Reserve Bank of India’s (RBI) medium-term target of 4 percent.

As expected, fuel items led the charge, with the index for the ‘fuel and light’ group of the CPI rising 3.1 percent month-on-month in April, resulting in an inflation rate of 10.8 percent. The food index inflation rate in April rose to 8.38 percent against 7.68 percent earlier.

More recently, on May 17, commerce ministry data showed that wholesale inflation increased to 15.08 percent last month, the highest in three decades.

The data underscores that MSMEs are reeling from higher costs.

At 15.08 percent, the inflation print for April was the highest in the current series, data for which is available starting April 2013.

The overall all-commodities index of the WPI rose 2.1 percent month-on-month, while the index for the fuel and power group was 2.8 percent higher in April over March. The index for manufactured products—which account for 64.23 percent of the WPI basket—rose 1.7 percent in April from March.

The food index posted the highest sequential gain in April, rising 3.4 percent month-on-month.

According to Aditi Nayar, chief economist at ICRA, high inflation may disproportionately impact SMEs as they may lack the pricing power to push through higher input costs into final prices.

“This would eat into their margins in FY23, and may amplify the shift that has been underway in the economy over the last few years with the large and organised firms gaining at the cost of the small,” she said.

Even as SMEs are facing demand shortage and price rise, the road ahead looks challenging as the RBI is widely expected to increase rates further in its forthcoming monetary policy committee (MPC) meetings.

To be sure, the RBI on May 4 announced an unscheduled 40-basis-point (bp) hike in the key lending rate to 4.40 percent and raised the cash reserve ratio (CRR) by 50 bps to 4.50 percent. Banks have since increased their lending rates by up to 40 bps accordingly across various loan tenures.

Soumyajit Niyogi, director at India Ratings & Research, said multiple shocks in the last five years have adversely impacted India's long-term trend growth, especially for small and micro entities. India’s fourth-quarter GDP figure will be cause for more concern as the economy is already facing an acute demand challenge, Niyogi said.

“My sense is that the repo rate will be hiked by 75 basis points by the end of March 2023, and it will be front loaded. By October we can expect a 50 bps hike and another 25 bps hike in H2FY23. Other than the 75 bps repo rate hike, 50 basis points CRR hike is also what I’m expecting,” Niyogi said.

A rate hike will result in more pressure on SMEs as their borrowing costs will rise, experts said.

“In the rate upcycle, transmission is expected to be relatively rapid, which would increase costs for all borrowers including MSMEs and small businesses,” ICRA’s Nayar said, adding that the RBI may raise rates by 75 bps in the next two MPC meetings.

Further, said Niyogi, as the repayment cycle for loans that were extended under the government’s Emergency Credit Line Guarantee Scheme (ECLGS) began only this fiscal, SMEs are in for more heat.

“For SMEs, from the perspective of top line they are facing muted growth, bottom side they are facing raw material, energy cost pressure and other overhead costs pressure. On top of that, ECLGS payments will start from this fiscal only,” Niyogi said.

At the start of the first wave of Covid, the government launched a series of loan schemes to help India’s SMEs. Under the ECLGS plan, these companies have so far availed a total of over Rs 3 lakh crore, according to government data. The scheme was extended recently.

What next?It’s not just rising input expenses, a depreciating local currency and logistical costs are adding to woes. Worried owners of small businesses have called for the government to step up.

“We import more and manufacture less, there was a shortage earlier and now that things are costly, the buying capacity is going down. Our sales are low and we have low working capital. The rupee’s fall must be controlled. The government must make container movement stable, freight rates must come down,” Laddha said.

Other suggestions include the introduction of trade policies that promote machinery import at lower prices as there is no virtual advantage in ordering machines from abroad due to associated import costs.

“The MSME sector is facing headwinds such as inflationary pressures, the shortage of raw materials, and high input prices, including fuel and commodities,” said Arun Nayyar, whole-time director and chief executive officer of NeoGrowth, an SME-focused non-banking financial company.

“Even then, we believe that MSMEs are more prepared to deal with unconventional situations now than they were two years back and we expect that the momentum will continue from various sectors. Timely credit will be a key enabler of MSME growth and digital loan journeys will enable easy credit access,” he said.

Industry officials are also batting for incentivisation of operations, lower raw material prices, bank credit flow and regular feedback mechanism, which are some of the other demands that SME business owners have made of the government.

Challenges such as GST evasion, fraud and compliance, however, still need to be addressed for the overall health of the industry to improve, they said.

(This is the third part in a Moneycontrol series assessing the impact of high retail inflation on the Indian economy. You can read the first and second parts here and here)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.