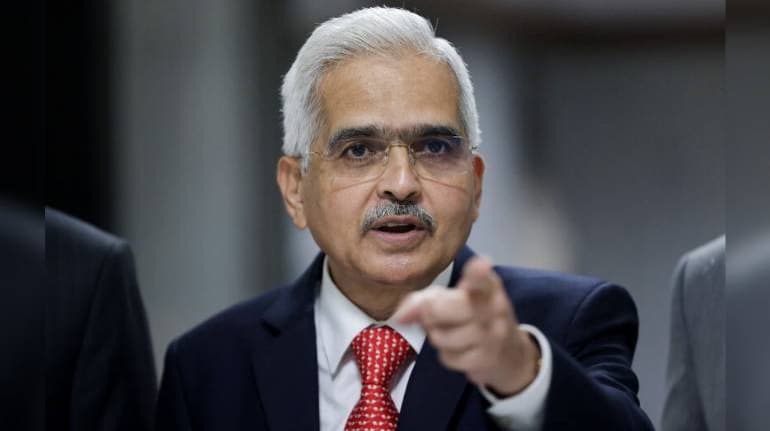

Reserve Bank of India (RBI) Governor Shaktikanta Das said the central bank is not looking at any particular level for the rupee but will act to curb the volatility plaguing the currency.

“We have no particular level of rupee in mind but we would like to ensure orderly evolution. We have zero tolerance for high volatility and bumpy movements,” Das said at a banking event in Mumbai on July 22.

The RBI has been supplying dollars to the market to ensure stability, and will continue to intervene in market when rupee is volatile, he added.

Also, the truly unhedged portion of external borrowing is lower than what is speculated in the market, he pointed out.

The Indian currency is trading at record lows, declining below 80 to a dollar and losing around 7 percent so far this year. The RBI’s suspected intervention has arrested further fall in recent sessions.

The devaluation in the currency is believed to have stemmed from a host of macro fundamentals like surging inflation in most major economies, global slowdown, fears of a recession in the US, geopolitical crisis due to the Russia-Ukraine conflict, and heavy and sustained selling of Indian equities by foreign institutional investors.

Das said on July 22 that the Indian rupee holding up well compared to other currencies, domestic inflation levels are stabilising, India’s current account deficit is modest and that forex reserves are “adequate.”

The RBI’s recent measures are aimed to attract dollar inflows and protect the rupee, the governor said. However, it is too early to assess the impact of those now, he added.

“All options are on the table,” Das said when asked if more measures could be announced to stabilise the rupee’s exchange rate against the dollar.

Das, further, reaffirmed that the Indian economy is relatively better placed, despite the global economic scenario turning more and more turbulent, drawing strength from its strong macroeconomic fundamentals.

The rate-setting panel of the banking regulator hiked the key policy rates by a cumulative 90 basis points in recent months to control heavy inflation, which has stayed above the 6 percent mark for six months in a row.

The Indian banking system is well capitalised, asset quality has improved and banks have returned to profitability, he noted, mentioning that the RBI remains watchful to ensure price stability in the market.

Banks are well positioned to withstand extreme stress scenario, the governor said. Lenders, however, need to embrace newer and timely technologies to understand consumer interests, he added. Banks must strike a fine balance between digital and paper-based banking systems, he said.

Das emphasised on the need for banks to develop adequate governance strategies.

“Good governance cannot be compromised any time,” said Das.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.