IIFL Wealth (subsidiary of IIFL Holdings), one of the largest wealth managers in the country, has raised Rs 746 crore of equity capital at Rs 1,661 per share.

This translates to a dilution of around 5.1 percent of the company's share capital. After dilution, IIFL Holdings will own 51.11 percent in the wealth management business.

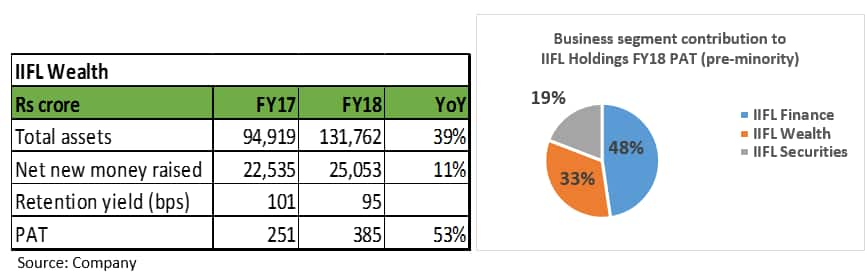

IIFL Wealth will be listed as a separate entity in the future, according to the proposed scheme of demerger. In FY18, the wealth business reported a profit growth of 54 percent on year, as the assets under its management rose 39 percent to over Rs 1.31 lakh crore.

The capital raised by the wealth management company suggests that its valuation is currently around Rs 14,600 crore, which is 38 times its FY18 profit.

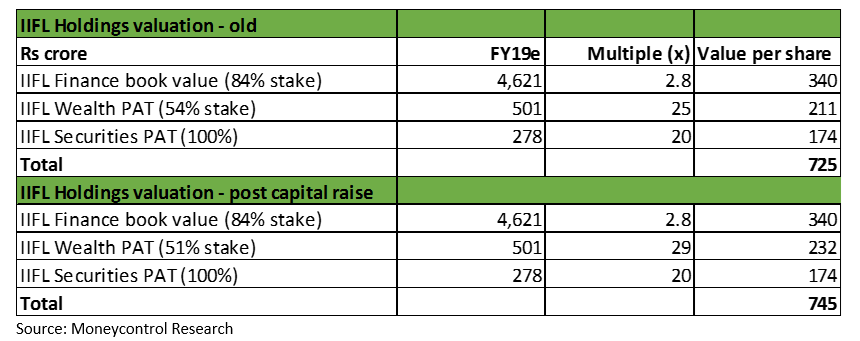

The number also works out to around 29 times the company's estimated earnings for FY19, which is slightly higher than our earlier assumption of 25 times.

The company's decision to raise capital is certainly positive news because the funds raised will be utilised to grow the wealth and asset management business.

IIFL HoldingsIIFL Holdings has three main core businesses: IIFL Finance (loans and mortgages), IIFL Wealth (wealth and asset management) and IIFL Securities (equities, investment banking, and commodities).

These three businesses will be listed as separate entities after the proposed reorganisation goes through.

With such a diversified business, IIFL Holdings has unique growth drivers and remains one of the key beneficiaries of the increased penetration of financial services in the country.

We see the NBFC's profitability improving on the back of strong growth in its lending book, buoyant capital markets and growing wealth and asset management businesses.

We have revised upward IIFL Wealth's value per share after its capital raising initiative. IIFL Holdings' value also increases proportionately.

While there are multiple growth drivers for IIFL Holdings, it is the non-lending or fee-based business in general, and the wealth management business in particular, that excites us most about the franchise.

Since the wealth management business does not require additional capital, it can potentially generate non-linear profit growth and an increase in return on equity.

Also, revenue streams from wealth management are less cyclical and can give rise to cross-selling opportunities.

The outlook for the wealth management sector is promising as the market is under-penetrated and likely to grow in sync with India's economic growth and rising income levels.

The void created in the wealth management space by the exit of a few foreign banks is being smartly capitalised on by IIFL.

The phenomenal growth in wealth management assets and alternative investment funds (AIF) have been the key catalysts in IIFL Holdings' growth over the last couple of years.

While the stock seems fairly valued at its current level and offers little upside, the capital raised enhances its ability to expand the wealth management business and can result in higher profitability in the future.

So investors with a long-term horizon wanting to participate in the growth story of a diversified financial services company can consider buying the stock.

Follow @nehadave01For more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.