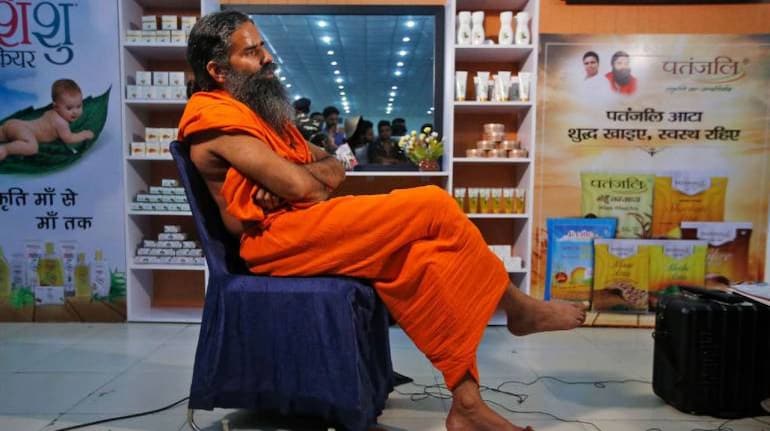

Baba Ramdev's Patanjali has got a wildcard entry in its battle for debt-laden Ruchi Soya, after Adani Wilmar bowed out of the deal, citing delays in the resolution process. But, what does Patanjali stand to gain by bagging the edible oil maker?

In the fierce bidding battle for Ruchi Soya, Patanjali was the second-highest bidder. The company has now written to resolution professional Shailendra Ajmera from EY and the creditors to Ruchi Soya, expressing interest in the asset. It has also said it is willing to match Adani's offer if needed.

Adani had offered Rs 5,474 crore, out of which Rs 4,300 crore would go to the lenders, whereas Patanjali's offer was of Rs 5,765 crore, of which Rs 4,065 crore would be for the lenders. Even though the latter's offer was higher, Adani won because repaying bank loans is given a higher priority than infusing funds into a company.

Patanjali had moved the courts against the lenders' decision to opt for Adani's offer.

It has been a tough year for Baba Ramdev-promoted Patanjali, as its mission to dominate India's growing FMCG market was not fulfilled. In April 2017, the company had set a target of reaching revenue of Rs 20,000-25,000 crore in the next three to five years. However, it closed the previous fiscal with a revenue of Rs 10,000 crore.

A reported decline in consumer offtake in various product categories and general trade distribution are some of the issues that Patanjali is facing on the way to its ambitious target. The company has already compromised a lot on the core element of its business, its distribution network, to reach this target.

In such a scenario, acquiring a company like Ruchi Soya would be very helpful to Patanjali. Ruchi Soya has an oil seed extraction capacity of 3.72 million tonnes, the largest in India. It has 24 plants of manufacturing edible oils, including crushing, milling, refining and packaging. The company also heads diverse brands ranging from Nutrela to Sunrich oil. It is also one of the largest exporters of value-added soy products.

Patanjali has already inked deals with the oil maker. In March 2017, the two companies had signed a deal for refining, processing and packaging edible oil. A few months after this, they struck another deal for sales and distribution of Patanjali's edible oils.

Ruchi Soya has a 14 percent market share in the edible oil market, and buying this company could give Patanjali the necessary exposure to fulfill its target.

Due to economic growth and a rise in disposable income, vegetable oil consumption in India has been climbing aggressively. Rabo Bank published a report which pegged the consumption to grow 3 percent annually, to exceed 34 MT by 2030.

As of December 31, 2017, Ruchi Soya had a debt of Rs 12,000 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.