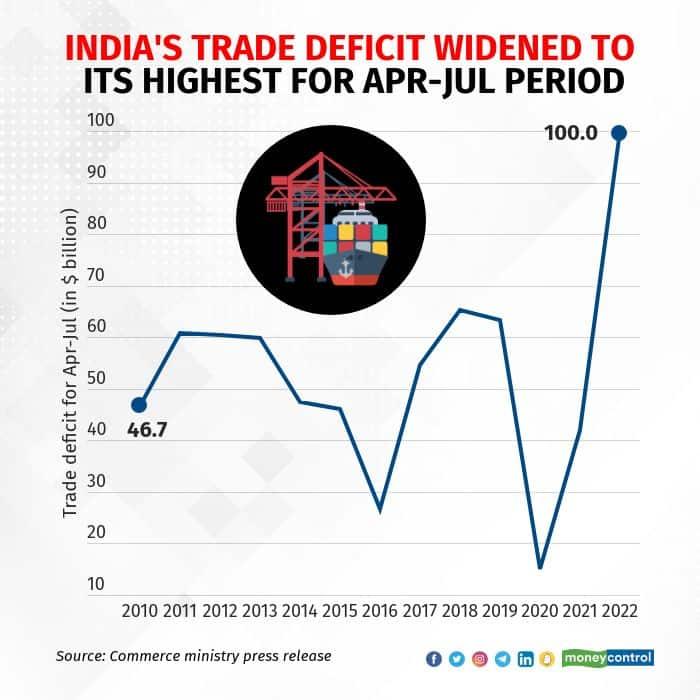

A sharp 31 percent sequential fall in earnings from petroleum product exports following interventions by the Union government even as imports stayed strong was among the key reasons for the widening of India’s trade deficit to a record in July 2022. The trade deficit for the month was provisionally estimated at a record $31 billion against $25.6 billion in June and at $100 billion for the first four months of the financial year.

India’s trade deficit had breached the $60 million level in the April-July period four times since 2010. In 2011-12 and 2012-13, it went past $60 billion when elevated prices of petroleum crude and gold raised the imports bill. More recently, it crossed $60 billion level in 2018-19 and 2019-20, again when petroleum prices climbed.

In the current instance, government intervention to control exports of petroleum products and certain commodities due to domestic demand and inflation contributed to the widening of the trade deficit.

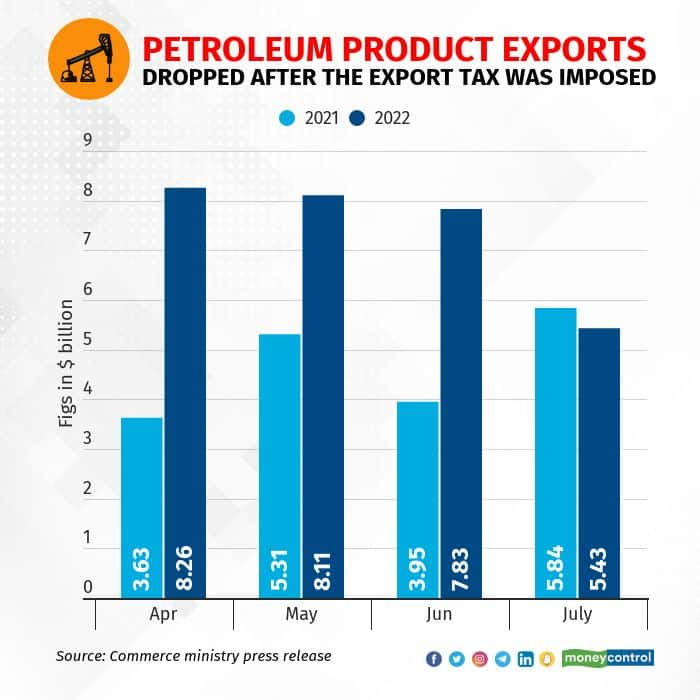

Earnings from petroleum product exports declined by $2.4 billion in July from $7.83 billion in June 2022, as volumes fell after the government imposed an export cess on petrol and diesel and global prices cooled amid concerns about economic growth in the US and China.

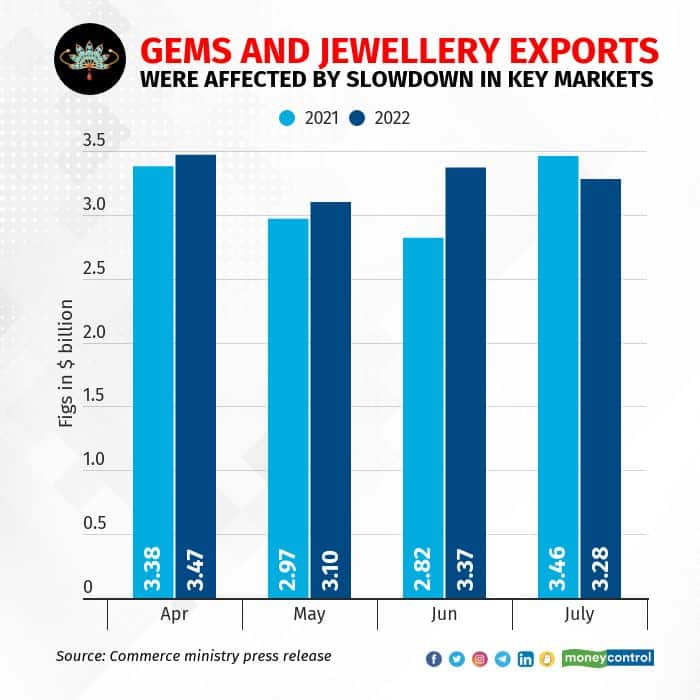

A contraction in earnings from exports of gems and jewellery, organic and inorganic chemicals and readymade garments also contributed to lowering July’s export earnings by $2.7 billion from the previous month.

Exports of gems and jewellery were affected by muted consumer demand in several key markets. India exports plain gold and studded jewellery and the US is a key destination. Hong Kong is another important destination for exports of gems and jewellery. The US is also the largest destination for readymade garments. Given that the US is in a technical recession, exports of gems and jewellery and readymade garments may continue to be muted for some months.

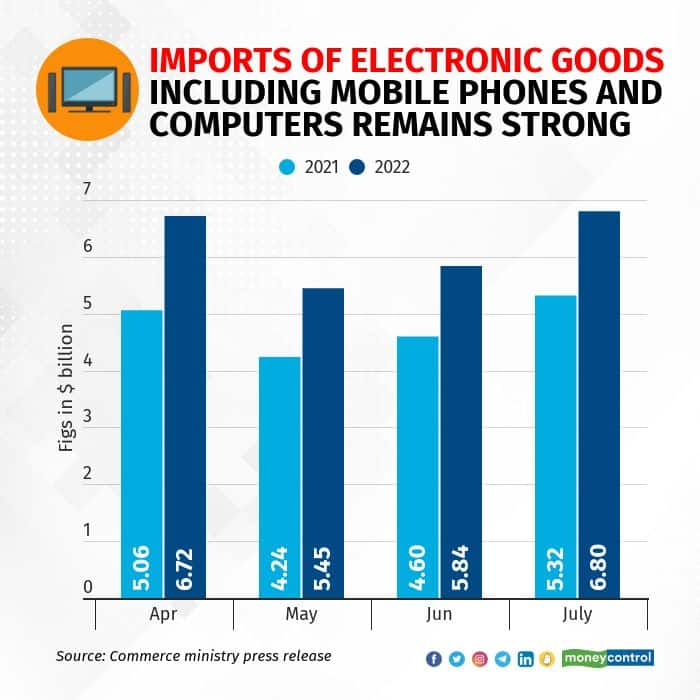

Imports maintained their momentum in July, rising about 4.2 percent from the previous month, due to the country’s dependence on imported energy, electronics goods and certain machinery.

Imports of petroleum crude and products were up about 2 percent on a sequential basis and a massive 70.4 percent from a year ago. Petroleum crude and products together accounted for about 32 percent of the import bill in July. It might have been higher if Indian refiners were not buying Russian crude. Reports suggested that India had emerged as the largest buyer of relatively cheaper Russian oil last month.

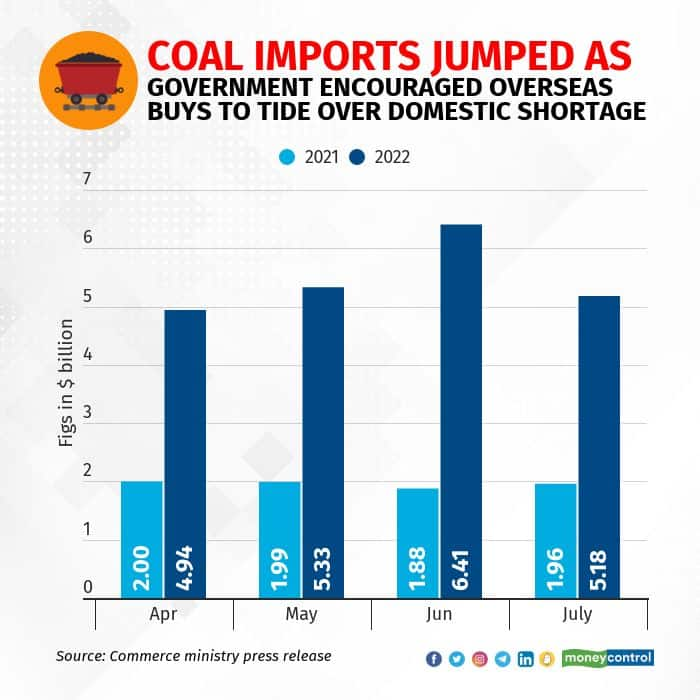

Coal imports were another transaction that contributed to the import bill and the widening of the trade deficit this financial year. Cooling of coal prices from the levels they climbed after the Russian invasion of Ukraine and slowing demand for the expensive imported fuel as the monsoon set in lowered the import bill for July from the June level but the bill for the first four months was nearly 200 percent more compared to the corresponding period of last financial year. The Centre had mandated that power producers blend imported coal with that from domestic sources when supplies from Coal India fell short during the summer months.

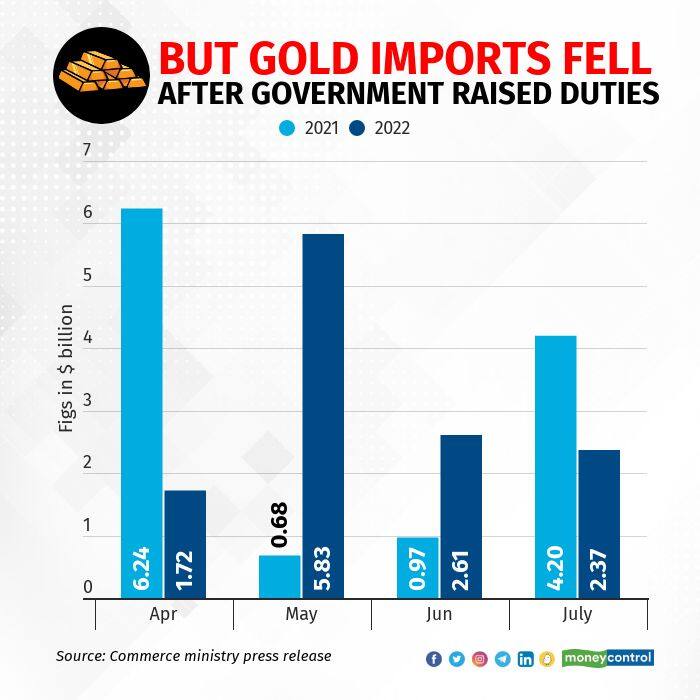

Slower inflows of gold through the official channels after import tariffs were raised provided some relief but rising demand for electronic goods including mobile phones and computers contributed to rising import bills and widening trade deficit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.