Borrowing costs of some non-banking finance companies (NBFC) and housing finance companies have fallen by 10-25 basis points (bps) as investors look beyond HDFC to other companies ahead of the mortgage lender's exit from the market, a Moneycontrol analysis of the market data showed.

Dealers said the fall in yields on some papers was also due to a sharp easing of yields on government securities. In the last few weeks, the yield on a 10-year benchmark bond has eased more than 20 basis points (bps) due to a pause on rate hikes by the Reserve Bank of India (RBI) and easing oil prices.

One basis point is one-hundredth of a percentage point.

“Demand for NBFC or housing finance companies have increased post HDFC/HDFC Bank merger. But lower yields is also a function of lower benchmark yield,” said Mataprasad Pandey, Vice President, Arete Capital Service.

Further, Umesh Kumar Tulsyan, Managing Director of Sovereign Global Markets, a New Delhi-based fund house, said borrowing figures of HDFC were on the elevated side due to the merger. “Now this figure would come down substantially and crowding will reduce.”

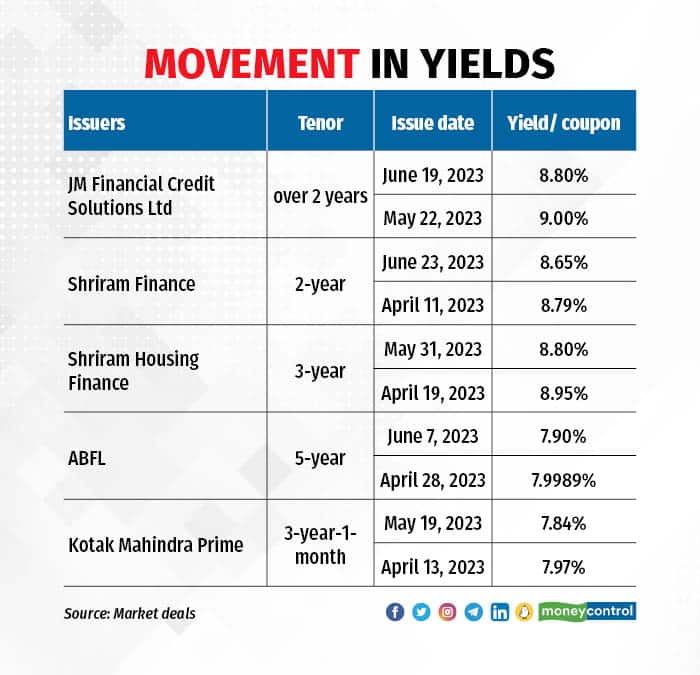

Also read: Demand for housing loans will continue to grow in the next 4-5 years: Keki MistryThe issuancesAccording to the NSE and BSE electronic bidding platform data compiled by Moneycontrol, JM Financial Credit Solutions issued bonds on June 19 with a yield of 8.80 percent compared to 9.00 percent on May 22.

Similarly, Shriram Finance sold bonds on June 23 at an 8.65 percent coupon as compared to 8.79 percent on April 11. The maturity of both bonds was the same at around two years.

Another bond of Shriram Housing Finance maturing in three years was sold by the company at an 8.80 percent coupon rate on May 31 as against 8.95 percent on April 19.

Money markets dealers said this shows the demand from investors was already shifting to other entities since May.

Earlier on today, HDFC Chairman Deepak Parekh said the merger between the country's largest private sector bank, HDFC Bank, and mortgage lender, HDFC Ltd, is expected to be completed by July 1.

"The merger is expected to be complete by July 1. Both HDFC Bank and HDFC Ltd will have separate board meetings on June 30," said Parekh.

Dealers say the exit of HDFC from the bond market after the merger is likely to help other players get demand from investors, who will turn towards them for better returns.

However, Pandey added that demand will be confined majorly to quality and top-rated papers.

“I don't see the merger improving demand for AA-rated papers meaningfully as it is about to be replaced with equally strong papers,” he said.

This is because of the risk involved in AA and below-rated papers despite their giving higher returns, a bond dealer at a state-owned bank said.

This will obviously help with respect to spreads coming down for other NBFCs, said Tulsyan.

How much HDFC borrowed this fiscal?According to the data compiled from NSE and BSE EBP, HDFC raised over Rs 45,000 crore between April and June.

In March, the board of directors of the company approved raising Rs 57,000 crore via non-convertible debentures (NCDs) on a private placement basis.

Also read: Expecting regulatory approval within a month for Credila sale: ParekhThe merger processHDFC and HDFC Bank announced the decision to merge on April 4, 2022. As per the plan, HDFC will acquire a 41 percent stake in HDFC Bank through the merger.

Back in 2015, Parekh said his firm could consider a merger with HDFC Bank if circumstances were favourable. But the wait for the merger got longer with the parent putting the idea on the backburner. Parekh had said that the merger makes sense, provided there is no loss of value for shareholders.

Sashidhar Jagdishan, Managing Director, HDFC Bank, on an analyst call on May 24 had said that the merger is only about a month away.

“It's now just another four or five weeks before the big day,” Jagdishan had said.

Once the deal comes into force, HDFC Bank will be 100 percent owned by public shareholders, with existing shareholders of HDFC holding 41 percent of the bank.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.