Any assessment of a government's performance invariably ends up at the economic door. At the start of Narendra Modi's ninth year as prime minister (PM), it is then pertinent to ask: how has the Indian economy fared so far?

Making any straight comparisons between now and May 2014 would be unfair given the impact of the coronavirus pandemic. And even before the pandemic's end, Russia’s invasion of Ukraine upended all calculations again.

"No one country today can plan for its recovery...because of these kinds of disturbances. Our recovery, not just of India, but for countries everywhere, will be severely hampered," Finance Minister Nirmala Sitharaman had noted in late February a day after Russia attacked Ukraine.

But it must not be forgotten that India has attempted to kick-start its economic recovery multiple times in the last eight years.

The first of these was soon after Modi took charge as PM in May 2014. Working in tandem with Raghuram Rajan at the Reserve Bank of India (RBI), the government managed to undo much of the damage caused by the taper tantrum of 2013.

A huge concession was then made in the form of the flexible inflation targeting framework, which was formally adopted in 2016 along with the constitution of a monetary policy committee (MPC). It would have taken all of Rajan's powers of persuasion to convince the government to let the central bank focus on maintaining low and stable inflation. And it would have taken an equal amount of courage for the government to let go of some control it could always exert on monetary policy.

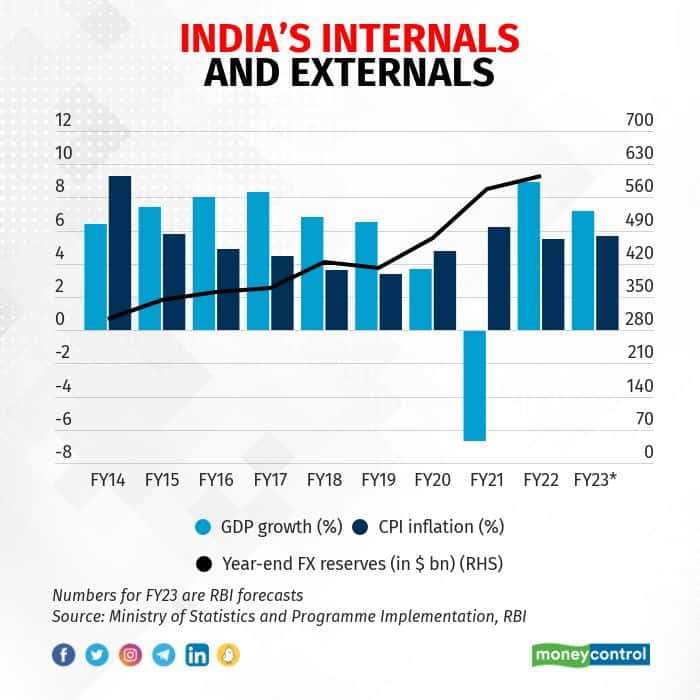

By the time the Finance Bill, 2016—proposing these changes—was tabled in Parliament in early 2016, the economy was chugging along at a fair rate. GDP growth in FY16 rose to 8.0 percent from 7.4 percent in FY15, while Consumer Price Index (CPI) inflation fell further to 4.9 percent from 5.8 percent. Reforms were on the agenda too, with the Constitution Amendment bill for the rollout of the goods and services tax (GST) regime being passed by Parliament in August 2016, soon after the Insolvency and Bankruptcy Code (IBC) came into being.

The initial promise was perhaps as good as it got.

Modi's 8 pm announcement on November 8, 2016 to ban 500- and 1,000-rupee currency notes seemingly set in motion a chain of events that continue to cast a shadow on the economy.

The adverse effects of demonetisation have been discussed ad nauseam over the last five and a half years, so perhaps it is appropriate to make no more than a couple of brief points in this regard.

Also read: Modi Govt @ 8 | A look back at Indian economy’s journey over the last eight years

The lack of any economic basis for demonetisation is clear through two things: Rajan opposing the move as RBI governor; and Subhash Chandra Garg, who took over as the economic affairs secretary midway through 2017, calling it an "unnecessary convulsion" in a May 25 column for Moneycontrol.

Bank credit data tells more of the story. Loans to micro and small industries, which largely operate in the informal sector, rose 13.2 percent on average every year during FY11-FY15, as per RBI data. However, in FY16-FY20, the loans outstanding to these industries increased by a mere Rs 1,797 crore – or an average of 0.1 percent every year.

In contrast, overall non-food bank credit rose 14.7 percent every year during FY11-FY15 and 9.0 percent during FY16-FY20.

Also read: Modi Govt @ 8 : How the BJP’s dominance changed the political landscape of India

The effect of demonetisation was also visible on the job market, with Centre for Monitoring Indian Economy (CMIE) noting in July 2017 that entrants to India's labour force faced "a serious dearth of jobs" after November 8, 2016, with the labour force participation rate dropping to 43.5 percent in April 2017 from an average of 46.9 percent in the first 10 months of 2016.

Amid the demonetisation blame game, it should not be forgotten that the economy was already slowing down before November 2016. The manufacturing sector, for instance, grew by 15.5 percent in October-December 2015. In the subsequent three quarters—all pre-demonetisation—the sector's growth rate fell to 14.8 percent, 9.8 percent, and 7.6 percent, as per statistics ministry data.

The developments around the two legislative achievements of the Modi government cannot be ignored either. GST was rolled out some eight months after demonetisation. While teething troubles were to be expected, the indirect tax regime continues to be a bone of contention between the Union and state governments even if one were to look past criticisms about its hurried implementation.

The second legal landmark, the IBC, is equally concerning.

In his July 2020 book 'Overdraft', former RBI governor Urjit Patel laid bare how the bankruptcy law was deliberately weakened in mid-2018 after the central bank released its famous February 12, 2018 circular that spelt out an amended framework for the resolution of banks' stressed assets.

According to Patel, the Supreme Court striking down the circular in April 2019 made the "insolvency regime vulnerable, possibly brittle".

A consultation paper released by the Insolvency and Bankruptcy Board of India in April said the average time taken for the admission of an insolvency application had increased to 650 days in FY22 from 468 days in FY21. Not only is this significantly longer than the 14 days prescribed for the same by the IBC, it is longer than the deadline for the completion of the insolvency process itself!

Fiscal mathAn economy is only as strong as its government's finances. And the Centre's finances—on the surface—have improved. The 2020 budget, presented before the coronavirus pandemic struck India, had targeted a fiscal deficit of 3.5 percent of GDP for FY21. Yes, the road to a 3 percent fiscal deficit had been delayed by a few years, but the intent seemed to be there.

But a closer look at the finances shows that the government was not really deserving of the plaudits it received because the degree of fiscal consolidation achieved was not as high as it seemed. Take, for instance, the loans the Food Corporation of India (FCI) had to take from the National Small Savings Fund from FY17 onwards in lieu of food subsidy. The off-balance-sheet nature of these loans—totalling Rs 4.3 lakh crore over a period of five years—helped the Centre contain its fiscal deficit.

Of course, the Centre repaid these loans and did not leave the FCI saddled with them—but only in FY21, after the pandemic had distorted the government's finances. The fiscal deficit in FY21 hit an unexpectedly large 9.2 percent of GDP, with the government then taking credit for cleaning up its books.

To be sure, previous governments too have performed their own versions of fiscal jugglery to show an improvement in finances.

Then and nowIt is worth taking a look at what the supposed impartial assessors of the financial world have to say about India. In September 2014, S&P Global Ratings affirmed its BBB- rating on India and revised the outlook to stable from negative. A few months later in April 2015, Moody's Investors Service revised its outlook on India to positive while affirming the Baa3 rating, while Fitch Ratings affirmed its BBB- rating and maintained the stable outlook.

Although S&P has not budged from its position since then, Moody's and Fitch both have a weaker outlook on India now—with an unchanged rating—than they did seven years ago: stable and negative, respectively.

PM Modi may have begun well but the job doesn't look like it's half done.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.