Ruchi Agrawal Moneycontrol Research

- Falling crop prices in wholesale markets - Despite productivity uptick, agriculture remains devoid of profitability - Farm loan waiver a sign of MSP failure - Rural logistics and storage infrastructure remain weak - New policy awaited for agri exports, crop insurance and storage provisions

Reports about farmers disposing their crops on roads along with increasing farmer suicides are indicative of the degree of distress in Indian agriculture and the inability of politically motivated government policies in addressing age long farmer issues. While there was a time when farm productivity was a major issue for Indian farmers, the mismanagement of produce is now the lead cause for falling incomes. Despite improvements in productivity, agriculture in India remains devoid of profitability.

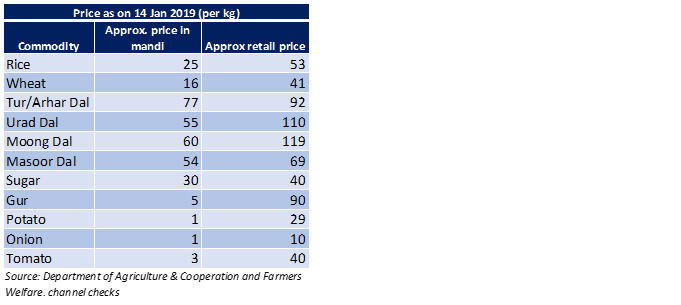

Crashing crop prices in wholesale markets

The crop prices in the wholesale markets have seen a sharp fall in recent weeks with most major crops selling significantly below the MSPs (minimum support prices). This weakness in commodity prices has resulted in steep reduction in the returns for the farmers. Moreover, there has been a continuous uptick in the input prices over the years in the form of seeds fertilisers etc. This creates a bigger hole in farmers' pockets.

While the government is quick to utilise farmer woes for political mileage and announce loan waivers, the very need for a loan waiver proves the failure of the much-propagated hollow MSP hikes. Incomes of the farmers are much below minimum requirements and little is being done to correct the agriculture machinery to ensure adequate returns for farmers.

High cost of loan waivers

The myopic patchwork of farm loan waivers comes at high costs. According to reports, loan waivers in the last 2-3 years have been more than Rs 180,000 crore or nearly 20 percent of the total bank NPA and around 29 percent of India’s fiscal deficit target for FY19. Such a huge amount deserves attention as to why this was rather not utilised to increase procurement or develop rural infrastructure.

Despite the heavy costs, the benefits of farm loan waivers accrue only to a handful 15 percent farmers given most farmers do not borrow from the official credit institutions. Moreover, it is much debated that loan waivers spoil the credit discipline in the country.

Weak rural logistics

Weak rural logistics and the lack of adequate storage infrastructure remains the major reason for the farmer’s plight. According to reports underutilization of the current infrastructure also remains a major issue. Most storage houses are single crop storages which remain empty half the year, and remain underutilized. Due to lack of storage, the farmer is forced to sell his produce right after harvest which leads to crash in prices. While consumers still continue to pay high prices for crops, the profits do not reach the farmer and are eaten away by the middlemen.

Domestic Policy failure

While eNAM aimed to empower the farmer by providing a countrywide platform to sell crops, the project has fallen short of the promise. Without quality assurance and categorisations, remote buying remains an issue. To enable remote buying, commodity grades would have to be set and farmers will have to produce according to those grades. The current structure of eNAM is merely an electronification of the old methods and does not empower the farmer.

Inadequate government procurement has led to the failure of the MSP announcement. Moreover, a flawed system of cost plus 50 percent disturbs the demand-supply situation with farmers producing without gauging the demand for a commodity.

New Agri policy

There are talks the government is close to announcing a policy for farm credit, crop insurance and agri export policy which remained largely unaddressed and demands attention. While we would have to wait and watch what is announced, the three areas are crucial to ensure a minimum income for farmers and protect them from falling in the debt trap. The lifting of restriction on exports could prove vital in times of increasing crop yields and avoid a sudden crash in crop prices. Policy support for the promotion of allied agri activities would also be something to watch out for.

Rabi Update

According to the latest update, crop acreages (area sown) during this year’s Rabi season are marginally lower than last year, down by approximately 4.75 percent year-on-year (YoY). Most decline came in rice (-20.6 percent), coarse cereal (-15.8 percent), pulses (-5.7 percent), wheat (-2.1 percent), oilseeds (-0.99 percent).

Water storage level across 91 major reservoirs in the country is also marginally down YoY. While the water levels at north and central reservoirs have improved over last year, there has been a marginal decline in the southern reservoir level and a substantial decline in the eastern and western reservoir levels. Regions with low water levels might face issues during the irrigation period and impact the crop yields and soil health.

Outlook

Though agri distress remains a common theme in the electoral campaigns, little is implemented adequately at the grass root level. Government's inability to provide adequate storage infrastructure, unequal allocation of water resources between crops, unmanaged imports, weak incentives for allied farm activities, low concentration of high-value crops, skewed crop acreages and unjustified margins of middlemen and traders are only a few issues farmers face.

Agriculture profitability remains a major issue and industrialisation would be the key to reduce the number of people who depend on the agrarian economy. Short-term eye wash schemes are only temporary solutions that come at high costs and provide no respite from chronic agrarian distress.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.