India's Consumer Price Index (CPI) inflation jumped to 5.59 percent in December from 4.91 percent the previous month.

However, the Reserve Bank of India's monetary policy committee will likely not be too disturbed because the average for the last quarter of 2021 undershot the central bank's forecast by 10 basis points.

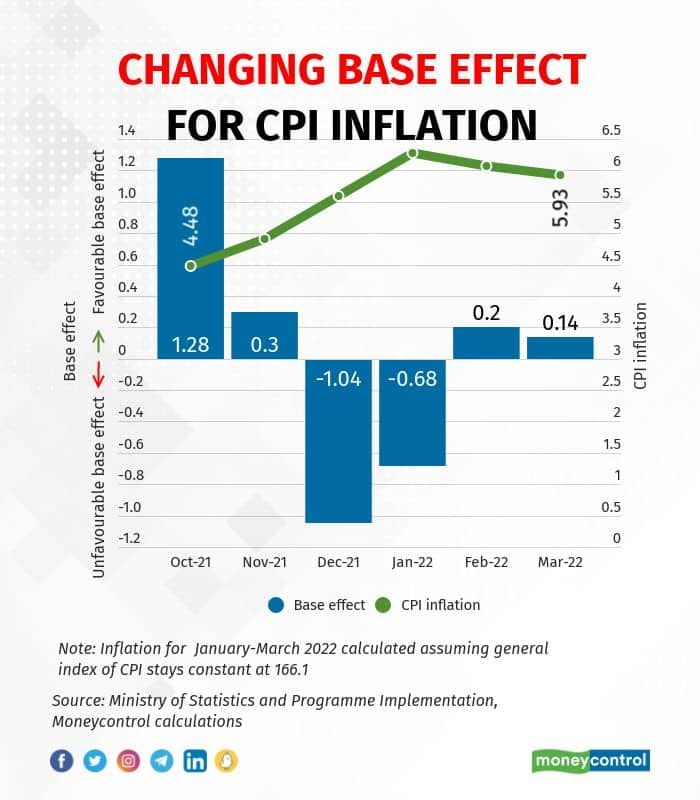

The base effect, which was instrumental in lowering CPI inflation from 6+ percent to close to the central bank's target of 4 percent in the space of a few months, turned for the worse in December and is unlikely to help policymakers in the first quarter of 2022.

"The base effect turns distinctly unfavourable in Q1 2022, with headline inflation in Q1 2021 dipping to 4.9 percent from 6.4 percent in Q4 2020,” Nomura said in a report on January 13.

In November, CPI inflation had risen less than expected to 4.91 percent from 4.48 percent the previous month. The RBI noted last month in its monthly State of the Economy article that inflation had risen only 43 basis points due to a favourable base effect of about 30 basis points, partially offsetting price momentum of around 70 basis points.

Back-of-the-envelope calculations showed this favourable base effect of 30 basis points in November turned into an unfavourable base effect of 104 basis points in December.

"The higher year-on-year (inflation) print was mainly due to an unfavourable base even as sequentially, the index recorded a decline," Elara Capital said in a note on January 13, commenting on CPI data for December.

The general index of the CPI fell to 166.1 in December from 166.7 the previous month.

The base will remain unfavourable in January, too, resulting in CPI inflation trending even higher and going past 6 percent, the upper bound of the RBI's inflation mandate.

If there is zero overall price momentum – the general index of the CPI is unchanged – over January-March 2022, inflation would average 6.1 percent in the quarter, 40 basis points higher than the RBI's forecast of 5.7 percent.

The general index of the CPI can move higher or lower in January and beyond, depending on how prices evolve.

"We see average inflation during the March 2022 quarter can range from 5.7 percent, if the fall in vegetable prices continues in line with seasonality and none of the other factors majorly impact inflation, to around 6.4 percent if further passthrough of telecom tariff hikes, other price hikes and rise in Covid infections all have an impact during the quarter," Sreejith Balasubramanian, India economist at IDFC AMC, wrote on January 14.