Jitendra Kumar Gupta Moneycontrol Research

India's capex cycle recovery may have been struggling for a while now, but recent data shows some signs of improvement. One of the indicators that corroborates this is the rising Gross Fixed Capital Formation (GFCF).

Capex – nascent signs of revival?

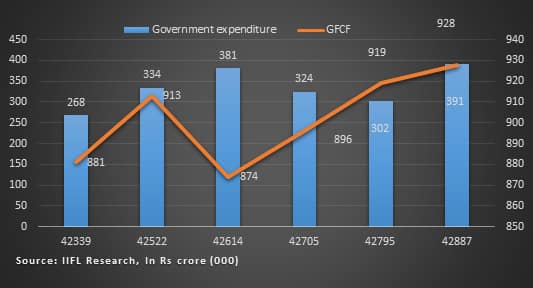

Since September 2016 quarter, GFCF has moved up from a low of Rs 8,74,000 crore to Rs 9,28,000 crore by the end of June 2017 quarter. What is more, from a contraction of 2.1 percent in Q4FY17 quarter, GFCF has seen a growth of 1.6 percent in Q1FY18, thereby raising hopes of revival in the capex cycle.

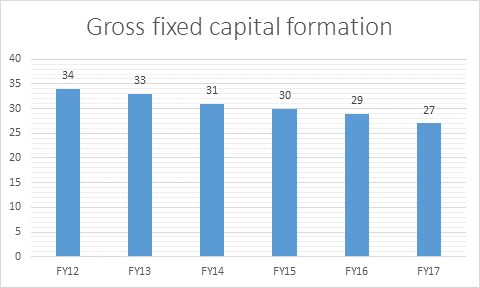

While there are green shoots, what is lacking is private sector participation. The gross fixed capital formation of the private sector has dipped to 29.2 percent in FY17 from 34.3 percent of GDP in the financial year 2012.

A gradual recovery

Government capex is expected to remain elevated particularly in the light of the growing tax revenues, an endeavour to fill the void caused by the slowdown in private capex and general elections in 2019.

But that has only helped marginally. The biggest concern remains the private capex cycle. The share of private capex in the overall projects under implementation has dropped from 61 percent June 2011 to 49 percent in June 2015, 45 percent in June 2016 and further to 41 percent in June 2017.

This means that the period of recovery would be longer. According to experts it requires capacity utilisation to reach up to a level of about 80 percent for the private capex cycle to kick-start and the corporates to start building new capacities again.

Excess capacity

The latest RBI data suggest that on an overall basis, India’s capacity utilisation remained at 74.1 percent at the end of March 2017. One should not expect this data to improve in the past few months considering the lingering impact of demonetisation and pre-GST hiccups.

Revival on the cards?

Companies will likely wait for a few more months after GST implementation to gauge the market and consumer mood before undertaking any new capex.

The other big hurdle is the over-leveraged corporate balance sheet. Despite improvement in the liquidity scenario, money is being sucked out by stressed companies to repair their balance sheets rather than being used in making fresh investments. This might continue for a while as the stress in the corporate sector still remains high. In fact, there is not much demand for credit from the corporate sector which is evident from the credit growth figure that had hit multi-decade lows a few months ago.

The other risk to revival in corporate capex is the timing of the next general elections.

If the revival takes a little longer than expectations, corporates will be hesitant to invest in the election year or a few months prior to the elections, which essentially means that that the corporate capex cycle could actually remain muted despite the GCFC growing more strongly as a result of government support and low base effect.

Markets predicating a distant recovery

Meanwhile, the BSE capital goods index has given a 27 percent return this calendar year so far, which is about 600 basis points higher than Sensex return of 21 percent over this period. While the market started pinning hopes on a revival in private capex, this did not sustain and has lost some steam as markets figured out that the recovery was going to take longer and was largely driven by government-led capex.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.