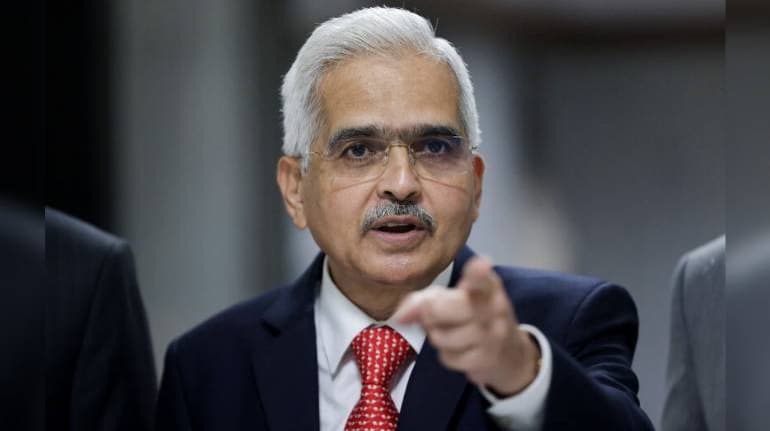

Reserve Bank of India (RBI) Governor Shaktikanta Das said easing core inflation has given confidence and satisfaction to the central bank that monetary policy has worked towards containing the price rise.

“Core inflation has reached 3.8 percent, and that gives us the confidence or satisfaction that monetary policy has worked and is working through the system,” Das said at the World Economic Forum (WEF) Annual Meetings 2024 at Davos on January 18.

India’s core inflation - or inflation excluding food and fuel - fell further to 3.9 percent in December from 4.1 percent in November.

This was despite, India's headline retail inflation rate accelerated to a four-month high of 5.69 percent in December. The Consumer Price Index (CPI) inflation print in November was 5.55 percent.

At 5.69 percent, the latest CPI inflation figure is below expectations, with economists having predicted prices likely rose 5.9 percent year-on-year in December.

While headline retail inflation rose again in December - it has now spent 51 consecutive months above the Reserve Bank of India's (RBI) medium-term target of 4 percent - it has undershot forecasts for the second month running, ensuring that it has been lower than the Indian central bank's forecast of 5.6 percent for October-December.

An unfavourable base effect was the key driver of inflation in December, although the price momentum - indicated by the month-on-month change in prices - weakened.

Das further said that inflation has also moderated from its peak of 7.8 percent and now it is well within the target band, but it is a journey towards 4 percent which we are continuing. “So our policy remained actively disinflationary and we hope that this pace will continue.”

However, Das said the main uncertainty in inflation is food inflation because it is subject to supply-side factors on which central banks have little control. There are related events that add to spike in vegetable prices create bottlenecks about transportation and add to headline inflation.

Before this, the RBI is not considering a rate cut at this point amid speculations of a rate cut later this year, and the focus will be on bringing inflation to a target of 4 percent.

Speaking to Bloomberg TV, the governor said, at this time, the topic of rate cut is not on our table, it’s not even under discussion. “Our focus is to remain actively disinflationary, to bring the inflation to 4 percent.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.