Madhuchanda Dey

Moneycontrol Research

Zensar Technologies, the IT company from RPG Group’s stable, delivered a solid Q1 FY19 where fruits of its earlier acquisitions have clearly come to the fore. While the journey looks exciting and beckons attention, the moot question is whether the optimism is already priced in?

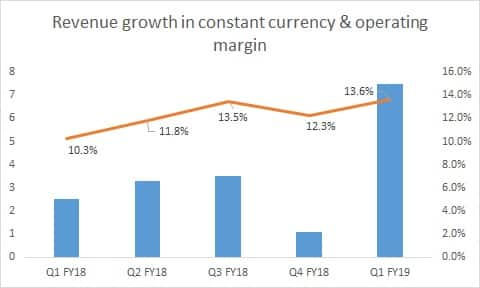

Q1 FY19 result snapshot The company reported a strong first quarter that saw 6.6 percent revenue growth at $135 million. It consummated the acquisition of Cynosure, which had a revenue contribution of $5.9 million ($2.9 million digital), largely explaining the higher revenue. Consequently, growth in constant currency was a healthy 7.5 percent.

Source: Company

Initiatives around new capabilities, digital acquisitions, US sales, client mining and a focus on large deals have started to bear fruit and was reflected in the strong revenue turnaround.

In terms of geographies, the dominant US market delivered strong growth. Decent performance was reported by Europe as well as Africa, whereas the relatively un-remunerative rest of the world de-grew.

Cloud and infrastructure services recorded sequential growth of 13 percent. Digital businesses grew at a scorching pace on application as well as infrastructure services, with sequential growth of 13.5 percent and 16.7 percent, respectively. Digital now constitutes 43 percent of total revenue and grew a healthy 13.8 percent sequentially.

Digital through the inorganic route Zensar has bolstered its digital portfolio through acquisitions. In the past couple of years, it has undertaken four acquisitions. It acquired UK-based Foolproof, which helps global brands design digital products and services, and Bengaluru-based retail technology provider Keystone Logic Solutions and its US subsidiary to strengthen its technology solutions to global retail and consumer brands using Keystone's expertise in omnichannel retail order and warehouse management.

The company, in recent times, has added two more to bolster its digital presence. It recently acquired Cynosure as it looks to deepen its offerings and expand in the US market, where firms are looking to shed legacy technology and adopt platforms to improve service. Cynosure is a US IT services firm that focuses on mid-tier and smaller insurance clients.

It recently acquired another US company by the name of Indigo Slate. This Washington-based company is a digital marketing focused customer experience agency. This acquisition will give Zensar access to around 10 of the company’s large digital clients all of whom are Fortune 500 companies.

Keystone recorded 4.8 percent sequential growth and synergies are generating good traction. The Foolproof acquisition, which is targeted towards the Chief Digital Officer and Chief Marketing Officer, has enabled Zensar to tap these spends.

Margin outlook positive In Q1, financial services and emerging services led the show, while manufacturing was subdued. Retail de-grew, impacted by the bankruptcy of a large client. This also had an effect on operating margin, although the same improved sequentially by close to 130 basis points to 13.6 percent. We feel continued growth, fructification of investments and a reduction of low-margin businesses should propel this higher.

Utilisation remains high at 85.8 percent and employee addition has been strong courtesy the high level of attrition in the quarter under review. This is an area that warrants monitoring as having the right skill set is critical to scaling up the digital business.

Client matrix, though was encouraging with the company adding 42 clients in Q1, with some large sized clients as well (one each in over $10 million and $5 million bracket).

Strong outlook The management highlighted that the demand environment continues to be healthy across the board, with clients focusing on driving digital transformation with faster implementation cycles and measurable impact. They have been able to win large deals, where competition has been from Tier I global and Indian peers.

The management’s strategy around ‘return on digital’ is resonating well and digital remains one of the key growth engines for FY19. It is seeing strong traction in both new and existing clients.

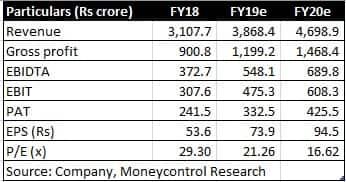

While we expect a respectable compounded earnings of 33 percent in the next couple of years, the multiple re-rating in the past one year captures the same. We have to carefully monitor the growth in business, translating into a similar profitability trajectory in upcoming quarters. We would recommend buying into any weakness in the stock.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.