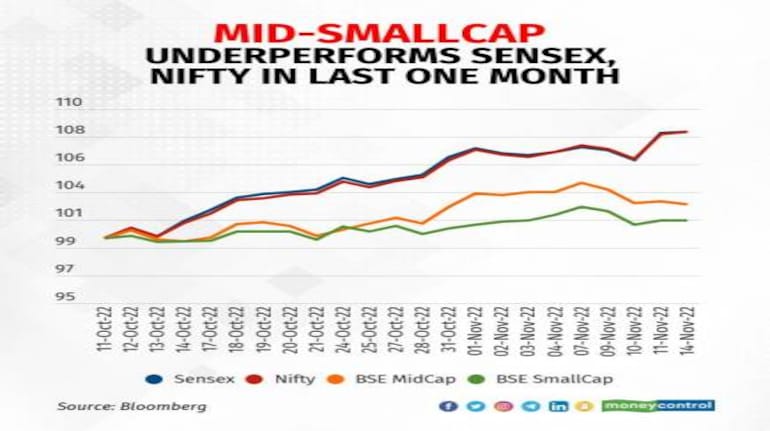

India’s broader market has not shown the exuberance exhibited by the benchmark Sensex and Nifty indices over the last month.

In the last one month, the Sensex and Nifty rose nearly 6.5 percent each while the BSE MidCap gained just 1.2 percent and BSE SmallCap declined 0.1 percent.

Both BSE MidCap and SmallCap indices were nearly 3.3 percent off the recent highs they hit on September 15. The BSE MidCap is 5.5 percent off its October 18, 2021, all-time high of 26,952.13 points. The BSE SmallCap on its part is 6.1 percent down from its record high of 31,140.28 points posted on January 17, 2022.

Some analysts suggest that in such a rally the main index takes the lead and smaller stocks take time to join in, while some feel that the underperformance was due to profit booking. Analysts are also awaiting the end of the earnings season for a clearer picture.

“The underperformance by small- and mid-caps is due to a variety of reasons including profit booking and below-par results by some of the mid- and small-cap stocks. A similar trend has been noted for the last one week. It is observed that during sudden rallies the main index takes lead and mid- and small-caps take time to catch up,” said Kamlesh Shah, president, Association of National Exchanges Members of India.

Mid-cap and small-cap firms reported weaker earnings in the September quarter. After excluding banking and finance, aggregate net profit at 82 firms of the BSE MidCap declined 36 percent year-on-year while sequentially it rose just 2 percent. Revenue rose 19.7 percent while on a quarter-ago basis it rose 2.2 percent. Operating profit declined 13 percent on-year while net profit margin declined to 3.2 percent from 4.7 percent and operating profit margin fell 12.12 percent versus 14.1 percent last year.

For 649 firms of the BSE SmallCap firms, net profit for the quarter declined 4 percent year-on-year while on a quarterly basis it fell 34 percent. The decline on both quarterly and yearly bases was the most in five quarters. Net sales rose 24 percent on-year while sequentially it was up marginally. Net profit margin in the quarter fell to 4.36 percent from 5.8 percent a year ago while operating profit margin declined to 11.4 percent from 14.14 percent last year.

“The action nowadays is in large-caps as FPIs (foreign portfolio investors) seem to have returned to buying mode and their first choice is large-caps with liquidity. Traders and HNI (high net-worth individuals)/retail investors have also shifted their focus temporarily to large-caps. Small- and mid-cap companies have either disappointed in the latest quarterly numbers or are adequately valued, leaving little room for upside. However, if the large-cap rally lasts for some more time, then the profits made in large-caps will be diverted to small/mid-caps and action will shift to them later,” said Deepak Jasani, Head of Retail Research, HDFC Securities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.